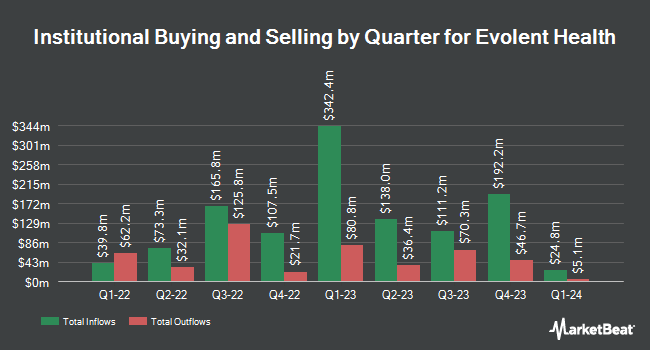

Polar Asset Management Partners Inc. purchased a new position in Evolent Health, Inc. (NYSE:EVH - Free Report) in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 240,600 shares of the technology company's stock, valued at approximately $6,804,000. Polar Asset Management Partners Inc. owned 0.21% of Evolent Health as of its most recent SEC filing.

Other large investors also recently bought and sold shares of the company. William Blair Investment Management LLC increased its position in shares of Evolent Health by 35.2% during the second quarter. William Blair Investment Management LLC now owns 5,026,043 shares of the technology company's stock worth $96,098,000 after acquiring an additional 1,308,376 shares during the last quarter. First Light Asset Management LLC increased its holdings in Evolent Health by 401.5% during the 2nd quarter. First Light Asset Management LLC now owns 1,445,305 shares of the technology company's stock worth $27,634,000 after purchasing an additional 1,157,124 shares during the last quarter. Bellevue Group AG raised its position in shares of Evolent Health by 59.9% in the 3rd quarter. Bellevue Group AG now owns 2,670,050 shares of the technology company's stock valued at $75,509,000 after purchasing an additional 1,000,215 shares in the last quarter. Engaged Capital LLC boosted its stake in shares of Evolent Health by 26.1% during the 2nd quarter. Engaged Capital LLC now owns 4,111,458 shares of the technology company's stock valued at $78,611,000 after buying an additional 850,000 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its position in shares of Evolent Health by 24.8% during the second quarter. Bank of New York Mellon Corp now owns 2,048,341 shares of the technology company's stock worth $39,164,000 after buying an additional 406,837 shares in the last quarter.

Evolent Health Stock Performance

EVH stock traded down $0.24 during mid-day trading on Thursday, reaching $11.27. The company had a trading volume of 2,345,173 shares, compared to its average volume of 1,825,950. The company has a quick ratio of 1.04, a current ratio of 1.04 and a debt-to-equity ratio of 0.58. Evolent Health, Inc. has a one year low of $11.10 and a one year high of $35.00. The stock's 50-day simple moving average is $20.44 and its two-hundred day simple moving average is $23.10. The stock has a market capitalization of $1.31 billion, a P/E ratio of -12.66 and a beta of 1.45.

Analysts Set New Price Targets

Several research firms recently issued reports on EVH. JMP Securities cut their price target on shares of Evolent Health from $34.00 to $31.00 and set a "market outperform" rating on the stock in a report on Friday, August 9th. Truist Financial reiterated a "buy" rating and issued a $33.00 price target on shares of Evolent Health in a research note on Tuesday, August 27th. Citigroup cut their price objective on Evolent Health from $33.00 to $21.00 and set a "buy" rating on the stock in a research note on Wednesday, November 13th. Barclays decreased their target price on Evolent Health from $39.00 to $19.00 and set an "overweight" rating for the company in a research report on Monday, November 11th. Finally, Oppenheimer dropped their price target on Evolent Health from $34.00 to $28.00 and set an "outperform" rating on the stock in a research report on Monday, November 18th. One equities research analyst has rated the stock with a hold rating, ten have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Buy" and an average price target of $26.18.

View Our Latest Stock Analysis on Evolent Health

About Evolent Health

(

Free Report)

Evolent Health, Inc, through its subsidiary, Evolent Health LLC, offers specialty care management services in oncology, cardiology, and musculoskeletal markets in the United States. The company provides platform for health plan administration and value-based business infrastructure. It offers administrative services, such as health plan services, pharmacy benefits management, risk management, analytics and reporting, and leadership and management; and Identifi, a proprietary technology system that aggregates and analyzes data, manages care workflows, and engages patients.

See Also

Before you consider Evolent Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evolent Health wasn't on the list.

While Evolent Health currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.