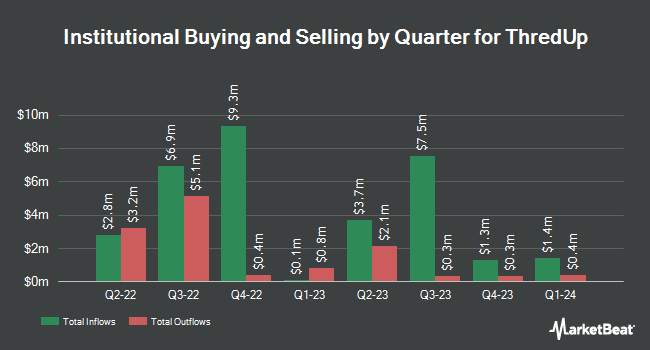

Archon Capital Management LLC bought a new stake in shares of ThredUp Inc. (NASDAQ:TDUP - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund bought 331,789 shares of the company's stock, valued at approximately $461,000. Archon Capital Management LLC owned approximately 0.29% of ThredUp at the end of the most recent reporting period.

A number of other hedge funds have also recently added to or reduced their stakes in the company. Virtu Financial LLC acquired a new position in shares of ThredUp in the fourth quarter worth about $33,000. O Shaughnessy Asset Management LLC acquired a new stake in ThredUp in the fourth quarter valued at approximately $64,000. Wells Fargo & Company MN raised its stake in shares of ThredUp by 32.1% during the 4th quarter. Wells Fargo & Company MN now owns 57,426 shares of the company's stock worth $80,000 after buying an additional 13,941 shares during the period. Barclays PLC lifted its position in shares of ThredUp by 278.7% during the 3rd quarter. Barclays PLC now owns 104,018 shares of the company's stock valued at $87,000 after buying an additional 76,553 shares in the last quarter. Finally, JPMorgan Chase & Co. increased its holdings in ThredUp by 450.6% in the 4th quarter. JPMorgan Chase & Co. now owns 201,755 shares of the company's stock worth $280,000 after acquiring an additional 165,115 shares in the last quarter. 89.08% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at ThredUp

In other ThredUp news, Director Patricia Nakache sold 91,070 shares of the stock in a transaction dated Thursday, March 20th. The shares were sold at an average price of $2.48, for a total value of $225,853.60. Following the completion of the sale, the director now owns 250,956 shares in the company, valued at approximately $622,370.88. This represents a 26.63 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Over the last three months, insiders have sold 2,208,114 shares of company stock valued at $5,413,508. Corporate insiders own 34.42% of the company's stock.

ThredUp Price Performance

TDUP traded down $0.06 on Tuesday, hitting $3.42. 1,369,702 shares of the company's stock were exchanged, compared to its average volume of 808,278. ThredUp Inc. has a fifty-two week low of $0.50 and a fifty-two week high of $3.54. The stock has a market cap of $397.39 million, a price-to-earnings ratio of -5.34 and a beta of 1.64. The firm has a 50-day moving average price of $2.61 and a 200-day moving average price of $1.79. The company has a current ratio of 0.96, a quick ratio of 0.86 and a debt-to-equity ratio of 0.28.

Analysts Set New Price Targets

Several analysts have recently issued reports on TDUP shares. Needham & Company LLC reiterated a "hold" rating on shares of ThredUp in a research report on Tuesday, March 4th. Telsey Advisory Group reiterated an "outperform" rating and set a $3.00 price objective on shares of ThredUp in a research note on Tuesday, March 4th.

View Our Latest Report on ThredUp

About ThredUp

(

Free Report)

ThredUp Inc, together with its subsidiaries, operates an online resale platform in the United States and internationally. Its platform enables consumers to buy and sell primarily secondhand apparel, shoes, and accessories. ThredUp Inc was incorporated in 2009 and is headquartered in Oakland, California.

Further Reading

Before you consider ThredUp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ThredUp wasn't on the list.

While ThredUp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.