272 Capital LP purchased a new stake in H&E Equipment Services, Inc. (NASDAQ:HEES - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm purchased 20,000 shares of the industrial products company's stock, valued at approximately $974,000. 272 Capital LP owned about 0.05% of H&E Equipment Services as of its most recent SEC filing.

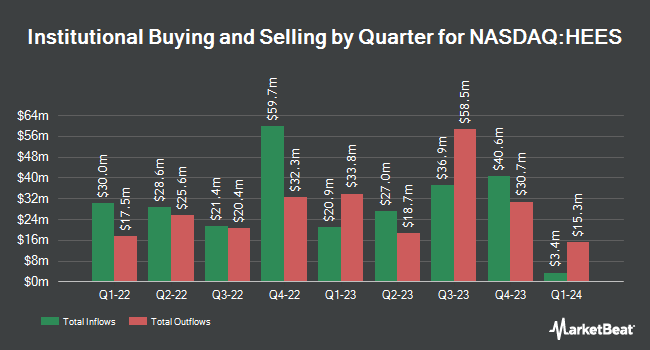

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. CWM LLC grew its position in shares of H&E Equipment Services by 42.5% during the 2nd quarter. CWM LLC now owns 932 shares of the industrial products company's stock worth $41,000 after buying an additional 278 shares during the period. SG Americas Securities LLC grew its holdings in H&E Equipment Services by 688.1% during the 2nd quarter. SG Americas Securities LLC now owns 20,862 shares of the industrial products company's stock worth $921,000 after acquiring an additional 18,215 shares during the period. Diversified Trust Co raised its position in shares of H&E Equipment Services by 5.3% during the 2nd quarter. Diversified Trust Co now owns 10,027 shares of the industrial products company's stock valued at $443,000 after acquiring an additional 503 shares during the last quarter. Wedge Capital Management L L P NC lifted its stake in shares of H&E Equipment Services by 7.5% in the 2nd quarter. Wedge Capital Management L L P NC now owns 82,322 shares of the industrial products company's stock valued at $3,636,000 after purchasing an additional 5,731 shares during the period. Finally, Summit Global Investments boosted its position in shares of H&E Equipment Services by 10.2% in the 2nd quarter. Summit Global Investments now owns 23,464 shares of the industrial products company's stock worth $1,036,000 after purchasing an additional 2,168 shares during the last quarter. 84.08% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Separately, B. Riley reissued a "buy" rating and issued a $60.00 target price (down previously from $62.00) on shares of H&E Equipment Services in a research note on Wednesday, October 30th. Three research analysts have rated the stock with a hold rating and four have given a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $61.25.

Check Out Our Latest Report on HEES

H&E Equipment Services Trading Down 0.2 %

Shares of HEES stock traded down $0.14 on Friday, hitting $55.89. The stock had a trading volume of 177,838 shares, compared to its average volume of 268,947. The company has a current ratio of 0.64, a quick ratio of 0.59 and a debt-to-equity ratio of 2.09. H&E Equipment Services, Inc. has a twelve month low of $40.92 and a twelve month high of $66.18. The company has a fifty day moving average price of $55.77 and a two-hundred day moving average price of $49.71. The firm has a market cap of $2.05 billion, a P/E ratio of 14.19, a PEG ratio of 13.24 and a beta of 1.84.

H&E Equipment Services (NASDAQ:HEES - Get Free Report) last posted its earnings results on Tuesday, October 29th. The industrial products company reported $0.85 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.00 by ($0.15). The business had revenue of $384.86 million during the quarter, compared to analyst estimates of $388.18 million. H&E Equipment Services had a net margin of 9.47% and a return on equity of 25.46%. The firm's revenue was down 4.0% on a year-over-year basis. During the same period in the previous year, the firm posted $1.46 earnings per share. As a group, analysts forecast that H&E Equipment Services, Inc. will post 3.27 earnings per share for the current fiscal year.

H&E Equipment Services Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Friday, November 29th will be issued a dividend of $0.275 per share. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.10 annualized dividend and a yield of 1.97%. H&E Equipment Services's dividend payout ratio (DPR) is currently 27.92%.

H&E Equipment Services Company Profile

(

Free Report)

H&E Equipment Services, Inc operates as an integrated equipment services company in the United States. The company operates in five segments: Equipment Rentals, Sales of Rental Equipment, Sales of New Equipment, Parts Sales, and Repair and Maintenance Services. The Equipment Rentals segment provides construction and industrial equipment for rent on a daily, weekly, and monthly basis.

Read More

Before you consider H&E Equipment Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&E Equipment Services wasn't on the list.

While H&E Equipment Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.