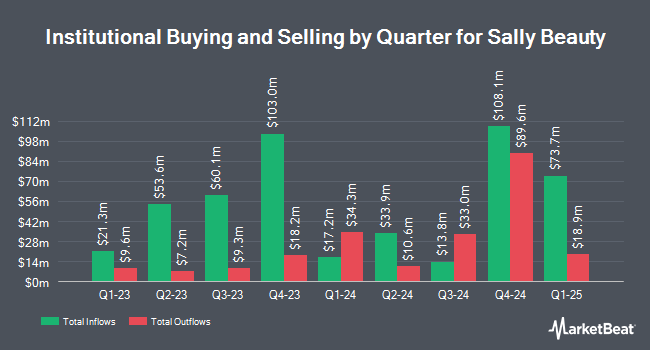

EntryPoint Capital LLC acquired a new stake in Sally Beauty Holdings, Inc. (NYSE:SBH - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm acquired 31,208 shares of the specialty retailer's stock, valued at approximately $326,000.

Several other hedge funds and other institutional investors have also recently bought and sold shares of SBH. Charles Schwab Investment Management Inc. lifted its holdings in shares of Sally Beauty by 2.3% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 2,605,586 shares of the specialty retailer's stock valued at $27,228,000 after purchasing an additional 59,478 shares in the last quarter. M&T Bank Corp lifted its stake in Sally Beauty by 127.4% in the 4th quarter. M&T Bank Corp now owns 64,352 shares of the specialty retailer's stock valued at $672,000 after buying an additional 36,057 shares in the last quarter. Hillsdale Investment Management Inc. purchased a new stake in Sally Beauty in the 4th quarter valued at approximately $3,177,000. Barclays PLC grew its holdings in Sally Beauty by 36.6% during the 3rd quarter. Barclays PLC now owns 212,159 shares of the specialty retailer's stock valued at $2,878,000 after buying an additional 56,879 shares during the last quarter. Finally, Amundi increased its position in Sally Beauty by 1,215.4% during the fourth quarter. Amundi now owns 237,700 shares of the specialty retailer's stock worth $2,555,000 after buying an additional 219,630 shares in the last quarter.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on SBH. StockNews.com raised Sally Beauty from a "hold" rating to a "buy" rating in a research note on Wednesday, February 19th. Morgan Stanley reduced their target price on shares of Sally Beauty from $12.00 to $10.00 and set an "underweight" rating on the stock in a report on Tuesday, January 21st. DA Davidson lowered their price target on shares of Sally Beauty from $13.00 to $10.50 and set a "neutral" rating for the company in a report on Tuesday, February 18th. Finally, Canaccord Genuity Group assumed coverage on shares of Sally Beauty in a research note on Thursday, January 16th. They set a "buy" rating and a $14.00 price objective on the stock. One analyst has rated the stock with a sell rating, two have issued a hold rating and four have given a buy rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and an average price target of $12.70.

Read Our Latest Stock Analysis on Sally Beauty

Sally Beauty Trading Down 1.1 %

SBH traded down $0.10 during midday trading on Tuesday, hitting $8.94. The company's stock had a trading volume of 2,362,447 shares, compared to its average volume of 1,689,684. Sally Beauty Holdings, Inc. has a 52-week low of $8.25 and a 52-week high of $14.79. The firm has a 50-day moving average price of $9.55 and a two-hundred day moving average price of $11.49. The company has a current ratio of 2.27, a quick ratio of 0.44 and a debt-to-equity ratio of 1.43. The firm has a market cap of $910.96 million, a P/E ratio of 5.35 and a beta of 1.54.

Sally Beauty (NYSE:SBH - Get Free Report) last released its earnings results on Thursday, February 13th. The specialty retailer reported $0.43 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.43. Sally Beauty had a net margin of 4.73% and a return on equity of 30.35%. The firm had revenue of $937.90 million during the quarter, compared to the consensus estimate of $941.44 million. On average, research analysts anticipate that Sally Beauty Holdings, Inc. will post 1.81 earnings per share for the current year.

Sally Beauty Profile

(

Free Report)

Sally Beauty Holdings, Inc operates as a specialty retailer and distributor of professional beauty supplies. The company operates through two segments, Sally Beauty Supply and Beauty Systems Group. The Sally Beauty Supply segment offers beauty products, including hair color and care products, skin and nail care products, styling tools, and other beauty products for retail customers, salons, and salon professionals.

Featured Stories

Before you consider Sally Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sally Beauty wasn't on the list.

While Sally Beauty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.