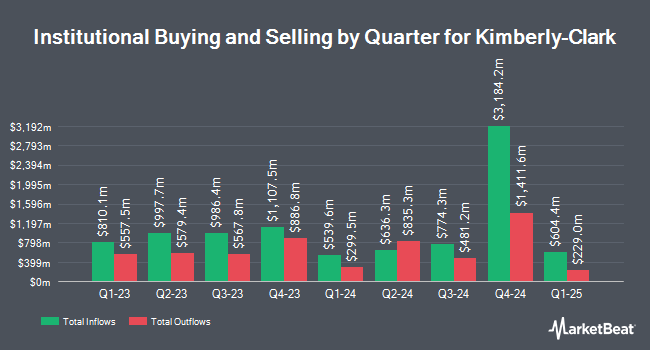

Bryce Point Capital LLC acquired a new position in shares of Kimberly-Clark Co. (NYSE:KMB - Free Report) in the fourth quarter, according to its most recent disclosure with the SEC. The firm acquired 3,932 shares of the company's stock, valued at approximately $515,000.

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. FMR LLC increased its stake in shares of Kimberly-Clark by 3.2% during the third quarter. FMR LLC now owns 572,463 shares of the company's stock worth $81,450,000 after acquiring an additional 17,919 shares during the period. HighTower Advisors LLC increased its holdings in shares of Kimberly-Clark by 2.5% in the 3rd quarter. HighTower Advisors LLC now owns 141,612 shares of the company's stock valued at $20,164,000 after purchasing an additional 3,514 shares in the last quarter. Janus Henderson Group PLC raised its stake in shares of Kimberly-Clark by 4.2% during the 3rd quarter. Janus Henderson Group PLC now owns 47,338 shares of the company's stock worth $6,735,000 after buying an additional 1,900 shares during the last quarter. Integrated Wealth Concepts LLC raised its position in shares of Kimberly-Clark by 23.1% during the 3rd quarter. Integrated Wealth Concepts LLC now owns 25,962 shares of the company's stock worth $3,694,000 after purchasing an additional 4,873 shares during the last quarter. Finally, IHT Wealth Management LLC increased its position in Kimberly-Clark by 27.1% during the third quarter. IHT Wealth Management LLC now owns 7,115 shares of the company's stock worth $1,013,000 after buying an additional 1,517 shares in the last quarter. 76.29% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research firms have recently weighed in on KMB. Royal Bank of Canada reissued an "outperform" rating and issued a $165.00 price objective on shares of Kimberly-Clark in a research report on Friday, January 24th. Citigroup decreased their target price on Kimberly-Clark from $125.00 to $118.00 and set a "sell" rating for the company in a report on Wednesday, January 15th. TD Cowen cut shares of Kimberly-Clark from a "buy" rating to a "hold" rating and set a $145.00 price target for the company. in a research report on Wednesday, January 8th. Piper Sandler reissued an "overweight" rating and issued a $158.00 price objective (down from $161.00) on shares of Kimberly-Clark in a research report on Wednesday, January 29th. Finally, StockNews.com raised Kimberly-Clark from a "hold" rating to a "buy" rating in a research report on Thursday, March 6th. Two equities research analysts have rated the stock with a sell rating, eight have assigned a hold rating and five have issued a buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average price target of $144.85.

Read Our Latest Stock Analysis on KMB

Kimberly-Clark Stock Performance

Shares of NYSE KMB traded up $1.97 during mid-day trading on Wednesday, hitting $135.25. The company had a trading volume of 2,436,408 shares, compared to its average volume of 2,149,761. Kimberly-Clark Co. has a 12 month low of $123.84 and a 12 month high of $150.45. The stock has a market cap of $44.86 billion, a price-to-earnings ratio of 17.91, a PEG ratio of 4.46 and a beta of 0.37. The company has a debt-to-equity ratio of 7.05, a current ratio of 0.80 and a quick ratio of 0.54. The firm's 50 day simple moving average is $138.05 and its two-hundred day simple moving average is $135.76.

Kimberly-Clark (NYSE:KMB - Get Free Report) last released its quarterly earnings data on Tuesday, January 28th. The company reported $1.50 earnings per share for the quarter, hitting analysts' consensus estimates of $1.50. Kimberly-Clark had a net margin of 12.69% and a return on equity of 201.43%. As a group, equities research analysts forecast that Kimberly-Clark Co. will post 7.5 earnings per share for the current year.

Kimberly-Clark Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Wednesday, April 2nd. Stockholders of record on Friday, March 7th were paid a $1.26 dividend. This is a boost from Kimberly-Clark's previous quarterly dividend of $1.22. The ex-dividend date of this dividend was Friday, March 7th. This represents a $5.04 annualized dividend and a dividend yield of 3.73%. Kimberly-Clark's dividend payout ratio is presently 66.75%.

Insider Activity at Kimberly-Clark

In other Kimberly-Clark news, VP Andrew Drexler sold 2,500 shares of the business's stock in a transaction dated Friday, February 21st. The shares were sold at an average price of $140.00, for a total transaction of $350,000.00. Following the sale, the vice president now directly owns 2,553 shares in the company, valued at approximately $357,420. The trade was a 49.48 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Company insiders own 0.64% of the company's stock.

About Kimberly-Clark

(

Free Report)

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

Recommended Stories

Before you consider Kimberly-Clark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimberly-Clark wasn't on the list.

While Kimberly-Clark currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report