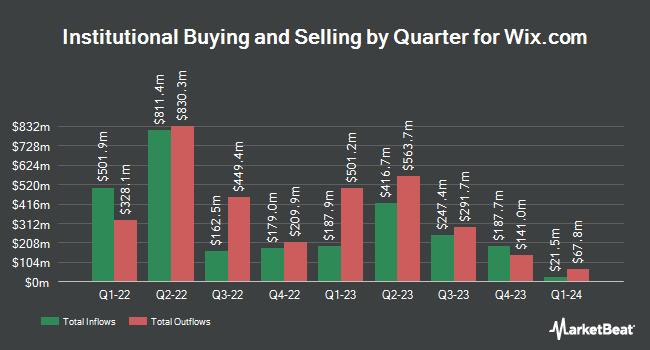

Thames Capital Management LLC bought a new stake in Wix.com Ltd. (NASDAQ:WIX - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund bought 24,793 shares of the information services provider's stock, valued at approximately $5,319,000. Wix.com makes up approximately 1.4% of Thames Capital Management LLC's holdings, making the stock its 28th biggest holding.

A number of other institutional investors and hedge funds also recently made changes to their positions in the company. Wellington Management Group LLP lifted its holdings in shares of Wix.com by 518.3% in the fourth quarter. Wellington Management Group LLP now owns 1,510,515 shares of the information services provider's stock worth $324,081,000 after acquiring an additional 1,266,202 shares during the last quarter. Geode Capital Management LLC increased its position in Wix.com by 4.3% during the 4th quarter. Geode Capital Management LLC now owns 481,535 shares of the information services provider's stock worth $102,926,000 after purchasing an additional 19,633 shares in the last quarter. SG Americas Securities LLC boosted its position in Wix.com by 558.5% in the fourth quarter. SG Americas Securities LLC now owns 471,933 shares of the information services provider's stock valued at $101,253,000 after buying an additional 400,265 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. grew its stake in shares of Wix.com by 4.2% during the fourth quarter. Connor Clark & Lunn Investment Management Ltd. now owns 314,039 shares of the information services provider's stock worth $67,377,000 after buying an additional 12,531 shares during the last quarter. Finally, Norges Bank acquired a new position in shares of Wix.com during the fourth quarter worth $63,829,000. Institutional investors own 81.52% of the company's stock.

Wix.com Stock Up 1.4 %

NASDAQ:WIX traded up $2.14 on Friday, hitting $157.82. The stock had a trading volume of 423,142 shares, compared to its average volume of 645,860. Wix.com Ltd. has a 52 week low of $117.58 and a 52 week high of $247.11. The business's fifty day moving average is $187.20 and its 200 day moving average is $196.44. The company has a market cap of $8.86 billion, a PE ratio of 67.24, a P/E/G ratio of 2.83 and a beta of 1.65.

Wix.com announced that its Board of Directors has approved a share buyback plan on Thursday, February 27th that allows the company to buyback $200.00 million in shares. This buyback authorization allows the information services provider to reacquire up to 1.8% of its stock through open market purchases. Stock buyback plans are generally a sign that the company's management believes its stock is undervalued.

Wall Street Analyst Weigh In

A number of equities research analysts recently weighed in on the company. Morgan Stanley upgraded Wix.com from an "equal weight" rating to an "overweight" rating and boosted their price objective for the stock from $248.00 to $276.00 in a research report on Monday, January 13th. Wells Fargo & Company raised Wix.com from an "underweight" rating to an "equal weight" rating and increased their price target for the company from $169.00 to $176.00 in a research note on Tuesday. UBS Group set a $250.00 price objective on Wix.com in a research note on Wednesday, March 5th. Cantor Fitzgerald increased their target price on shares of Wix.com from $260.00 to $270.00 and gave the company an "overweight" rating in a research report on Thursday, February 20th. Finally, Bank of America boosted their price target on shares of Wix.com from $228.00 to $270.00 and gave the stock a "buy" rating in a research report on Wednesday, February 19th. Four research analysts have rated the stock with a hold rating, fifteen have given a buy rating and three have assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $242.53.

Get Our Latest Report on Wix.com

Wix.com Profile

(

Free Report)

Wix.com Ltd., together with its subsidiaries, operates as a cloud-based web development platform for registered users and creators worldwide. The company offers Wix Editor, a drag-and-drop visual development and website editing environment platform; and Wix ADI that enables users to have the freedom of customization that the classic editor offers.

Recommended Stories

Before you consider Wix.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wix.com wasn't on the list.

While Wix.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.