Dynamic Technology Lab Private Ltd acquired a new stake in Alignment Healthcare, Inc. (NASDAQ:ALHC - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 39,398 shares of the company's stock, valued at approximately $443,000.

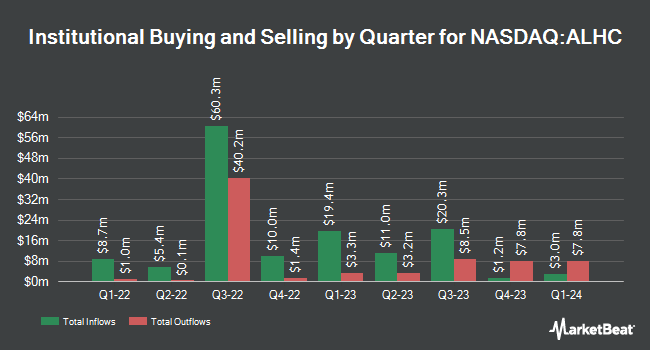

A number of other large investors have also added to or reduced their stakes in the stock. JPMorgan Chase & Co. boosted its stake in shares of Alignment Healthcare by 249.3% in the 3rd quarter. JPMorgan Chase & Co. now owns 288,219 shares of the company's stock valued at $3,407,000 after purchasing an additional 205,705 shares in the last quarter. Principal Financial Group Inc. grew its position in Alignment Healthcare by 1,335.1% during the 3rd quarter. Principal Financial Group Inc. now owns 194,043 shares of the company's stock worth $2,294,000 after acquiring an additional 180,522 shares during the last quarter. The Manufacturers Life Insurance Company increased its position in Alignment Healthcare by 132.2% in the 3rd quarter. The Manufacturers Life Insurance Company now owns 128,933 shares of the company's stock valued at $1,524,000 after acquiring an additional 73,402 shares during the period. Barclays PLC lifted its holdings in Alignment Healthcare by 144.1% during the 3rd quarter. Barclays PLC now owns 193,446 shares of the company's stock worth $2,287,000 after buying an additional 114,191 shares during the period. Finally, US Bancorp DE boosted its holdings in Alignment Healthcare by 6,544.2% in the fourth quarter. US Bancorp DE now owns 98,932 shares of the company's stock valued at $1,113,000 after acquiring an additional 97,443 shares during the last quarter. Institutional investors and hedge funds own 86.19% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have weighed in on ALHC shares. William Blair reiterated an "outperform" rating on shares of Alignment Healthcare in a report on Friday, February 28th. Stifel Nicolaus increased their price target on Alignment Healthcare from $18.00 to $23.00 and gave the company a "buy" rating in a research report on Tuesday, April 8th. Bank of America increased their target price on shares of Alignment Healthcare from $15.50 to $18.50 and gave the company a "buy" rating in a research report on Tuesday, March 4th. Stephens reiterated an "overweight" rating and issued a $17.00 price objective on shares of Alignment Healthcare in a research note on Monday, February 24th. Finally, Barclays boosted their target price on Alignment Healthcare from $8.00 to $9.00 and gave the company an "underweight" rating in a research note on Friday, February 28th. One investment analyst has rated the stock with a sell rating, three have assigned a hold rating, seven have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $15.39.

Check Out Our Latest Report on Alignment Healthcare

Alignment Healthcare Trading Down 4.5 %

ALHC traded down $0.88 on Monday, hitting $18.86. 524,938 shares of the company were exchanged, compared to its average volume of 1,634,160. The company has a debt-to-equity ratio of 1.82, a quick ratio of 1.60 and a current ratio of 1.60. Alignment Healthcare, Inc. has a 12 month low of $4.66 and a 12 month high of $21.06. The firm has a fifty day simple moving average of $16.14 and a two-hundred day simple moving average of $13.61. The stock has a market capitalization of $3.62 billion, a PE ratio of -24.49 and a beta of 1.32.

Insider Buying and Selling at Alignment Healthcare

In other news, insider Robert L. Scavo sold 2,864 shares of the firm's stock in a transaction dated Thursday, March 27th. The shares were sold at an average price of $17.89, for a total transaction of $51,236.96. Following the sale, the insider now owns 702,953 shares of the company's stock, valued at $12,575,829.17. This trade represents a 0.41 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Christopher J. Joyce sold 25,000 shares of the stock in a transaction that occurred on Tuesday, April 1st. The shares were sold at an average price of $18.47, for a total transaction of $461,750.00. Following the transaction, the insider now owns 415,022 shares in the company, valued at approximately $7,665,456.34. This trade represents a 5.68 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,891,855 shares of company stock valued at $29,415,212 in the last 90 days. Insiders own 6.60% of the company's stock.

Alignment Healthcare Company Profile

(

Free Report)

Alignment Healthcare, Inc, a tech-enabled Medicare advantage company, operates consumer-centric health care platform for seniors in the United States. It provides customized health care designed to meet the needs of a diverse array of seniors through its Medicare advantage plans. The company was founded in 2013 and is based in Orange, California.

Further Reading

Before you consider Alignment Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alignment Healthcare wasn't on the list.

While Alignment Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.