Proficio Capital Partners LLC purchased a new stake in shares of Terex Co. (NYSE:TEX - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund purchased 30,805 shares of the industrial products company's stock, valued at approximately $1,424,000.

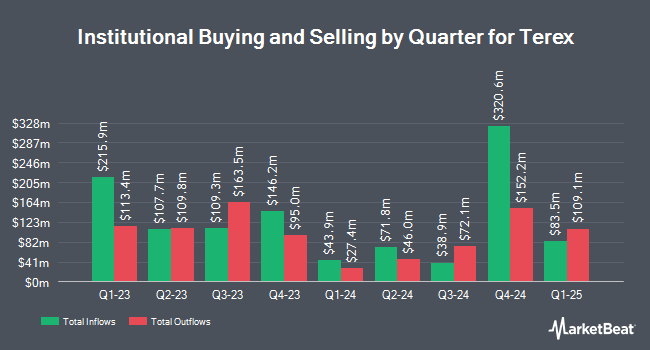

Several other hedge funds and other institutional investors also recently modified their holdings of TEX. International Assets Investment Management LLC increased its position in shares of Terex by 105.0% during the third quarter. International Assets Investment Management LLC now owns 4,074 shares of the industrial products company's stock valued at $216,000 after buying an additional 2,087 shares during the period. US Bancorp DE grew its holdings in Terex by 4.0% in the third quarter. US Bancorp DE now owns 5,837 shares of the industrial products company's stock worth $309,000 after purchasing an additional 227 shares during the period. Farther Finance Advisors LLC grew its holdings in Terex by 74.6% in the third quarter. Farther Finance Advisors LLC now owns 1,180 shares of the industrial products company's stock worth $62,000 after purchasing an additional 504 shares during the period. QRG Capital Management Inc. grew its holdings in Terex by 7.6% in the third quarter. QRG Capital Management Inc. now owns 6,037 shares of the industrial products company's stock worth $319,000 after purchasing an additional 424 shares during the period. Finally, Olympiad Research LP purchased a new stake in Terex in the third quarter worth about $301,000. Hedge funds and other institutional investors own 92.88% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on the stock. Truist Financial cut their price objective on shares of Terex from $65.00 to $58.00 and set a "buy" rating on the stock in a report on Thursday, December 19th. Evercore ISI cut their price objective on shares of Terex from $63.00 to $59.00 and set an "outperform" rating on the stock in a report on Wednesday, February 19th. JPMorgan Chase & Co. cut their price objective on shares of Terex from $59.00 to $52.00 and set a "neutral" rating on the stock in a report on Tuesday, January 14th. StockNews.com cut shares of Terex from a "hold" rating to a "sell" rating in a report on Friday, February 7th. Finally, Citigroup dropped their target price on shares of Terex from $57.00 to $48.00 and set a "neutral" rating on the stock in a research note on Tuesday, January 14th. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $56.11.

View Our Latest Report on Terex

Insider Buying and Selling

In other news, CEO Simon Meester sold 9,877 shares of Terex stock in a transaction on Wednesday, December 11th. The shares were sold at an average price of $51.14, for a total transaction of $505,109.78. Following the transaction, the chief executive officer now owns 127,858 shares in the company, valued at $6,538,658.12. This trade represents a 7.17 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, Director David A. Sachs purchased 10,000 shares of the company's stock in a transaction dated Wednesday, December 11th. The shares were acquired at an average price of $51.30 per share, for a total transaction of $513,000.00. Following the purchase, the director now directly owns 107,500 shares in the company, valued at approximately $5,514,750. The trade was a 10.26 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last quarter, insiders have purchased 31,325 shares of company stock worth $1,556,972. 1.90% of the stock is owned by insiders.

Terex Stock Performance

TEX stock traded up $0.62 on Friday, hitting $41.02. The company had a trading volume of 940,270 shares, compared to its average volume of 903,754. Terex Co. has a 12-month low of $36.15 and a 12-month high of $68.08. The company has a current ratio of 2.16, a quick ratio of 1.09 and a debt-to-equity ratio of 1.41. The stock's 50-day simple moving average is $45.20 and its 200 day simple moving average is $49.95. The stock has a market cap of $2.72 billion, a price-to-earnings ratio of 8.27, a P/E/G ratio of 4.53 and a beta of 1.56.

Terex (NYSE:TEX - Get Free Report) last issued its earnings results on Thursday, February 6th. The industrial products company reported $0.77 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.76 by $0.01. Terex had a net margin of 6.54% and a return on equity of 21.99%. During the same period in the previous year, the company earned $1.88 EPS. As a group, equities research analysts expect that Terex Co. will post 4.83 earnings per share for the current fiscal year.

Terex Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, March 19th. Investors of record on Friday, March 7th will be issued a $0.17 dividend. This represents a $0.68 annualized dividend and a yield of 1.66%. The ex-dividend date is Friday, March 7th. Terex's dividend payout ratio is currently 13.71%.

About Terex

(

Free Report)

Terex Corporation manufactures and sells aerial work platforms and materials processing machinery worldwide. It operates in two segments, Materials Processing (MP) and Aerial Work Platforms (AWP). The MP segment designs, manufactures, services, and markets materials processing and specialty equipment, includes crushers, washing systems, screens, trommels, apron feeders, material handlers, pick and carry cranes, rough terrain cranes, tower cranes, wood processing, biomass and recycling equipment, concrete mixer trucks and concrete pavers, conveyors, and related components and replacement parts under the Terex, Powerscreen, Fuchs, EvoQuip, Canica, Cedarapids, CBI, Simplicity, Franna, Terex Ecotec, Finlay, ProAll, ZenRobotics, Terex Washing Systems, Terex MPS, Terex Jaques, Terex Advance, ProStack, Terex Bid-Well, MDS, and Terex Recycling Systems brands.

Featured Stories

Before you consider Terex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terex wasn't on the list.

While Terex currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report