XTX Topco Ltd acquired a new stake in shares of OptimizeRx Co. (NASDAQ:OPRX - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor acquired 36,674 shares of the company's stock, valued at approximately $178,000. XTX Topco Ltd owned approximately 0.20% of OptimizeRx as of its most recent SEC filing.

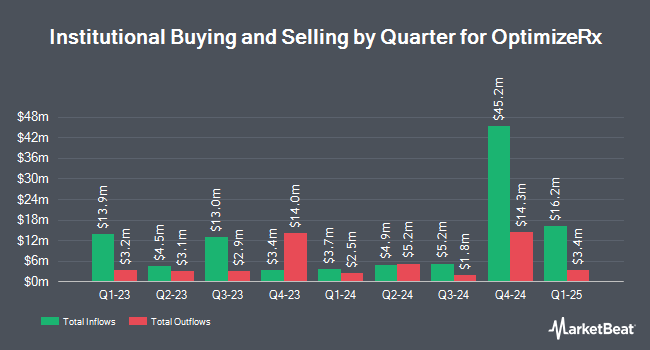

Several other institutional investors and hedge funds have also recently bought and sold shares of the company. Whetstone Capital Advisors LLC acquired a new stake in OptimizeRx during the fourth quarter valued at approximately $6,563,000. Royce & Associates LP acquired a new stake in OptimizeRx during the fourth quarter valued at approximately $5,198,000. Kennedy Capital Management LLC raised its stake in OptimizeRx by 57.8% during the fourth quarter. Kennedy Capital Management LLC now owns 594,000 shares of the company's stock valued at $2,887,000 after buying an additional 217,676 shares in the last quarter. Geode Capital Management LLC raised its stake in OptimizeRx by 1.2% during the fourth quarter. Geode Capital Management LLC now owns 400,621 shares of the company's stock valued at $1,948,000 after buying an additional 4,821 shares in the last quarter. Finally, AMH Equity Ltd raised its stake in OptimizeRx by 25.0% during the fourth quarter. AMH Equity Ltd now owns 125,000 shares of the company's stock valued at $608,000 after buying an additional 25,000 shares in the last quarter. Institutional investors and hedge funds own 76.47% of the company's stock.

OptimizeRx Stock Performance

Shares of OPRX stock opened at $8.74 on Tuesday. OptimizeRx Co. has a 12-month low of $3.78 and a 12-month high of $14.13. The firm has a market capitalization of $161.60 million, a price-to-earnings ratio of -6.57 and a beta of 1.18. The business has a 50 day simple moving average of $7.38 and a 200 day simple moving average of $6.10. The company has a debt-to-equity ratio of 0.29, a current ratio of 3.23 and a quick ratio of 3.23.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the company. B. Riley upgraded OptimizeRx to a "strong-buy" rating in a research report on Wednesday, March 12th. JMP Securities reiterated a "market outperform" rating and set a $8.00 price target on shares of OptimizeRx in a research report on Thursday, February 6th. Finally, Royal Bank of Canada reiterated a "sector perform" rating and set a $6.00 price target (down from $7.00) on shares of OptimizeRx in a research report on Wednesday, January 8th. Three research analysts have rated the stock with a hold rating, five have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, OptimizeRx presently has a consensus rating of "Moderate Buy" and an average price target of $9.06.

Check Out Our Latest Report on OptimizeRx

Insider Buying and Selling at OptimizeRx

In other news, Director James Paul Lang purchased 321,408 shares of the firm's stock in a transaction on Friday, March 14th. The stock was purchased at an average cost of $7.60 per share, with a total value of $2,442,700.80. Following the purchase, the director now owns 389,452 shares in the company, valued at $2,959,835.20. This trade represents a 472.35 % increase in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 6.10% of the stock is currently owned by corporate insiders.

OptimizeRx Profile

(

Free Report)

OptimizeRx Corporation, a digital health technology company, enables care-focused engagement between life sciences organizations, healthcare providers, and patients at critical junctures throughout the patient care journey. It offers various tech-enabled marketing solutions through its Artificial Intelligence-generated Dynamic Audience and Activation Platform, which enables customers to execute traditional marketing campaigns on its proprietary digital point-of-care network, as well as dynamic marketing campaigns that optimize audiences in real time to increase the value of treatment information for healthcare professionals and patients in response to clinical care events.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider OptimizeRx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OptimizeRx wasn't on the list.

While OptimizeRx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.