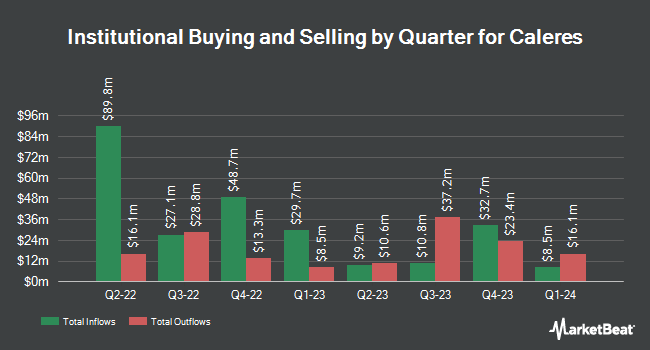

Verition Fund Management LLC purchased a new position in shares of Caleres, Inc. (NYSE:CAL - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor purchased 26,103 shares of the textile maker's stock, valued at approximately $863,000. Verition Fund Management LLC owned about 0.07% of Caleres as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently bought and sold shares of CAL. nVerses Capital LLC acquired a new stake in Caleres in the 2nd quarter valued at about $40,000. Creative Planning purchased a new position in Caleres during the third quarter worth approximately $204,000. AXA S.A. boosted its stake in Caleres by 28.5% during the second quarter. AXA S.A. now owns 6,939 shares of the textile maker's stock worth $233,000 after buying an additional 1,540 shares during the last quarter. Allspring Global Investments Holdings LLC grew its holdings in Caleres by 31,308.7% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 7,224 shares of the textile maker's stock valued at $243,000 after buying an additional 7,201 shares in the last quarter. Finally, Bailard Inc. acquired a new stake in shares of Caleres in the 2nd quarter worth $255,000. 98.44% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on CAL. Loop Capital lowered their price target on shares of Caleres from $30.00 to $25.00 and set a "hold" rating on the stock in a research report on Friday. StockNews.com cut shares of Caleres from a "buy" rating to a "hold" rating in a research note on Thursday, October 3rd.

Read Our Latest Report on Caleres

Caleres Stock Performance

CAL remained flat at $26.97 on Tuesday. 687,102 shares of the company traded hands, compared to its average volume of 548,774. The stock's 50-day simple moving average is $30.83 and its two-hundred day simple moving average is $34.02. Caleres, Inc. has a 12-month low of $26.05 and a 12-month high of $44.51. The stock has a market cap of $949.37 million, a price-to-earnings ratio of 6.01 and a beta of 1.92.

Caleres (NYSE:CAL - Get Free Report) last issued its quarterly earnings data on Thursday, December 5th. The textile maker reported $1.23 EPS for the quarter, missing the consensus estimate of $1.38 by ($0.15). Caleres had a return on equity of 22.71% and a net margin of 5.69%. The company had revenue of $740.90 million during the quarter, compared to analyst estimates of $751.35 million. During the same quarter in the prior year, the company posted $1.37 earnings per share. The business's revenue was down 2.8% compared to the same quarter last year. On average, equities research analysts predict that Caleres, Inc. will post 3.5 EPS for the current year.

Caleres Profile

(

Free Report)

Caleres, Inc engages in the retail and wholesale of footwear business in the United States, Canada, East Asia, and internationally. It operates through Famous Footwear and Brand Portfolio segments. The company offers licensed, branded, and private-label athletic, casual, and dress footwear products. The company provides brand name athletic, casual, and dress shoes, including Nike, Skechers, adidas, Vans, Crocs, Converse, Puma, Birkenstock, New Balance, Under Armour, Dr.

Featured Stories

Before you consider Caleres, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caleres wasn't on the list.

While Caleres currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.