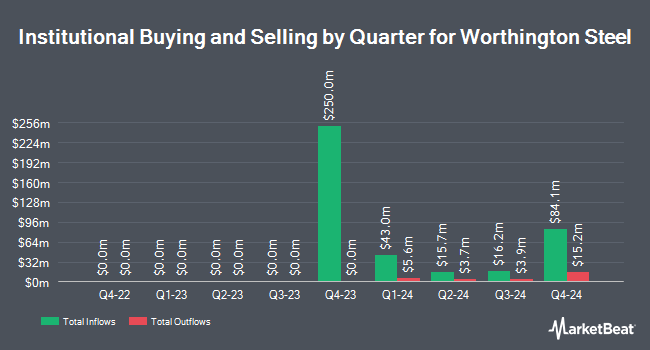

Intech Investment Management LLC acquired a new stake in Worthington Steel, Inc. (NYSE:WS - Free Report) during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor acquired 32,955 shares of the company's stock, valued at approximately $1,121,000. Intech Investment Management LLC owned approximately 0.06% of Worthington Steel at the end of the most recent quarter.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. CWM LLC lifted its holdings in shares of Worthington Steel by 845.4% during the 2nd quarter. CWM LLC now owns 1,021 shares of the company's stock valued at $34,000 after buying an additional 913 shares during the period. DekaBank Deutsche Girozentrale purchased a new stake in shares of Worthington Steel in the 1st quarter worth $37,000. GAMMA Investing LLC increased its stake in shares of Worthington Steel by 153.0% in the 3rd quarter. GAMMA Investing LLC now owns 1,255 shares of the company's stock worth $43,000 after purchasing an additional 759 shares in the last quarter. nVerses Capital LLC purchased a new stake in shares of Worthington Steel in the 3rd quarter worth $71,000. Finally, Eastern Bank purchased a new stake in Worthington Steel in the 3rd quarter worth $99,000. 45.41% of the stock is owned by institutional investors.

Worthington Steel Stock Up 1.4 %

WS stock traded up $0.63 during trading on Thursday, reaching $44.69. The company's stock had a trading volume of 194,289 shares, compared to its average volume of 169,940. Worthington Steel, Inc. has a 1 year low of $21.00 and a 1 year high of $47.19. The company has a market capitalization of $2.27 billion and a P/E ratio of 18.02. The company's fifty day moving average is $38.27 and its 200-day moving average is $35.14.

Worthington Steel (NYSE:WS - Get Free Report) last issued its quarterly earnings results on Wednesday, September 25th. The company reported $0.56 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.55 by $0.01. Worthington Steel had a return on equity of 12.14% and a net margin of 3.71%. The business had revenue of $834.00 million during the quarter, compared to analyst estimates of $748.40 million. The company's revenue was down 7.9% compared to the same quarter last year. Analysts anticipate that Worthington Steel, Inc. will post 2.95 earnings per share for the current year.

Worthington Steel Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Shareholders of record on Friday, December 13th will be paid a $0.16 dividend. The ex-dividend date is Friday, December 13th. This represents a $0.64 dividend on an annualized basis and a yield of 1.43%. Worthington Steel's payout ratio is presently 25.81%.

Worthington Steel Profile

(

Free Report)

Worthington Steel, Inc operates as a steel processor in North America. It offers carbon flat-rolled steel and tailor welded blanks, as well as electrical steel laminations; and aluminum tailor welded blanks. The company serves various end-markets, including automotive, heavy truck, agriculture, construction, and energy.

Further Reading

Before you consider Worthington Steel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Worthington Steel wasn't on the list.

While Worthington Steel currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.