Y Intercept Hong Kong Ltd purchased a new stake in IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 2,499 shares of the company's stock, valued at approximately $1,263,000.

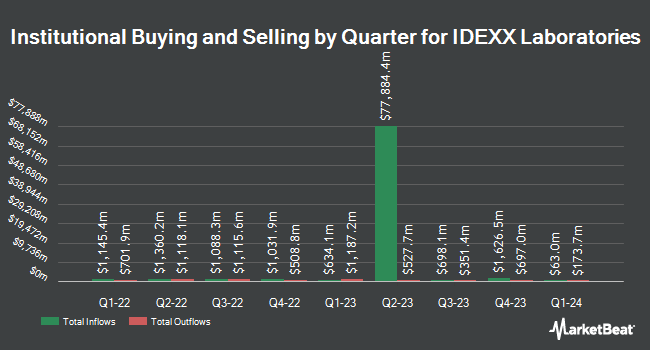

A number of other hedge funds have also recently made changes to their positions in the company. Sequoia Financial Advisors LLC increased its stake in IDEXX Laboratories by 7.9% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 1,589 shares of the company's stock worth $774,000 after acquiring an additional 117 shares during the last quarter. Wealth Enhancement Advisory Services LLC raised its stake in IDEXX Laboratories by 91.7% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 9,975 shares of the company's stock valued at $4,860,000 after purchasing an additional 4,772 shares in the last quarter. Great Valley Advisor Group Inc. purchased a new stake in IDEXX Laboratories in the second quarter valued at approximately $238,000. 180 Wealth Advisors LLC lifted its position in IDEXX Laboratories by 9.0% during the second quarter. 180 Wealth Advisors LLC now owns 656 shares of the company's stock valued at $320,000 after purchasing an additional 54 shares during the last quarter. Finally, Baader Bank Aktiengesellschaft purchased a new position in IDEXX Laboratories in the 2nd quarter worth approximately $313,000. 87.84% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at IDEXX Laboratories

In other news, Director Sophie V. Vandebroek sold 344 shares of the firm's stock in a transaction dated Wednesday, November 27th. The shares were sold at an average price of $420.44, for a total value of $144,631.36. Following the completion of the sale, the director now directly owns 905 shares of the company's stock, valued at approximately $380,498.20. This trade represents a 27.54 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. 2.11% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

IDXX has been the topic of several research reports. Barclays lowered their price objective on shares of IDEXX Laboratories from $570.00 to $481.00 and set an "overweight" rating on the stock in a research report on Monday, November 4th. Leerink Partners initiated coverage on IDEXX Laboratories in a research report on Monday, December 2nd. They set an "outperform" rating and a $500.00 price target on the stock. Leerink Partnrs upgraded IDEXX Laboratories to a "strong-buy" rating in a report on Monday, December 2nd. JPMorgan Chase & Co. decreased their price objective on IDEXX Laboratories from $630.00 to $575.00 and set an "overweight" rating on the stock in a report on Friday, October 11th. Finally, Stifel Nicolaus cut their target price on IDEXX Laboratories from $510.00 to $500.00 and set a "hold" rating for the company in a research note on Thursday, October 10th. Two investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $539.63.

Get Our Latest Report on IDXX

IDEXX Laboratories Trading Up 0.0 %

Shares of IDEXX Laboratories stock traded up $0.10 on Thursday, hitting $437.18. The stock had a trading volume of 415,504 shares, compared to its average volume of 512,824. The stock's 50-day simple moving average is $441.39 and its two-hundred day simple moving average is $472.64. IDEXX Laboratories, Inc. has a one year low of $398.50 and a one year high of $583.39. The company has a quick ratio of 1.03, a current ratio of 1.42 and a debt-to-equity ratio of 0.32. The stock has a market cap of $35.80 billion, a price-to-earnings ratio of 42.01, a PEG ratio of 3.98 and a beta of 1.37.

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The company reported $2.80 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.69 by $0.11. The firm had revenue of $975.50 million for the quarter, compared to analysts' expectations of $980.32 million. IDEXX Laboratories had a net margin of 22.53% and a return on equity of 55.42%. The company's revenue for the quarter was up 6.6% compared to the same quarter last year. During the same quarter in the previous year, the company earned $2.53 earnings per share. As a group, sell-side analysts predict that IDEXX Laboratories, Inc. will post 10.44 EPS for the current year.

IDEXX Laboratories Profile

(

Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Further Reading

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.