Johnson Financial Group LLC purchased a new position in shares of Accolade, Inc. (NASDAQ:ACCD - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 426,615 shares of the company's stock, valued at approximately $1,642,000. Accolade comprises approximately 0.2% of Johnson Financial Group LLC's holdings, making the stock its 17th biggest position. Johnson Financial Group LLC owned approximately 0.53% of Accolade at the end of the most recent quarter.

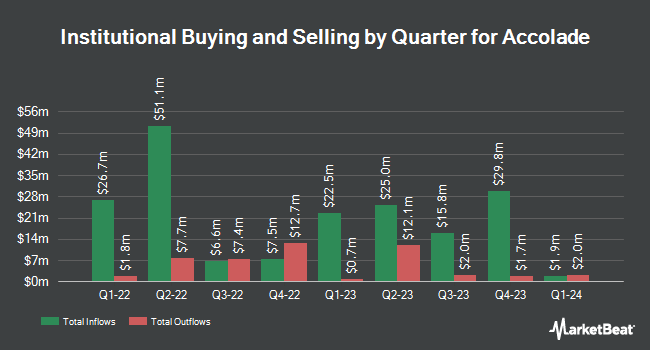

Several other institutional investors and hedge funds have also made changes to their positions in ACCD. Millennium Management LLC grew its holdings in Accolade by 244.7% during the 2nd quarter. Millennium Management LLC now owns 2,623,201 shares of the company's stock valued at $9,391,000 after buying an additional 1,862,178 shares during the last quarter. Clearline Capital LP purchased a new stake in Accolade during the 2nd quarter worth about $2,974,000. Acadian Asset Management LLC acquired a new position in Accolade in the 2nd quarter valued at about $1,229,000. Sumitomo Mitsui Trust Holdings Inc. lifted its holdings in Accolade by 18.5% in the 2nd quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 2,011,931 shares of the company's stock valued at $7,203,000 after purchasing an additional 314,371 shares in the last quarter. Finally, Bellevue Group AG lifted its holdings in Accolade by 6.6% in the 1st quarter. Bellevue Group AG now owns 4,804,514 shares of the company's stock valued at $50,351,000 after purchasing an additional 297,110 shares in the last quarter. 84.99% of the stock is currently owned by hedge funds and other institutional investors.

Accolade Stock Up 6.2 %

Shares of NASDAQ:ACCD traded up $0.20 during midday trading on Wednesday, hitting $3.41. 1,873,415 shares of the company's stock traded hands, compared to its average volume of 1,082,445. The firm's fifty day moving average price is $3.78 and its two-hundred day moving average price is $4.95. The company has a debt-to-equity ratio of 0.49, a quick ratio of 2.72 and a current ratio of 2.72. Accolade, Inc. has a twelve month low of $3.08 and a twelve month high of $15.36. The company has a market cap of $274.64 million, a PE ratio of -3.31 and a beta of 2.02.

Accolade (NASDAQ:ACCD - Get Free Report) last issued its earnings results on Tuesday, October 8th. The company reported ($0.30) earnings per share for the quarter, topping the consensus estimate of ($0.44) by $0.14. Accolade had a negative return on equity of 18.43% and a negative net margin of 18.16%. The company had revenue of $106.40 million during the quarter, compared to the consensus estimate of $104.87 million. During the same quarter in the prior year, the business earned ($0.43) earnings per share. The company's revenue was up 9.8% compared to the same quarter last year. On average, equities research analysts anticipate that Accolade, Inc. will post -0.92 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently commented on ACCD shares. Barclays cut their price objective on shares of Accolade from $5.50 to $5.00 and set an "equal weight" rating for the company in a research report on Wednesday, October 9th. Stephens lowered their target price on shares of Accolade from $10.00 to $8.00 and set an "overweight" rating for the company in a research note on Wednesday, October 9th. Canaccord Genuity Group dropped their target price on Accolade from $13.00 to $7.00 and set a "buy" rating for the company in a research note on Wednesday, October 9th. Truist Financial decreased their price target on Accolade from $9.00 to $7.50 and set a "buy" rating on the stock in a research note on Wednesday, October 9th. Finally, Wells Fargo & Company dropped their price objective on shares of Accolade from $7.00 to $6.00 and set an "equal weight" rating for the company in a research note on Friday, October 11th. Three investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $9.04.

Check Out Our Latest Research Report on ACCD

About Accolade

(

Free Report)

Accolade, Inc, together with its subsidiaries, engages in the development and provision of personalized and technology-enabled solutions that help people to understand, navigate, and utilize the healthcare system and their workplace benefits in the United States. The company offers a platform with cloud-based intelligent technology and multimodal support from a team of advocates and clinicians, including registered nurses, physician medical directors, pharmacists, behavioral health specialists, women's health specialists, case management specialists, expert medical opinion providers, and primary care physicians.

Recommended Stories

Before you consider Accolade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Accolade wasn't on the list.

While Accolade currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.