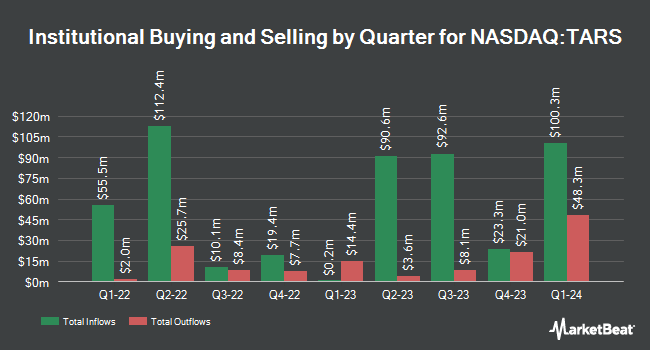

Ally Bridge Group NY LLC bought a new position in Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS - Free Report) during the third quarter, according to its most recent disclosure with the SEC. The firm bought 321,898 shares of the company's stock, valued at approximately $10,587,000. Tarsus Pharmaceuticals accounts for about 5.7% of Ally Bridge Group NY LLC's investment portfolio, making the stock its 2nd biggest holding. Ally Bridge Group NY LLC owned approximately 0.85% of Tarsus Pharmaceuticals at the end of the most recent quarter.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Quest Partners LLC bought a new stake in shares of Tarsus Pharmaceuticals during the 2nd quarter valued at $61,000. Canada Pension Plan Investment Board purchased a new stake in Tarsus Pharmaceuticals in the 2nd quarter worth $114,000. FMR LLC raised its holdings in Tarsus Pharmaceuticals by 236.6% during the third quarter. FMR LLC now owns 5,032 shares of the company's stock valued at $166,000 after acquiring an additional 3,537 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank lifted its position in shares of Tarsus Pharmaceuticals by 33.4% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 6,109 shares of the company's stock valued at $166,000 after acquiring an additional 1,530 shares in the last quarter. Finally, SG Americas Securities LLC boosted its stake in shares of Tarsus Pharmaceuticals by 87.5% in the third quarter. SG Americas Securities LLC now owns 7,242 shares of the company's stock worth $238,000 after acquiring an additional 3,379 shares during the period. 90.01% of the stock is currently owned by hedge funds and other institutional investors.

Tarsus Pharmaceuticals Price Performance

Shares of TARS stock traded up $1.18 on Thursday, reaching $50.84. The company's stock had a trading volume of 486,401 shares, compared to its average volume of 724,973. Tarsus Pharmaceuticals, Inc. has a 1 year low of $15.60 and a 1 year high of $52.99. The company has a market capitalization of $1.94 billion, a price-to-earnings ratio of -13.34 and a beta of 1.00. The stock's fifty day simple moving average is $40.37 and its 200-day simple moving average is $33.19. The company has a current ratio of 5.42, a quick ratio of 5.38 and a debt-to-equity ratio of 0.30.

Wall Street Analyst Weigh In

TARS has been the topic of a number of research analyst reports. The Goldman Sachs Group boosted their price target on Tarsus Pharmaceuticals from $36.00 to $41.00 and gave the stock a "neutral" rating in a report on Friday, November 15th. Oppenheimer raised their target price on shares of Tarsus Pharmaceuticals from $63.00 to $65.00 and gave the company an "outperform" rating in a research note on Thursday, November 14th. Finally, William Blair upgraded shares of Tarsus Pharmaceuticals to a "strong-buy" rating in a report on Friday, August 30th. One equities research analyst has rated the stock with a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, Tarsus Pharmaceuticals has an average rating of "Buy" and an average price target of $54.20.

Get Our Latest Report on TARS

About Tarsus Pharmaceuticals

(

Free Report)

Tarsus Pharmaceuticals, Inc, a commercial stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutic candidates for eye care in the United States. The company's lead product candidate is XDEMVY, a novel therapeutic for the treatment of blepharitis caused by the infestation of Demodex mites, as well as to treat meibomian gland disease.

Read More

Before you consider Tarsus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tarsus Pharmaceuticals wasn't on the list.

While Tarsus Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.