Verition Fund Management LLC acquired a new stake in Monarch Casino & Resort, Inc. (NASDAQ:MCRI - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor acquired 29,637 shares of the company's stock, valued at approximately $2,349,000. Verition Fund Management LLC owned 0.16% of Monarch Casino & Resort at the end of the most recent reporting period.

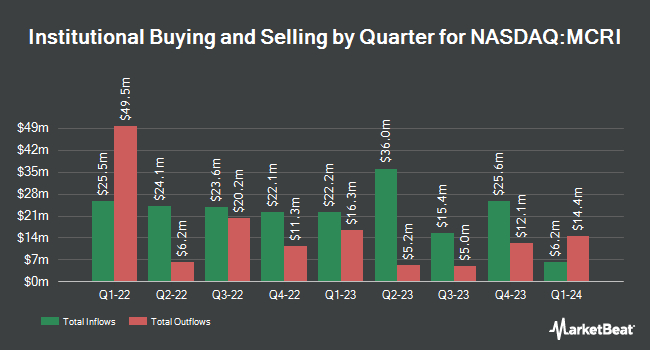

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the business. Millennium Management LLC boosted its holdings in Monarch Casino & Resort by 376.1% during the second quarter. Millennium Management LLC now owns 85,869 shares of the company's stock worth $5,850,000 after buying an additional 67,833 shares during the last quarter. Manning & Napier Advisors LLC bought a new position in Monarch Casino & Resort during the 2nd quarter worth approximately $3,307,000. American Century Companies Inc. grew its holdings in Monarch Casino & Resort by 17.3% during the second quarter. American Century Companies Inc. now owns 313,682 shares of the company's stock valued at $21,371,000 after purchasing an additional 46,323 shares during the period. Segall Bryant & Hamill LLC bought a new stake in Monarch Casino & Resort in the third quarter valued at approximately $1,868,000. Finally, Renaissance Technologies LLC raised its holdings in Monarch Casino & Resort by 11.7% in the second quarter. Renaissance Technologies LLC now owns 110,100 shares of the company's stock worth $7,501,000 after purchasing an additional 11,500 shares during the period. 62.37% of the stock is owned by institutional investors.

Monarch Casino & Resort Stock Performance

NASDAQ MCRI traded down $1.01 on Friday, reaching $85.17. The company had a trading volume of 52,475 shares, compared to its average volume of 119,887. The company's fifty day moving average is $80.40 and its 200-day moving average is $74.51. The firm has a market capitalization of $1.57 billion, a price-to-earnings ratio of 18.84 and a beta of 1.72. Monarch Casino & Resort, Inc. has a 1-year low of $63.51 and a 1-year high of $89.06.

Monarch Casino & Resort (NASDAQ:MCRI - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The company reported $1.47 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.37 by $0.10. The business had revenue of $137.87 million during the quarter, compared to the consensus estimate of $134.50 million. Monarch Casino & Resort had a return on equity of 17.06% and a net margin of 16.82%. During the same period last year, the company earned $1.38 earnings per share. On average, research analysts forecast that Monarch Casino & Resort, Inc. will post 4.72 earnings per share for the current year.

Wall Street Analysts Forecast Growth

MCRI has been the subject of a number of recent analyst reports. Truist Financial upped their price objective on shares of Monarch Casino & Resort from $75.00 to $82.00 and gave the company a "hold" rating in a research report on Wednesday, October 23rd. Stifel Nicolaus increased their price target on Monarch Casino & Resort from $72.00 to $77.00 and gave the stock a "hold" rating in a report on Thursday, October 24th. Finally, StockNews.com upgraded Monarch Casino & Resort from a "buy" rating to a "strong-buy" rating in a report on Thursday, November 28th.

Check Out Our Latest Report on Monarch Casino & Resort

Monarch Casino & Resort Profile

(

Free Report)

Monarch Casino & Resort, Inc, through its subsidiaries, owns and operates the Atlantis Casino Resort Spa, a hotel and casino in Reno, Nevada. It also owns and operates the Monarch Casino Resort Spa Black Hawk in Black Hawk, Colorado. The company was incorporated in 1993 and is based in Reno, Nevada.

Featured Stories

Before you consider Monarch Casino & Resort, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monarch Casino & Resort wasn't on the list.

While Monarch Casino & Resort currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.