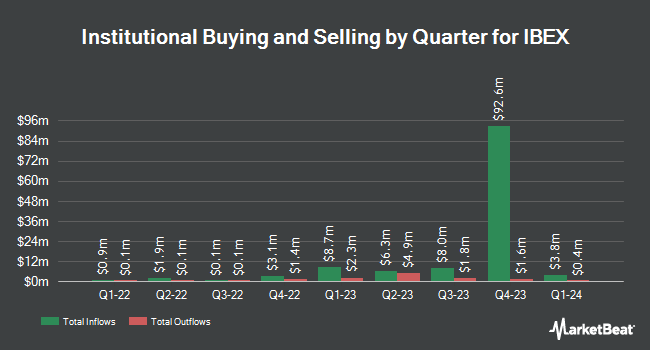

Quadrature Capital Ltd acquired a new stake in IBEX Limited (NASDAQ:IBEX - Free Report) in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 26,122 shares of the company's stock, valued at approximately $522,000. Quadrature Capital Ltd owned approximately 0.16% of IBEX as of its most recent filing with the SEC.

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. FMR LLC raised its position in IBEX by 314.5% in the third quarter. FMR LLC now owns 2,139 shares of the company's stock worth $43,000 after purchasing an additional 1,623 shares in the last quarter. Meeder Asset Management Inc. bought a new stake in shares of IBEX in the 2nd quarter valued at approximately $38,000. Janus Henderson Group PLC raised its holdings in shares of IBEX by 11.9% in the 3rd quarter. Janus Henderson Group PLC now owns 17,361 shares of the company's stock worth $347,000 after buying an additional 1,842 shares in the last quarter. Ritholtz Wealth Management acquired a new position in shares of IBEX in the 3rd quarter worth approximately $371,000. Finally, Martingale Asset Management L P lifted its position in shares of IBEX by 110.9% during the 3rd quarter. Martingale Asset Management L P now owns 21,720 shares of the company's stock worth $434,000 after buying an additional 11,421 shares during the period. 81.24% of the stock is owned by institutional investors.

IBEX Stock Up 3.2 %

IBEX traded up $0.63 during trading on Monday, hitting $20.42. The company's stock had a trading volume of 145,037 shares, compared to its average volume of 74,122. The stock has a market capitalization of $342.24 million, a price-to-earnings ratio of 10.74 and a beta of 0.80. The firm's 50 day moving average price is $19.40 and its two-hundred day moving average price is $17.68. IBEX Limited has a 12 month low of $13.00 and a 12 month high of $21.63.

IBEX (NASDAQ:IBEX - Get Free Report) last announced its earnings results on Thursday, September 12th. The company reported $0.54 earnings per share for the quarter. The company had revenue of $124.53 million during the quarter. IBEX had a return on equity of 22.54% and a net margin of 6.57%.

Insiders Place Their Bets

In related news, Director Group International L. Resource sold 59,269 shares of the firm's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $20.05, for a total value of $1,188,343.45. Following the transaction, the director now owns 5,375,114 shares in the company, valued at $107,771,035.70. This trade represents a 1.09 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Gem G.P. L.P. Pinebridge II sold 19,642 shares of IBEX stock in a transaction dated Thursday, October 10th. The stock was sold at an average price of $19.03, for a total value of $373,787.26. Following the completion of the sale, the director now owns 1,719,739 shares of the company's stock, valued at approximately $32,726,633.17. The trade was a 1.13 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 431,680 shares of company stock valued at $8,625,476. Insiders own 6.72% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on IBEX shares. Robert W. Baird upped their price target on IBEX from $23.00 to $26.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Royal Bank of Canada increased their target price on shares of IBEX from $18.00 to $20.00 and gave the stock a "sector perform" rating in a research report on Friday, September 13th. Two investment analysts have rated the stock with a hold rating and two have issued a buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $21.25.

Check Out Our Latest Stock Report on IBEX

IBEX Profile

(

Free Report)

IBEX Limited provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally. The company products and services portfolio includes ibex Connect, that offers customer service, technical support, revenue generation, and other revenue generation outsourced back-office services through the CX model, which integrates voice, email, chat, SMS, social media, and other communication applications; ibex Digital, a customer acquisition solution that comprises digital marketing, e-commerce technology, and platform solutions; and ibex CX, a customer experience solution, which provides a suite of proprietary software tools to measure, monitor, and manage its clients' customer experience.

Featured Articles

Before you consider IBEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IBEX wasn't on the list.

While IBEX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.