CWA Asset Management Group LLC bought a new stake in Clear Secure, Inc. (NYSE:YOU - Free Report) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor bought 23,998 shares of the company's stock, valued at approximately $795,000.

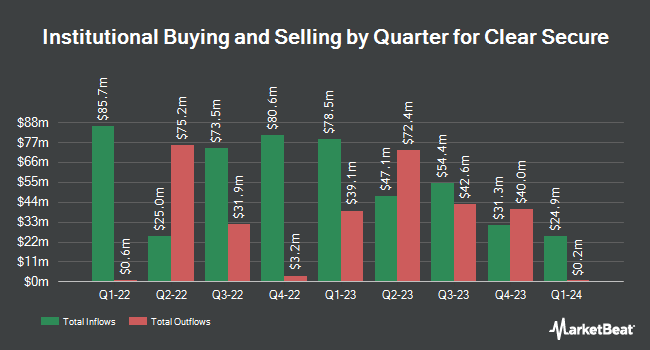

Other large investors have also recently added to or reduced their stakes in the company. Vanguard Group Inc. raised its stake in shares of Clear Secure by 11.7% in the first quarter. Vanguard Group Inc. now owns 10,571,993 shares of the company's stock valued at $224,866,000 after purchasing an additional 1,111,330 shares in the last quarter. Renaissance Technologies LLC boosted its stake in shares of Clear Secure by 56.5% in the 2nd quarter. Renaissance Technologies LLC now owns 2,954,100 shares of the company's stock valued at $55,271,000 after purchasing an additional 1,066,400 shares during the last quarter. Rice Hall James & Associates LLC boosted its stake in Clear Secure by 303.6% during the 2nd quarter. Rice Hall James & Associates LLC now owns 1,199,649 shares of the company's stock worth $22,445,000 after acquiring an additional 902,436 shares during the last quarter. Marshall Wace LLP lifted its stake in Clear Secure by 278.3% in the second quarter. Marshall Wace LLP now owns 1,099,062 shares of the company's stock valued at $20,563,000 after buying an additional 808,515 shares in the last quarter. Finally, Millennium Management LLC raised its holdings in shares of Clear Secure by 56.3% in the second quarter. Millennium Management LLC now owns 2,103,578 shares of the company's stock valued at $39,358,000 after purchasing an additional 757,528 shares during the last quarter. Institutional investors own 73.80% of the company's stock.

Clear Secure Price Performance

NYSE YOU traded down $0.25 during mid-day trading on Monday, hitting $27.52. The stock had a trading volume of 1,646,465 shares, compared to its average volume of 1,751,382. The firm's 50 day moving average is $33.08 and its 200 day moving average is $24.87. The stock has a market capitalization of $3.83 billion, a price-to-earnings ratio of 32.29 and a beta of 1.63. Clear Secure, Inc. has a twelve month low of $16.05 and a twelve month high of $38.88.

Clear Secure Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 17th. Shareholders of record on Tuesday, December 10th will be given a $0.125 dividend. The ex-dividend date is Tuesday, December 10th. This represents a $0.50 dividend on an annualized basis and a yield of 1.82%. This is a positive change from Clear Secure's previous quarterly dividend of $0.10. Clear Secure's dividend payout ratio (DPR) is currently 58.14%.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently issued reports on YOU shares. Needham & Company LLC reissued a "buy" rating and issued a $45.00 target price on shares of Clear Secure in a research report on Friday. The Goldman Sachs Group increased their price target on Clear Secure from $27.00 to $31.00 and gave the company a "buy" rating in a research report on Thursday, August 8th. Wedbush restated a "neutral" rating and issued a $26.00 target price (up previously from $24.00) on shares of Clear Secure in a research note on Thursday. Stifel Nicolaus lifted their price target on Clear Secure from $24.00 to $32.00 and gave the stock a "hold" rating in a research note on Monday, October 28th. Finally, Telsey Advisory Group boosted their target price on Clear Secure from $34.00 to $42.00 and gave the stock an "outperform" rating in a report on Friday, November 1st. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and three have given a buy rating to the company. According to MarketBeat, Clear Secure has an average rating of "Hold" and a consensus price target of $32.67.

Get Our Latest Stock Analysis on Clear Secure

Insider Transactions at Clear Secure

In related news, insider Richard N. Jr. Patterson sold 7,500 shares of Clear Secure stock in a transaction on Wednesday, August 14th. The stock was sold at an average price of $27.04, for a total transaction of $202,800.00. Following the completion of the transaction, the insider now directly owns 26,727 shares of the company's stock, valued at approximately $722,698.08. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this link. In other Clear Secure news, insider Richard N. Jr. Patterson sold 7,500 shares of the business's stock in a transaction dated Wednesday, August 14th. The stock was sold at an average price of $27.04, for a total transaction of $202,800.00. Following the completion of the sale, the insider now owns 26,727 shares of the company's stock, valued at approximately $722,698.08. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CAO Dennis W. Liu sold 1,500 shares of the company's stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $31.05, for a total value of $46,575.00. Following the completion of the sale, the chief accounting officer now directly owns 7,211 shares of the company's stock, valued at $223,901.55. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 1,164,435 shares of company stock valued at $36,610,377. Corporate insiders own 37.85% of the company's stock.

Clear Secure Company Profile

(

Free Report)

Clear Secure, Inc operates a secure identity platform under the CLEAR brand name primarily in the United States. Its secure identity platform is a multi-layered infrastructure consisting of front-end, including enrollment, verification, and linking, as well as back-end. The company also offers CLEAR Plus, a consumer aviation subscription service, which enables access to predictable entry lanes in airport security checkpoints, as well as access to broader network; and CLEAR mobile app, which is used to enroll new members and improve the experience for existing members.

Featured Articles

Before you consider Clear Secure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clear Secure wasn't on the list.

While Clear Secure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.