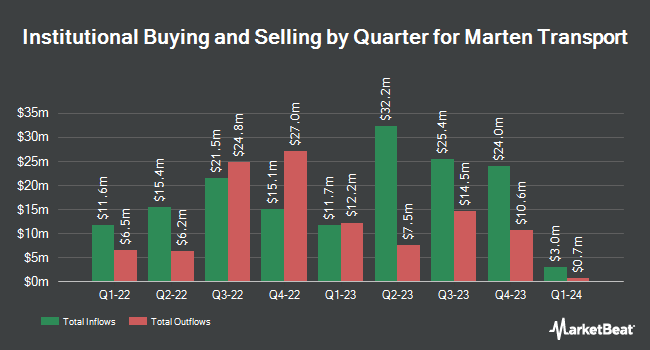

Fox Run Management L.L.C. purchased a new position in Marten Transport, Ltd. (NASDAQ:MRTN - Free Report) during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm purchased 27,526 shares of the transportation company's stock, valued at approximately $430,000.

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Confluence Investment Management LLC boosted its holdings in shares of Marten Transport by 0.5% in the fourth quarter. Confluence Investment Management LLC now owns 154,916 shares of the transportation company's stock worth $2,418,000 after buying an additional 754 shares during the period. Keybank National Association OH lifted its position in shares of Marten Transport by 5.5% in the 4th quarter. Keybank National Association OH now owns 24,006 shares of the transportation company's stock valued at $375,000 after acquiring an additional 1,258 shares in the last quarter. Franklin Resources Inc. boosted its stake in Marten Transport by 5.2% in the 3rd quarter. Franklin Resources Inc. now owns 31,148 shares of the transportation company's stock worth $521,000 after purchasing an additional 1,526 shares during the period. Y Intercept Hong Kong Ltd grew its position in Marten Transport by 11.4% during the 4th quarter. Y Intercept Hong Kong Ltd now owns 18,760 shares of the transportation company's stock worth $293,000 after purchasing an additional 1,916 shares in the last quarter. Finally, Hodges Capital Management Inc. raised its stake in Marten Transport by 2.1% during the 3rd quarter. Hodges Capital Management Inc. now owns 117,500 shares of the transportation company's stock valued at $2,080,000 after purchasing an additional 2,400 shares during the period. Institutional investors and hedge funds own 69.12% of the company's stock.

Wall Street Analyst Weigh In

Separately, Stephens raised their target price on Marten Transport from $18.00 to $19.00 and gave the stock an "overweight" rating in a research report on Tuesday, January 28th.

Get Our Latest Report on Marten Transport

Marten Transport Price Performance

MRTN traded down $0.30 on Friday, reaching $13.68. 336,023 shares of the company traded hands, compared to its average volume of 397,240. Marten Transport, Ltd. has a 52-week low of $13.45 and a 52-week high of $19.26. The stock's 50 day moving average price is $14.76 and its 200-day moving average price is $15.97. The company has a market cap of $1.11 billion, a price-to-earnings ratio of 40.24 and a beta of 0.84.

Marten Transport (NASDAQ:MRTN - Get Free Report) last issued its quarterly earnings results on Monday, January 27th. The transportation company reported $0.07 earnings per share for the quarter, beating analysts' consensus estimates of $0.06 by $0.01. Marten Transport had a net margin of 2.79% and a return on equity of 3.52%. As a group, equities research analysts forecast that Marten Transport, Ltd. will post 0.41 earnings per share for the current fiscal year.

Marten Transport Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, March 28th. Stockholders of record on Friday, March 14th were paid a $0.06 dividend. This represents a $0.24 dividend on an annualized basis and a dividend yield of 1.75%. The ex-dividend date of this dividend was Friday, March 14th. Marten Transport's dividend payout ratio is 70.59%.

Marten Transport Company Profile

(

Free Report)

Marten Transport, Ltd. operates as a temperature-sensitive truckload carrier for shippers in the United State, Mexico, and Canada. The company operates through four segments: Truckload, Dedicated, Intermodal, and Brokerage. The Truckload segment transports food and other consumer packaged goods that require a temperature-controlled or insulated environment, as well as dry freight; and regional short-haul and medium-to-long-haul full-load transportation services.

See Also

Before you consider Marten Transport, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marten Transport wasn't on the list.

While Marten Transport currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.