272 Capital LP bought a new position in shares of LiveRamp Holdings, Inc. (NYSE:RAMP - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 66,372 shares of the company's stock, valued at approximately $1,500,000. LiveRamp comprises 1.7% of 272 Capital LP's investment portfolio, making the stock its 21st largest position. 272 Capital LP owned 0.10% of LiveRamp at the end of the most recent reporting period.

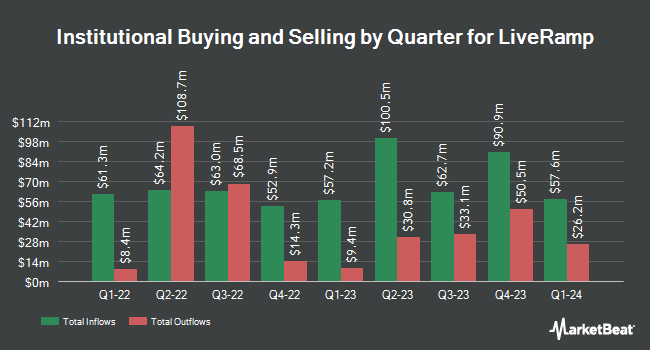

Other institutional investors have also made changes to their positions in the company. Louisiana State Employees Retirement System lifted its holdings in LiveRamp by 1.5% during the 2nd quarter. Louisiana State Employees Retirement System now owns 33,300 shares of the company's stock worth $1,030,000 after buying an additional 500 shares in the last quarter. Arizona State Retirement System lifted its stake in shares of LiveRamp by 2.9% during the second quarter. Arizona State Retirement System now owns 18,528 shares of the company's stock valued at $573,000 after acquiring an additional 523 shares during the period. DT Investment Partners LLC boosted its holdings in LiveRamp by 62.6% in the third quarter. DT Investment Partners LLC now owns 1,415 shares of the company's stock valued at $35,000 after acquiring an additional 545 shares during the last quarter. Blue Trust Inc. increased its position in LiveRamp by 187.1% in the second quarter. Blue Trust Inc. now owns 1,065 shares of the company's stock worth $33,000 after purchasing an additional 694 shares during the period. Finally, Quarry LP raised its holdings in LiveRamp by 4,575.0% during the 2nd quarter. Quarry LP now owns 935 shares of the company's stock worth $29,000 after purchasing an additional 915 shares during the last quarter. 93.83% of the stock is owned by institutional investors.

LiveRamp Stock Down 0.3 %

LiveRamp stock traded down $0.08 during mid-day trading on Friday, hitting $30.36. 196,541 shares of the company's stock were exchanged, compared to its average volume of 570,531. The company's 50 day simple moving average is $26.28 and its 200-day simple moving average is $27.93. The firm has a market capitalization of $1.98 billion, a P/E ratio of 607.32 and a beta of 0.96. LiveRamp Holdings, Inc. has a fifty-two week low of $21.45 and a fifty-two week high of $42.66.

LiveRamp (NYSE:RAMP - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.37 by $0.14. LiveRamp had a return on equity of 1.25% and a net margin of 0.40%. The business had revenue of $185.00 million for the quarter, compared to analysts' expectations of $176.16 million. During the same quarter in the previous year, the business posted $0.21 EPS. LiveRamp's revenue for the quarter was up 15.6% on a year-over-year basis. Research analysts expect that LiveRamp Holdings, Inc. will post 0.36 EPS for the current year.

Insider Activity

In related news, insider Kimberly Bloomston sold 4,000 shares of the stock in a transaction dated Thursday, September 26th. The stock was sold at an average price of $25.17, for a total transaction of $100,680.00. Following the completion of the transaction, the insider now directly owns 117,247 shares in the company, valued at approximately $2,951,106.99. This trade represents a 3.30 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Debora B. Tomlin sold 9,765 shares of the business's stock in a transaction that occurred on Thursday, September 26th. The shares were sold at an average price of $25.07, for a total value of $244,808.55. Following the completion of the sale, the director now owns 24,509 shares in the company, valued at $614,440.63. The trade was a 28.49 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 3.39% of the company's stock.

Analysts Set New Price Targets

RAMP has been the topic of several recent research reports. Macquarie reaffirmed an "outperform" rating and issued a $43.00 target price on shares of LiveRamp in a research note on Thursday, November 7th. Craig Hallum reduced their price objective on shares of LiveRamp from $55.00 to $43.00 and set a "buy" rating on the stock in a research note on Thursday, August 8th. Evercore ISI dropped their target price on shares of LiveRamp from $50.00 to $40.00 and set an "outperform" rating for the company in a research report on Thursday, August 8th. Wells Fargo & Company started coverage on LiveRamp in a research note on Monday, October 28th. They issued an "equal weight" rating and a $25.00 price target on the stock. Finally, Benchmark decreased their price objective on LiveRamp from $48.00 to $42.00 and set a "buy" rating for the company in a research note on Thursday, November 7th. One analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, LiveRamp has a consensus rating of "Moderate Buy" and a consensus target price of $41.14.

Read Our Latest Stock Analysis on LiveRamp

About LiveRamp

(

Free Report)

LiveRamp Holdings, Inc, a technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally. The company operates LiveRamp Data Collaboration platform enables an organization to unify customer and prospect data to build a single view of the customer in a way that protects consumer privacy.

Featured Stories

Before you consider LiveRamp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LiveRamp wasn't on the list.

While LiveRamp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.