Dynamic Technology Lab Private Ltd acquired a new position in Sinclair, Inc. (NASDAQ:SBGI - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund acquired 27,944 shares of the company's stock, valued at approximately $451,000.

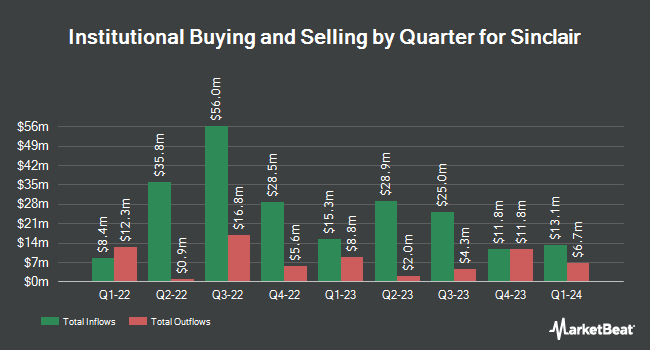

Several other institutional investors have also added to or reduced their stakes in the stock. Verition Fund Management LLC acquired a new position in shares of Sinclair in the 3rd quarter valued at about $822,000. HighTower Advisors LLC lifted its stake in Sinclair by 15.4% in the third quarter. HighTower Advisors LLC now owns 28,463 shares of the company's stock valued at $433,000 after buying an additional 3,801 shares during the period. Point72 Asset Management L.P. bought a new position in shares of Sinclair during the 3rd quarter worth approximately $2,110,000. Barclays PLC grew its position in shares of Sinclair by 378.1% during the 3rd quarter. Barclays PLC now owns 54,229 shares of the company's stock worth $831,000 after buying an additional 42,887 shares during the period. Finally, Geode Capital Management LLC increased its stake in shares of Sinclair by 1.9% in the 3rd quarter. Geode Capital Management LLC now owns 826,949 shares of the company's stock valued at $12,655,000 after acquiring an additional 15,263 shares in the last quarter. 41.71% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, Chairman David D. Smith bought 30,296 shares of the company's stock in a transaction on Wednesday, March 5th. The shares were purchased at an average cost of $14.09 per share, for a total transaction of $426,870.64. Following the completion of the purchase, the chairman now directly owns 728,986 shares in the company, valued at $10,271,412.74. The trade was a 4.34 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which is accessible through this link. Over the last three months, insiders have acquired 458,530 shares of company stock worth $6,636,392. 46.60% of the stock is owned by company insiders.

Sinclair Stock Up 4.9 %

Sinclair stock traded up $0.67 during trading on Monday, hitting $14.35. 153,558 shares of the company were exchanged, compared to its average volume of 354,784. The company has a current ratio of 1.91, a quick ratio of 1.91 and a debt-to-equity ratio of 11.73. The business's 50 day moving average is $14.82 and its 200 day moving average is $15.87. Sinclair, Inc. has a 52 week low of $11.13 and a 52 week high of $18.46. The company has a market capitalization of $953.83 million, a P/E ratio of -4.35 and a beta of 1.29.

Sinclair (NASDAQ:SBGI - Get Free Report) last announced its earnings results on Wednesday, February 26th. The company reported $2.61 EPS for the quarter, beating the consensus estimate of $1.99 by $0.62. Sinclair had a negative net margin of 6.14% and a positive return on equity of 63.89%. The company had revenue of $1 billion during the quarter, compared to the consensus estimate of $1.01 billion. Analysts predict that Sinclair, Inc. will post 4.24 earnings per share for the current year.

Sinclair Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, March 24th. Investors of record on Monday, March 10th were given a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 6.97%. The ex-dividend date was Monday, March 10th. Sinclair's payout ratio is 21.46%.

Wall Street Analysts Forecast Growth

Several research firms have weighed in on SBGI. Benchmark reaffirmed a "buy" rating and issued a $30.00 price target on shares of Sinclair in a research note on Tuesday, January 28th. Guggenheim dropped their price target on Sinclair from $19.00 to $17.00 and set a "buy" rating on the stock in a research note on Monday, March 10th. Wells Fargo & Company cut their price target on Sinclair from $19.00 to $17.00 and set an "equal weight" rating on the stock in a report on Thursday, February 27th. Finally, StockNews.com downgraded Sinclair from a "buy" rating to a "hold" rating in a report on Thursday, March 6th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating and two have given a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $19.30.

View Our Latest Stock Report on Sinclair

About Sinclair

(

Free Report)

Sinclair, Inc, a media company, provides content on local television stations and digital platforms in the United States. It operates through two segments, Local Media and Tennis. The Local Media segment operates broadcast television stations, original networks, and content; provides free-over-the-air programming and live local sporting events on its stations; distributes its content to multi-channel video programming distributors in exchange for contractual fees; and produces local and original news programs.

Featured Articles

Before you consider Sinclair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sinclair wasn't on the list.

While Sinclair currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.