Polar Asset Management Partners Inc. bought a new stake in Bruker Co. (NASDAQ:BRKR - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm bought 44,100 shares of the medical research company's stock, valued at approximately $3,046,000.

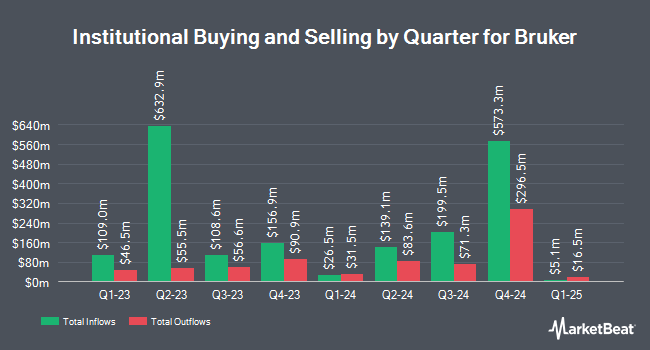

Several other large investors also recently bought and sold shares of the business. Point72 Asset Management L.P. purchased a new position in shares of Bruker in the 2nd quarter worth $36,472,000. Assenagon Asset Management S.A. lifted its holdings in shares of Bruker by 1,694.4% in the 2nd quarter. Assenagon Asset Management S.A. now owns 202,733 shares of the medical research company's stock valued at $12,936,000 after acquiring an additional 191,435 shares during the last quarter. Federated Hermes Inc. grew its position in Bruker by 5.3% in the second quarter. Federated Hermes Inc. now owns 166,561 shares of the medical research company's stock worth $10,628,000 after acquiring an additional 8,346 shares in the last quarter. Cerity Partners LLC increased its stake in Bruker by 446.8% during the third quarter. Cerity Partners LLC now owns 27,998 shares of the medical research company's stock worth $1,934,000 after acquiring an additional 22,878 shares during the last quarter. Finally, Envestnet Asset Management Inc. raised its position in Bruker by 48.5% during the second quarter. Envestnet Asset Management Inc. now owns 301,251 shares of the medical research company's stock valued at $19,223,000 after purchasing an additional 98,427 shares during the period. Institutional investors own 79.52% of the company's stock.

Bruker Trading Down 1.7 %

Bruker stock traded down $1.02 during trading hours on Thursday, hitting $58.48. The company had a trading volume of 1,245,356 shares, compared to its average volume of 1,114,866. The company has a debt-to-equity ratio of 1.24, a quick ratio of 0.73 and a current ratio of 1.66. The firm has a market cap of $8.87 billion, a P/E ratio of 28.61, a P/E/G ratio of 3.86 and a beta of 1.18. The company has a 50-day moving average price of $60.08 and a two-hundred day moving average price of $63.64. Bruker Co. has a 1 year low of $48.07 and a 1 year high of $94.86.

Bruker (NASDAQ:BRKR - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The medical research company reported $0.60 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.61 by ($0.01). The firm had revenue of $864.40 million during the quarter, compared to analysts' expectations of $866.46 million. Bruker had a net margin of 9.41% and a return on equity of 21.52%. The firm's revenue for the quarter was up 16.4% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.74 EPS. On average, sell-side analysts anticipate that Bruker Co. will post 2.4 earnings per share for the current year.

Bruker Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be paid a dividend of $0.05 per share. The ex-dividend date is Monday, December 2nd. This represents a $0.20 annualized dividend and a dividend yield of 0.34%. Bruker's dividend payout ratio is currently 9.62%.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on the company. Citigroup dropped their target price on Bruker from $80.00 to $75.00 and set a "buy" rating for the company in a report on Wednesday, November 6th. Barclays dropped their price objective on shares of Bruker from $75.00 to $69.00 and set an "overweight" rating for the company in a research note on Wednesday, November 6th. Wolfe Research cut shares of Bruker from an "outperform" rating to a "peer perform" rating in a research report on Monday, September 30th. TD Cowen lowered their target price on shares of Bruker from $72.00 to $70.00 and set a "hold" rating for the company in a report on Wednesday, November 6th. Finally, The Goldman Sachs Group upgraded shares of Bruker from a "sell" rating to a "neutral" rating and set a $60.00 price target on the stock in a report on Thursday. Five investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, Bruker presently has a consensus rating of "Moderate Buy" and an average price target of $79.36.

View Our Latest Analysis on Bruker

Insider Activity at Bruker

In other Bruker news, CEO Frank H. Laukien acquired 100,000 shares of the business's stock in a transaction that occurred on Monday, November 18th. The shares were bought at an average cost of $50.14 per share, with a total value of $5,014,000.00. Following the completion of the acquisition, the chief executive officer now directly owns 38,439,563 shares in the company, valued at $1,927,359,688.82. This represents a 0.26 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 28.30% of the stock is currently owned by corporate insiders.

Bruker Company Profile

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

Read More

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.