Healthcare of Ontario Pension Plan Trust Fund acquired a new position in shares of Olin Co. (NYSE:OLN - Free Report) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 31,724 shares of the specialty chemicals company's stock, valued at approximately $1,522,000.

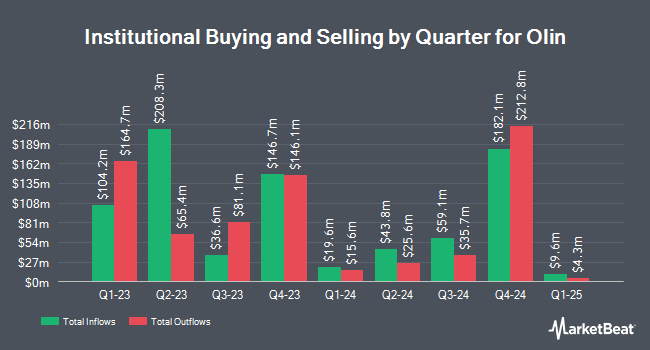

Other institutional investors and hedge funds also recently made changes to their positions in the company. OLD National Bancorp IN lifted its stake in Olin by 4.2% in the second quarter. OLD National Bancorp IN now owns 6,343 shares of the specialty chemicals company's stock valued at $299,000 after acquiring an additional 253 shares during the last quarter. Farther Finance Advisors LLC raised its holdings in shares of Olin by 88.2% in the 3rd quarter. Farther Finance Advisors LLC now owns 589 shares of the specialty chemicals company's stock valued at $28,000 after purchasing an additional 276 shares during the period. Mirae Asset Global Investments Co. Ltd. lifted its stake in Olin by 26.2% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,534 shares of the specialty chemicals company's stock valued at $75,000 after purchasing an additional 318 shares during the last quarter. Scott & Selber Inc. grew its holdings in Olin by 1.7% during the second quarter. Scott & Selber Inc. now owns 19,206 shares of the specialty chemicals company's stock worth $906,000 after purchasing an additional 326 shares during the period. Finally, Entropy Technologies LP increased its holdings in shares of Olin by 2.5% during the 3rd quarter. Entropy Technologies LP now owns 13,499 shares of the specialty chemicals company's stock worth $648,000 after acquiring an additional 332 shares during the last quarter. Institutional investors own 88.67% of the company's stock.

Olin Price Performance

OLN traded up $0.86 on Monday, reaching $43.45. The stock had a trading volume of 1,011,359 shares, compared to its average volume of 1,196,384. The company has a current ratio of 1.40, a quick ratio of 0.82 and a debt-to-equity ratio of 1.32. The company has a market capitalization of $5.07 billion, a price-to-earnings ratio of 34.35, a price-to-earnings-growth ratio of 1.72 and a beta of 1.43. Olin Co. has a fifty-two week low of $39.47 and a fifty-two week high of $60.60. The firm has a 50-day moving average of $44.41 and a 200-day moving average of $45.96.

Olin Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Thursday, November 14th will be issued a $0.20 dividend. The ex-dividend date is Thursday, November 14th. This represents a $0.80 dividend on an annualized basis and a yield of 1.84%. Olin's dividend payout ratio (DPR) is presently 64.52%.

Insider Buying and Selling

In other news, VP R Nichole Sumner sold 10,500 shares of the firm's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $43.75, for a total transaction of $459,375.00. Following the completion of the transaction, the vice president now directly owns 24,056 shares in the company, valued at $1,052,450. This trade represents a 30.39 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 1.60% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

Several brokerages have issued reports on OLN. Barclays cut their price objective on shares of Olin from $49.00 to $45.00 and set an "equal weight" rating for the company in a research report on Monday, October 28th. BMO Capital Markets dropped their target price on Olin from $50.00 to $47.00 and set a "market perform" rating for the company in a report on Tuesday, October 29th. Wells Fargo & Company decreased their price target on shares of Olin from $48.00 to $44.00 and set an "equal weight" rating on the stock in a research note on Monday, October 28th. KeyCorp dropped their price objective on shares of Olin from $57.00 to $56.00 and set an "overweight" rating for the company in a research note on Monday, October 28th. Finally, Royal Bank of Canada decreased their target price on shares of Olin from $52.00 to $48.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 29th. Eight investment analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $51.86.

Check Out Our Latest Report on Olin

Olin Profile

(

Free Report)

Olin Corporation manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada. It operates through three segments: Chlor Alkali Products and Vinyls; Epoxy; and Winchester. The Chlor Alkali Products and Vinyls segment offers chlorine and caustic soda, ethylene dichloride and vinyl chloride monomers, methyl chloride, methylene chloride, chloroform, carbon tetrachloride, perchloroethylene, hydrochloric acid, hydrogen, bleach products, potassium hydroxide, and chlorinated organics intermediates and solvents.

Further Reading

Before you consider Olin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Olin wasn't on the list.

While Olin currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.