EAM Global Investors LLC purchased a new position in Rocket Lab USA, Inc. (NASDAQ:RKLB - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 248,730 shares of the rocket manufacturer's stock, valued at approximately $6,335,000. Rocket Lab USA comprises 1.1% of EAM Global Investors LLC's investment portfolio, making the stock its 16th largest position.

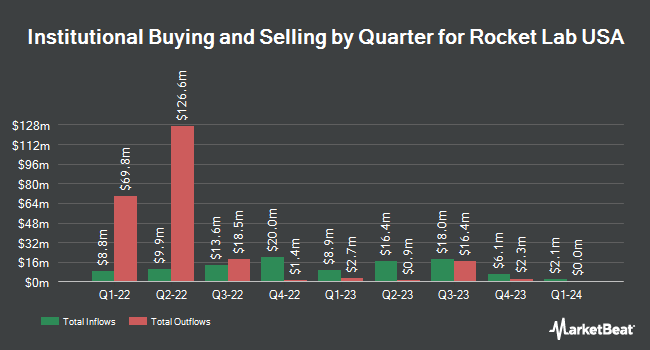

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Geode Capital Management LLC grew its stake in shares of Rocket Lab USA by 12.2% during the third quarter. Geode Capital Management LLC now owns 8,253,035 shares of the rocket manufacturer's stock valued at $80,317,000 after buying an additional 898,223 shares during the last quarter. Sanctuary Advisors LLC raised its holdings in shares of Rocket Lab USA by 34.0% in the 3rd quarter. Sanctuary Advisors LLC now owns 21,226 shares of the rocket manufacturer's stock valued at $207,000 after purchasing an additional 5,381 shares in the last quarter. Franklin Resources Inc. purchased a new stake in Rocket Lab USA during the third quarter worth $107,000. Everence Capital Management Inc. purchased a new stake in shares of Rocket Lab USA during the 4th quarter worth $286,000. Finally, Harbor Capital Advisors Inc. bought a new stake in shares of Rocket Lab USA in the 4th quarter valued at about $2,395,000. Hedge funds and other institutional investors own 71.78% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on RKLB. Morgan Stanley upped their price target on Rocket Lab USA from $18.00 to $20.00 and gave the stock an "equal weight" rating in a research report on Monday, March 10th. TD Cowen upgraded shares of Rocket Lab USA to a "strong-buy" rating in a research note on Monday, February 24th. Citigroup decreased their price objective on Rocket Lab USA from $35.00 to $33.00 and set a "buy" rating for the company in a report on Friday, February 28th. Stifel Nicolaus increased their price target on shares of Rocket Lab USA from $26.00 to $31.00 and gave the stock a "buy" rating in a report on Wednesday, January 8th. Finally, KeyCorp lowered their target price on shares of Rocket Lab USA from $32.00 to $28.00 and set an "overweight" rating on the stock in a research note on Friday, February 28th. Five equities research analysts have rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $22.72.

Check Out Our Latest Research Report on RKLB

Insider Activity at Rocket Lab USA

In other Rocket Lab USA news, insider Frank Klein sold 1,835 shares of Rocket Lab USA stock in a transaction on Monday, March 17th. The stock was sold at an average price of $19.93, for a total value of $36,571.55. Following the sale, the insider now owns 1,417,644 shares in the company, valued at $28,253,644.92. The trade was a 0.13 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 13.70% of the stock is currently owned by insiders.

Rocket Lab USA Price Performance

Shares of NASDAQ:RKLB traded down $0.24 during midday trading on Friday, hitting $19.74. The company's stock had a trading volume of 9,181,879 shares, compared to its average volume of 15,275,294. The company has a market cap of $8.95 billion, a P/E ratio of -53.35 and a beta of 2.08. The company has a debt-to-equity ratio of 0.97, a quick ratio of 2.16 and a current ratio of 2.58. Rocket Lab USA, Inc. has a 12-month low of $3.48 and a 12-month high of $33.34. The business's 50 day simple moving average is $20.49 and its 200 day simple moving average is $20.71.

Rocket Lab USA (NASDAQ:RKLB - Get Free Report) last posted its quarterly earnings results on Thursday, February 27th. The rocket manufacturer reported ($0.10) EPS for the quarter, missing the consensus estimate of ($0.09) by ($0.01). The company had revenue of $132.39 million during the quarter, compared to analyst estimates of $130.58 million. Rocket Lab USA had a negative net margin of 51.76% and a negative return on equity of 39.47%. On average, analysts forecast that Rocket Lab USA, Inc. will post -0.38 EPS for the current year.

Rocket Lab USA Profile

(

Free Report)

Rocket Lab USA, Inc, a space company, provides launch services and space systems solutions for the space and defense industries. The company provides launch services, spacecraft design services, spacecraft components, spacecraft manufacturing, and other spacecraft and on-orbit management solutions; and constellation management services, as well as designs and manufactures small and medium-class rockets.

Featured Articles

Before you consider Rocket Lab USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Lab USA wasn't on the list.

While Rocket Lab USA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.