Watts Gwilliam & Co. LLC acquired a new position in shares of DexCom, Inc. (NASDAQ:DXCM - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm acquired 42,021 shares of the medical device company's stock, valued at approximately $3,334,000.

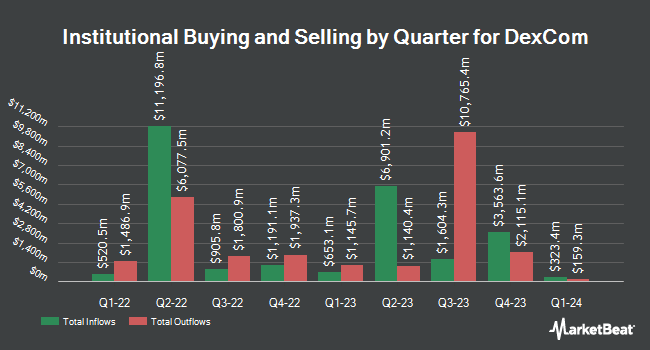

Other hedge funds have also added to or reduced their stakes in the company. Jennison Associates LLC increased its holdings in DexCom by 1,683.2% during the 3rd quarter. Jennison Associates LLC now owns 6,932,899 shares of the medical device company's stock worth $464,782,000 after purchasing an additional 6,544,102 shares in the last quarter. Westfield Capital Management Co. LP increased its holdings in DexCom by 44.6% during the 3rd quarter. Westfield Capital Management Co. LP now owns 2,842,057 shares of the medical device company's stock worth $190,532,000 after purchasing an additional 876,739 shares in the last quarter. Two Sigma Advisers LP increased its holdings in DexCom by 182.7% during the 3rd quarter. Two Sigma Advisers LP now owns 1,143,476 shares of the medical device company's stock worth $76,659,000 after purchasing an additional 739,000 shares in the last quarter. Canada Pension Plan Investment Board increased its holdings in DexCom by 189.1% during the 2nd quarter. Canada Pension Plan Investment Board now owns 665,646 shares of the medical device company's stock worth $75,471,000 after purchasing an additional 435,401 shares in the last quarter. Finally, Intech Investment Management LLC increased its holdings in DexCom by 2,083.0% during the 3rd quarter. Intech Investment Management LLC now owns 387,330 shares of the medical device company's stock worth $25,967,000 after purchasing an additional 369,587 shares in the last quarter. Institutional investors and hedge funds own 97.75% of the company's stock.

DexCom Stock Performance

DXCM stock traded down $2.33 during trading hours on Friday, hitting $77.76. 4,716,895 shares of the stock were exchanged, compared to its average volume of 3,332,783. The company has a current ratio of 2.46, a quick ratio of 2.12 and a debt-to-equity ratio of 1.23. The firm has a market capitalization of $30.37 billion, a P/E ratio of 46.56, a P/E/G ratio of 2.36 and a beta of 1.12. The company has a 50-day simple moving average of $76.93 and a two-hundred day simple moving average of $79.30. DexCom, Inc. has a 12 month low of $62.34 and a 12 month high of $142.00.

Insiders Place Their Bets

In related news, EVP Sadie Stern sold 4,259 shares of the firm's stock in a transaction on Wednesday, November 20th. The stock was sold at an average price of $74.73, for a total value of $318,275.07. Following the transaction, the executive vice president now owns 71,192 shares in the company, valued at approximately $5,320,178.16. This trade represents a 5.64 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.30% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the company. Oppenheimer decreased their price objective on DexCom from $115.00 to $105.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Canaccord Genuity Group increased their price objective on DexCom from $89.00 to $99.00 and gave the company a "buy" rating in a report on Monday, December 9th. StockNews.com downgraded DexCom from a "buy" rating to a "hold" rating in a report on Saturday, November 2nd. Leerink Partners cut their price objective on DexCom from $90.00 to $87.00 and set an "outperform" rating for the company in a report on Friday, October 25th. Finally, JPMorgan Chase & Co. increased their price objective on DexCom from $75.00 to $85.00 and gave the company a "neutral" rating in a report on Friday, October 25th. Seven equities research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $98.00.

Get Our Latest Analysis on DexCom

DexCom Company Profile

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Further Reading

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.