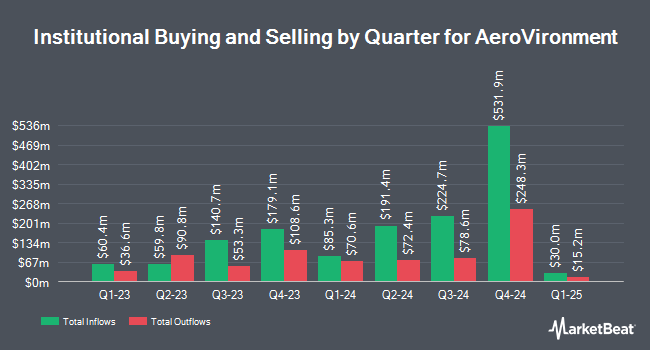

Cibc World Markets Corp bought a new position in AeroVironment, Inc. (NASDAQ:AVAV - Free Report) during the fourth quarter, according to its most recent Form 13F filing with the SEC. The firm bought 2,624 shares of the aerospace company's stock, valued at approximately $404,000.

Several other institutional investors and hedge funds have also made changes to their positions in AVAV. Modus Advisors LLC purchased a new position in AeroVironment during the fourth quarter worth approximately $31,000. Golden State Wealth Management LLC purchased a new position in shares of AeroVironment during the 4th quarter worth $31,000. Wilmington Savings Fund Society FSB boosted its position in shares of AeroVironment by 1,515.4% during the 4th quarter. Wilmington Savings Fund Society FSB now owns 210 shares of the aerospace company's stock valued at $32,000 after acquiring an additional 197 shares during the last quarter. Bogart Wealth LLC purchased a new stake in shares of AeroVironment in the fourth quarter valued at about $38,000. Finally, Blue Trust Inc. increased its position in AeroVironment by 2,950.0% during the fourth quarter. Blue Trust Inc. now owns 305 shares of the aerospace company's stock worth $47,000 after purchasing an additional 295 shares during the last quarter. 86.38% of the stock is currently owned by institutional investors and hedge funds.

AeroVironment Trading Up 1.5 %

NASDAQ AVAV traded up $1.96 on Tuesday, reaching $130.65. The stock had a trading volume of 150,060 shares, compared to its average volume of 390,156. The company has a quick ratio of 3.36, a current ratio of 4.61 and a debt-to-equity ratio of 0.02. The stock has a fifty day moving average price of $155.69 and a two-hundred day moving average price of $178.14. AeroVironment, Inc. has a 12-month low of $110.07 and a 12-month high of $236.60. The firm has a market capitalization of $3.69 billion, a price-to-earnings ratio of 74.73 and a beta of 0.42.

Wall Street Analysts Forecast Growth

AVAV has been the topic of several recent analyst reports. Robert W. Baird decreased their target price on shares of AeroVironment from $220.00 to $146.00 and set an "outperform" rating on the stock in a report on Wednesday, March 5th. Jefferies Financial Group decreased their price objective on AeroVironment from $230.00 to $190.00 and set a "buy" rating on the stock in a report on Wednesday, March 5th. Finally, William Blair reissued an "outperform" rating on shares of AeroVironment in a research note on Wednesday, March 5th. One equities research analyst has rated the stock with a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $202.40.

Read Our Latest Report on AeroVironment

About AeroVironment

(

Free Report)

AeroVironment, Inc designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally. It operates through Small Unmanned Aircraft Systems (SUAS), Tactical Missile System (TMS), Medium Unmanned Aircraft Systems (MUAS), and High Altitude Pseudo-Satellite Systems (HAPS) segments.

Featured Stories

Before you consider AeroVironment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AeroVironment wasn't on the list.

While AeroVironment currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.