CWA Asset Management Group LLC acquired a new position in shares of CarMax, Inc. (NYSE:KMX - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 32,297 shares of the company's stock, valued at approximately $2,499,000.

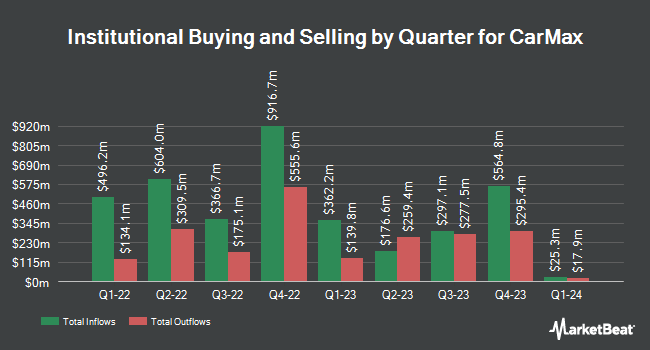

Other large investors have also recently bought and sold shares of the company. First Pacific Advisors LP raised its holdings in CarMax by 2.0% during the second quarter. First Pacific Advisors LP now owns 2,386,210 shares of the company's stock worth $175,005,000 after purchasing an additional 47,184 shares during the last quarter. Dimensional Fund Advisors LP raised its stake in shares of CarMax by 2.6% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,007,426 shares of the company's stock worth $147,230,000 after buying an additional 51,397 shares during the last quarter. Vulcan Value Partners LLC boosted its position in shares of CarMax by 299.7% in the 2nd quarter. Vulcan Value Partners LLC now owns 1,827,139 shares of the company's stock worth $133,773,000 after buying an additional 1,369,986 shares in the last quarter. Envestnet Asset Management Inc. grew its stake in CarMax by 21.1% in the 2nd quarter. Envestnet Asset Management Inc. now owns 1,656,388 shares of the company's stock valued at $121,479,000 after acquiring an additional 288,165 shares during the last quarter. Finally, Van Lanschot Kempen Investment Management N.V. increased its holdings in CarMax by 11.2% during the 2nd quarter. Van Lanschot Kempen Investment Management N.V. now owns 1,343,290 shares of the company's stock valued at $98,517,000 after acquiring an additional 134,987 shares in the last quarter.

CarMax Trading Down 1.2 %

Shares of KMX traded down $0.90 during mid-day trading on Friday, reaching $75.54. The company had a trading volume of 1,391,035 shares, compared to its average volume of 1,462,511. CarMax, Inc. has a fifty-two week low of $61.73 and a fifty-two week high of $88.22. The firm has a fifty day simple moving average of $75.63 and a 200-day simple moving average of $75.15. The stock has a market cap of $11.70 billion, a price-to-earnings ratio of 28.40, a price-to-earnings-growth ratio of 1.57 and a beta of 1.68. The company has a current ratio of 2.25, a quick ratio of 0.68 and a debt-to-equity ratio of 2.93.

CarMax (NYSE:KMX - Get Free Report) last released its quarterly earnings data on Thursday, September 26th. The company reported $0.85 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.86 by ($0.01). The business had revenue of $7.01 billion for the quarter, compared to analysts' expectations of $6.83 billion. CarMax had a return on equity of 6.83% and a net margin of 1.61%. CarMax's quarterly revenue was down .9% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.75 earnings per share. On average, sell-side analysts anticipate that CarMax, Inc. will post 2.99 EPS for the current fiscal year.

Wall Street Analyst Weigh In

Several analysts have issued reports on the stock. Needham & Company LLC reaffirmed a "buy" rating and issued a $90.00 price target on shares of CarMax in a report on Wednesday, October 16th. Wedbush reiterated an "outperform" rating and set a $95.00 target price on shares of CarMax in a report on Wednesday, October 16th. JPMorgan Chase & Co. raised their price target on CarMax from $55.00 to $65.00 and gave the stock an "underweight" rating in a research report on Thursday, September 19th. Royal Bank of Canada restated an "outperform" rating and issued a $82.00 price objective on shares of CarMax in a research report on Wednesday, October 16th. Finally, Oppenheimer reiterated an "outperform" rating and set a $105.00 price objective on shares of CarMax in a research report on Friday, October 4th. Four analysts have rated the stock with a sell rating, four have given a hold rating and six have issued a buy rating to the stock. Based on data from MarketBeat.com, CarMax presently has an average rating of "Hold" and an average price target of $79.73.

Check Out Our Latest Stock Analysis on KMX

CarMax Profile

(

Free Report)

CarMax, Inc, through its subsidiaries, operates as a retailer of used vehicles and related products in the United States. It operates in two segments: CarMax Sales Operations and CarMax Auto Finance. The CarMax Sales Operations segment offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services.

Featured Articles

Before you consider CarMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarMax wasn't on the list.

While CarMax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.