Neo Ivy Capital Management acquired a new stake in Cardinal Health, Inc. (NYSE:CAH - Free Report) during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm acquired 35,360 shares of the company's stock, valued at approximately $3,908,000. Cardinal Health makes up about 1.3% of Neo Ivy Capital Management's holdings, making the stock its 8th largest holding.

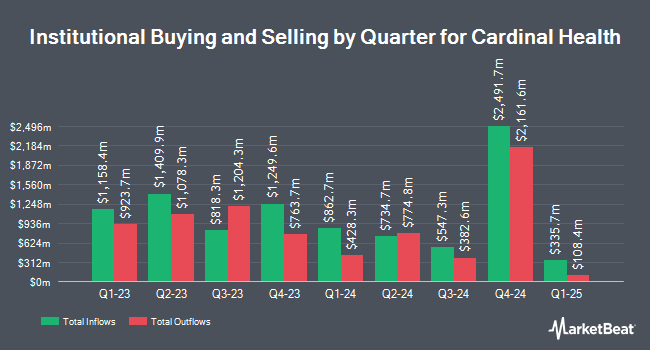

A number of other hedge funds have also added to or reduced their stakes in CAH. Coldstream Capital Management Inc. lifted its position in shares of Cardinal Health by 763.7% during the 3rd quarter. Coldstream Capital Management Inc. now owns 25,763 shares of the company's stock worth $2,883,000 after buying an additional 22,780 shares in the last quarter. Ashford Capital Management Inc. increased its position in shares of Cardinal Health by 7.1% during the third quarter. Ashford Capital Management Inc. now owns 17,585 shares of the company's stock valued at $1,943,000 after acquiring an additional 1,170 shares during the last quarter. Geode Capital Management LLC lifted its holdings in Cardinal Health by 0.7% during the third quarter. Geode Capital Management LLC now owns 5,749,859 shares of the company's stock worth $633,298,000 after acquiring an additional 42,082 shares during the period. M&T Bank Corp boosted its position in Cardinal Health by 43.2% in the third quarter. M&T Bank Corp now owns 28,326 shares of the company's stock worth $3,131,000 after purchasing an additional 8,544 shares during the last quarter. Finally, Barclays PLC grew its stake in Cardinal Health by 8.2% in the 3rd quarter. Barclays PLC now owns 707,404 shares of the company's stock valued at $78,183,000 after purchasing an additional 53,851 shares during the period. Institutional investors and hedge funds own 87.17% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently commented on CAH. Barclays lifted their target price on Cardinal Health from $117.00 to $133.00 and gave the stock an "overweight" rating in a research note on Monday, November 4th. Evercore ISI lifted their price objective on shares of Cardinal Health from $105.00 to $115.00 and gave the stock an "in-line" rating in a research report on Thursday, August 15th. Deutsche Bank Aktiengesellschaft boosted their target price on shares of Cardinal Health from $119.00 to $124.00 and gave the company a "hold" rating in a research note on Monday, November 4th. Argus raised their price target on shares of Cardinal Health from $115.00 to $125.00 and gave the stock a "buy" rating in a research note on Wednesday, September 11th. Finally, StockNews.com downgraded Cardinal Health from a "strong-buy" rating to a "buy" rating in a research note on Sunday, November 3rd. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating and nine have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Cardinal Health has a consensus rating of "Moderate Buy" and an average price target of $124.58.

Read Our Latest Stock Report on Cardinal Health

Cardinal Health Stock Down 2.7 %

CAH traded down $3.26 during trading on Wednesday, reaching $117.16. 745,802 shares of the company were exchanged, compared to its average volume of 2,094,213. The company has a market cap of $28.35 billion, a price-to-earnings ratio of 23.43, a P/E/G ratio of 1.53 and a beta of 0.61. Cardinal Health, Inc. has a 12-month low of $93.17 and a 12-month high of $126.23. The company's 50-day moving average is $116.71 and its two-hundred day moving average is $108.07.

Cardinal Health (NYSE:CAH - Get Free Report) last released its quarterly earnings data on Friday, November 1st. The company reported $1.88 EPS for the quarter, beating analysts' consensus estimates of $1.62 by $0.26. The company had revenue of $52.28 billion during the quarter, compared to analyst estimates of $50.90 billion. Cardinal Health had a net margin of 0.56% and a negative return on equity of 56.56%. Cardinal Health's revenue was down 4.3% compared to the same quarter last year. During the same period last year, the business earned $1.73 earnings per share. Equities analysts forecast that Cardinal Health, Inc. will post 7.82 earnings per share for the current year.

Cardinal Health Cuts Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Thursday, January 2nd will be issued a $0.5056 dividend. The ex-dividend date of this dividend is Thursday, January 2nd. This represents a $2.02 annualized dividend and a dividend yield of 1.73%. Cardinal Health's payout ratio is currently 39.30%.

About Cardinal Health

(

Free Report)

Cardinal Health, Inc operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home.

Further Reading

Before you consider Cardinal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Health wasn't on the list.

While Cardinal Health currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.