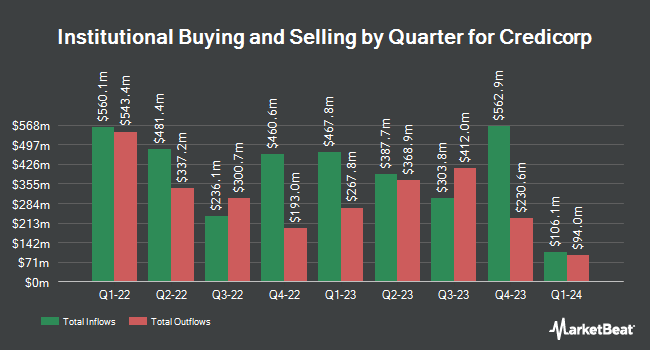

Public Employees Retirement System of Ohio purchased a new position in shares of Credicorp Ltd. (NYSE:BAP - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 236,468 shares of the bank's stock, valued at approximately $42,794,000.

A number of other large investors also recently modified their holdings of BAP. Brown Brothers Harriman & Co. purchased a new stake in Credicorp during the 3rd quarter worth $58,000. Headlands Technologies LLC acquired a new stake in shares of Credicorp in the second quarter valued at about $84,000. Atlas Capital Advisors LLC raised its holdings in shares of Credicorp by 14.9% during the 2nd quarter. Atlas Capital Advisors LLC now owns 687 shares of the bank's stock valued at $111,000 after buying an additional 89 shares during the period. Sanctuary Advisors LLC acquired a new position in Credicorp during the 2nd quarter worth approximately $210,000. Finally, Dynamic Advisor Solutions LLC purchased a new position in Credicorp in the 3rd quarter worth approximately $216,000. 89.81% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of research firms have recently commented on BAP. JPMorgan Chase & Co. boosted their target price on shares of Credicorp from $200.00 to $219.00 and gave the stock an "overweight" rating in a research report on Tuesday, November 12th. The Goldman Sachs Group upped their price objective on shares of Credicorp from $143.00 to $160.00 and gave the company a "sell" rating in a research report on Tuesday, October 8th.

View Our Latest Report on BAP

Credicorp Stock Performance

Shares of BAP stock traded up $0.41 on Tuesday, hitting $191.29. 356,289 shares of the stock traded hands, compared to its average volume of 233,885. The company's fifty day moving average is $187.71 and its 200 day moving average is $174.91. The company has a debt-to-equity ratio of 0.66, a current ratio of 1.07 and a quick ratio of 1.07. Credicorp Ltd. has a 1-year low of $123.80 and a 1-year high of $200.00. The company has a market capitalization of $15.21 billion, a PE ratio of 10.97, a PEG ratio of 0.65 and a beta of 1.13.

Credicorp Cuts Dividend

The business also recently declared an annual dividend, which was paid on Friday, October 18th. Stockholders of record on Monday, September 23rd were given a dividend of $2.9084 per share. This represents a dividend yield of 3.8%. The ex-dividend date of this dividend was Monday, September 23rd. Credicorp's payout ratio is 53.24%.

Credicorp Company Profile

(

Free Report)

Credicorp Ltd. provides various financial, insurance, and health services and products primarily in Peru and internationally. It operates through Universal Banking, Insurance and Pensions, Microfinance, and Investment Banking and Equity Management segments. The Universal Banking segment grants various credits and financial instruments to individuals and legal entities; and various deposits and current accounts.

Recommended Stories

Before you consider Credicorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Credicorp wasn't on the list.

While Credicorp currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.