272 Capital LP reduced its position in Twilio Inc. (NYSE:TWLO - Free Report) by 27.8% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 54,872 shares of the technology company's stock after selling 21,117 shares during the period. Twilio accounts for approximately 1.9% of 272 Capital LP's investment portfolio, making the stock its 22nd largest holding. 272 Capital LP's holdings in Twilio were worth $3,579,000 at the end of the most recent reporting period.

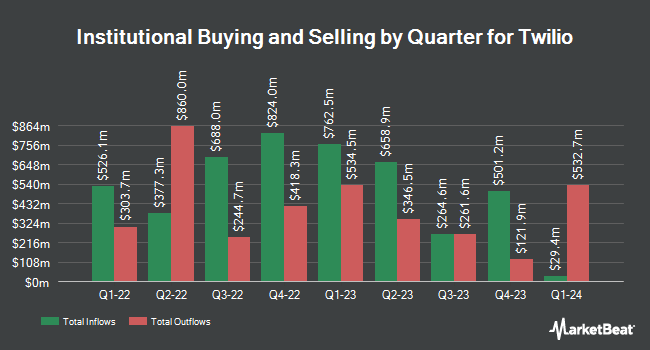

Other institutional investors and hedge funds also recently made changes to their positions in the company. SouthState Corp increased its position in Twilio by 159.1% in the second quarter. SouthState Corp now owns 500 shares of the technology company's stock worth $28,000 after purchasing an additional 307 shares during the period. True Wealth Design LLC raised its stake in shares of Twilio by 5,200.0% during the third quarter. True Wealth Design LLC now owns 424 shares of the technology company's stock worth $28,000 after buying an additional 416 shares during the last quarter. Migdal Insurance & Financial Holdings Ltd. acquired a new position in Twilio in the second quarter valued at approximately $29,000. Brooklyn Investment Group acquired a new stake in Twilio during the 3rd quarter worth $46,000. Finally, Venturi Wealth Management LLC lifted its stake in shares of Twilio by 205.4% in the 3rd quarter. Venturi Wealth Management LLC now owns 733 shares of the technology company's stock valued at $48,000 after purchasing an additional 493 shares during the period. Institutional investors own 84.27% of the company's stock.

Twilio Stock Down 1.7 %

TWLO stock traded down $2.00 during mid-day trading on Friday, reaching $112.96. The company had a trading volume of 2,178,359 shares, compared to its average volume of 2,689,135. The company has a market capitalization of $17.33 billion, a price-to-earnings ratio of -44.73, a PEG ratio of 3.27 and a beta of 1.38. Twilio Inc. has a 52 week low of $52.51 and a 52 week high of $116.43. The stock has a 50 day simple moving average of $88.86 and a two-hundred day simple moving average of $69.39. The company has a debt-to-equity ratio of 0.12, a current ratio of 5.06 and a quick ratio of 5.06.

Wall Street Analysts Forecast Growth

TWLO has been the subject of a number of recent analyst reports. Robert W. Baird upped their price objective on Twilio from $65.00 to $80.00 and gave the company a "neutral" rating in a report on Friday, November 1st. JPMorgan Chase & Co. upped their price target on Twilio from $78.00 to $83.00 and gave the company an "overweight" rating in a research note on Thursday, October 31st. Monness Crespi & Hardt raised shares of Twilio from a "neutral" rating to a "buy" rating and set a $135.00 price objective on the stock in a research note on Friday, November 15th. Northland Securities upped their target price on shares of Twilio from $66.00 to $86.00 and gave the company a "market perform" rating in a research note on Thursday, October 31st. Finally, UBS Group lifted their price target on shares of Twilio from $74.00 to $88.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Two analysts have rated the stock with a sell rating, eleven have assigned a hold rating and eleven have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $86.52.

Get Our Latest Stock Analysis on Twilio

Insiders Place Their Bets

In related news, CEO Khozema Shipchandler sold 11,073 shares of the business's stock in a transaction that occurred on Monday, September 30th. The stock was sold at an average price of $65.03, for a total transaction of $720,077.19. Following the transaction, the chief executive officer now directly owns 278,134 shares of the company's stock, valued at approximately $18,087,054.02. The trade was a 3.83 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CFO Aidan Viggiano sold 6,701 shares of the firm's stock in a transaction on Monday, September 30th. The shares were sold at an average price of $65.03, for a total value of $435,766.03. Following the sale, the chief financial officer now directly owns 177,869 shares of the company's stock, valued at $11,566,821.07. This represents a 3.63 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 54,575 shares of company stock valued at $3,863,961. 4.50% of the stock is currently owned by corporate insiders.

Twilio Company Profile

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

See Also

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.