Counterpoint Mutual Funds LLC acquired a new stake in shares of Smith & Wesson Brands, Inc. (NASDAQ:SWBI - Free Report) during the 4th quarter, according to its most recent disclosure with the SEC. The fund acquired 32,719 shares of the company's stock, valued at approximately $331,000. Counterpoint Mutual Funds LLC owned approximately 0.07% of Smith & Wesson Brands as of its most recent filing with the SEC.

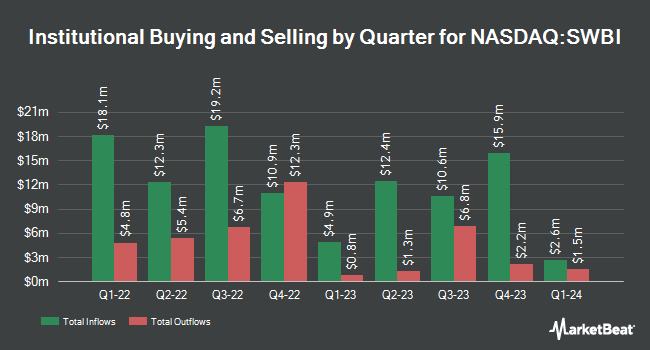

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the company. IMG Wealth Management Inc. purchased a new position in shares of Smith & Wesson Brands in the 4th quarter valued at approximately $44,000. Jones Financial Companies Lllp lifted its position in Smith & Wesson Brands by 238.6% during the fourth quarter. Jones Financial Companies Lllp now owns 4,933 shares of the company's stock valued at $50,000 after buying an additional 3,476 shares during the period. Wealthfront Advisers LLC bought a new stake in shares of Smith & Wesson Brands during the 4th quarter valued at $81,000. Sanctuary Advisors LLC bought a new stake in shares of Smith & Wesson Brands during the 4th quarter valued at $114,000. Finally, Larson Financial Group LLC grew its position in shares of Smith & Wesson Brands by 19.5% in the 4th quarter. Larson Financial Group LLC now owns 12,161 shares of the company's stock worth $123,000 after buying an additional 1,983 shares during the period. Hedge funds and other institutional investors own 59.33% of the company's stock.

Smith & Wesson Brands Stock Down 0.1 %

Shares of NASDAQ SWBI traded down $0.01 during midday trading on Friday, hitting $9.51. The stock had a trading volume of 726,544 shares, compared to its average volume of 457,525. The business's 50 day moving average is $10.46 and its 200-day moving average is $11.78. Smith & Wesson Brands, Inc. has a 52 week low of $9.17 and a 52 week high of $18.05. The company has a quick ratio of 1.43, a current ratio of 3.97 and a debt-to-equity ratio of 0.36. The company has a market cap of $418.47 million, a P/E ratio of 12.19 and a beta of 1.09.

Smith & Wesson Brands (NASDAQ:SWBI - Get Free Report) last issued its earnings results on Thursday, March 6th. The company reported $0.02 EPS for the quarter, meeting the consensus estimate of $0.02. The business had revenue of $115.89 million for the quarter, compared to the consensus estimate of $119.46 million. Smith & Wesson Brands had a return on equity of 8.78% and a net margin of 7.00%. As a group, analysts predict that Smith & Wesson Brands, Inc. will post 0.47 EPS for the current year.

Smith & Wesson Brands Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, April 3rd. Investors of record on Thursday, March 20th will be issued a $0.13 dividend. The ex-dividend date of this dividend is Thursday, March 20th. This represents a $0.52 annualized dividend and a yield of 5.47%. Smith & Wesson Brands's payout ratio is 80.00%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on SWBI shares. Lake Street Capital dropped their price objective on shares of Smith & Wesson Brands from $13.00 to $12.50 and set a "buy" rating on the stock in a research note on Friday, March 7th. Craig Hallum downgraded Smith & Wesson Brands from a "buy" rating to a "hold" rating and cut their price target for the stock from $18.00 to $13.00 in a research note on Friday, December 6th.

Get Our Latest Research Report on SWBI

About Smith & Wesson Brands

(

Free Report)

Smith & Wesson Brands, Inc is a holding company, which engages in the manufacture, design, and provision of firearms. Its portfolio includes handguns, long guns, handcuffs, suppressor, and other firearm-related products. The firm's brands are Smith & Wesson, M&P, Thompson/Center Arms, and Gemtech.

See Also

Before you consider Smith & Wesson Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Smith & Wesson Brands wasn't on the list.

While Smith & Wesson Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.