Amitell Capital Pte Ltd acquired a new stake in shares of Philip Morris International Inc. (NYSE:PM - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund acquired 26,444 shares of the company's stock, valued at approximately $3,183,000. Philip Morris International comprises approximately 2.6% of Amitell Capital Pte Ltd's investment portfolio, making the stock its 15th largest position.

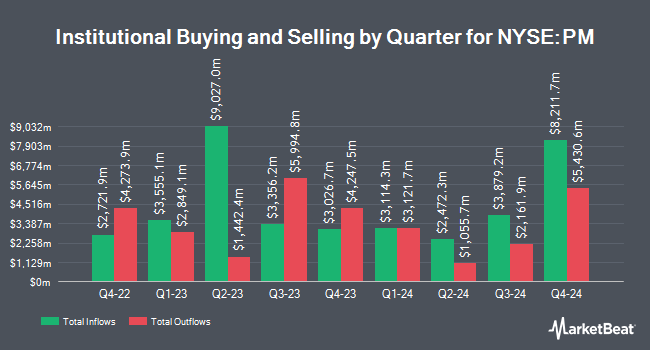

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. NewSquare Capital LLC grew its stake in shares of Philip Morris International by 53.7% during the 4th quarter. NewSquare Capital LLC now owns 206 shares of the company's stock valued at $25,000 after purchasing an additional 72 shares during the period. Dunhill Financial LLC boosted its holdings in shares of Philip Morris International by 203.8% in the third quarter. Dunhill Financial LLC now owns 240 shares of the company's stock worth $29,000 after buying an additional 161 shares during the last quarter. McClarren Financial Advisors Inc. bought a new stake in Philip Morris International during the fourth quarter valued at approximately $33,000. Knuff & Co LLC purchased a new stake in Philip Morris International during the fourth quarter valued at approximately $36,000. Finally, Sierra Ocean LLC bought a new position in Philip Morris International in the fourth quarter worth approximately $37,000. Institutional investors own 78.63% of the company's stock.

Analysts Set New Price Targets

PM has been the subject of a number of recent research reports. UBS Group boosted their price objective on shares of Philip Morris International from $105.00 to $120.00 and gave the company a "sell" rating in a research report on Friday, February 7th. Argus upgraded Philip Morris International from a "hold" rating to a "buy" rating in a research report on Friday, March 14th. Morgan Stanley started coverage on Philip Morris International in a research note on Thursday, January 16th. They issued an "overweight" rating and a $140.00 price objective on the stock. JPMorgan Chase & Co. boosted their price objective on Philip Morris International from $145.00 to $160.00 and gave the company an "overweight" rating in a research note on Tuesday, February 18th. Finally, Barclays raised their target price on shares of Philip Morris International from $145.00 to $175.00 and gave the stock an "overweight" rating in a research note on Wednesday, February 26th. One analyst has rated the stock with a sell rating, one has given a hold rating and nine have assigned a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $145.44.

Check Out Our Latest Research Report on PM

Insider Transactions at Philip Morris International

In related news, Chairman Andre Calantzopoulos sold 40,643 shares of Philip Morris International stock in a transaction dated Thursday, February 20th. The stock was sold at an average price of $149.06, for a total value of $6,058,245.58. Following the completion of the transaction, the chairman now owns 561,349 shares in the company, valued at approximately $83,674,681.94. This trade represents a 6.75 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, SVP Yann Guerin sold 2,500 shares of the firm's stock in a transaction that occurred on Thursday, February 20th. The shares were sold at an average price of $151.28, for a total value of $378,200.00. Following the completion of the sale, the senior vice president now directly owns 30,308 shares of the company's stock, valued at $4,584,994.24. The trade was a 7.62 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 131,822 shares of company stock valued at $19,655,585 in the last ninety days. Corporate insiders own 0.14% of the company's stock.

Philip Morris International Trading Up 1.8 %

Shares of NYSE:PM traded up $2.68 during midday trading on Friday, reaching $153.85. 6,458,822 shares of the company were exchanged, compared to its average volume of 5,569,399. The stock has a market cap of $239.47 billion, a PE ratio of 34.11, a price-to-earnings-growth ratio of 2.65 and a beta of 0.46. The business's fifty day moving average is $152.03 and its two-hundred day moving average is $134.63. Philip Morris International Inc. has a one year low of $87.82 and a one year high of $163.08.

Philip Morris International (NYSE:PM - Get Free Report) last released its quarterly earnings data on Thursday, February 6th. The company reported $1.55 EPS for the quarter, beating the consensus estimate of $1.49 by $0.06. Philip Morris International had a net margin of 7.89% and a negative return on equity of 120.08%. As a group, sell-side analysts expect that Philip Morris International Inc. will post 7.14 EPS for the current year.

Philip Morris International Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, April 10th. Shareholders of record on Thursday, March 20th were paid a $1.35 dividend. This represents a $5.40 dividend on an annualized basis and a yield of 3.51%. The ex-dividend date of this dividend was Thursday, March 20th. Philip Morris International's payout ratio is 119.73%.

About Philip Morris International

(

Free Report)

Philip Morris International Inc operates as a tobacco company working to delivers a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector. The company's product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products primarily under the IQOS and ZYN brands; and consumer accessories, such as lighters and matches.

Featured Stories

Before you consider Philip Morris International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Philip Morris International wasn't on the list.

While Philip Morris International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.