Westfuller Advisors LLC acquired a new position in JPMorgan Chase & Co. (NYSE:JPM - Free Report) in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm acquired 4,462 shares of the financial services provider's stock, valued at approximately $941,000.

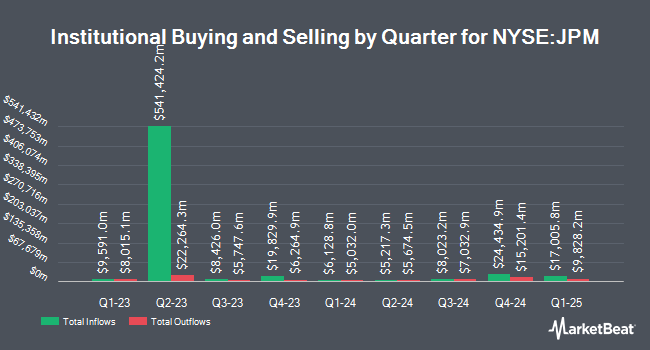

Several other institutional investors and hedge funds have also recently modified their holdings of JPM. Henrickson Nauta Wealth Advisors Inc. grew its position in JPMorgan Chase & Co. by 1.3% in the third quarter. Henrickson Nauta Wealth Advisors Inc. now owns 3,436 shares of the financial services provider's stock valued at $725,000 after acquiring an additional 45 shares during the last quarter. Sunburst Financial Group LLC grew its position in JPMorgan Chase & Co. by 0.8% in the third quarter. Sunburst Financial Group LLC now owns 5,696 shares of the financial services provider's stock valued at $1,201,000 after acquiring an additional 45 shares during the last quarter. West Wealth Group LLC grew its position in JPMorgan Chase & Co. by 3.6% in the third quarter. West Wealth Group LLC now owns 1,327 shares of the financial services provider's stock valued at $280,000 after acquiring an additional 46 shares during the last quarter. Delta Financial Advisors LLC grew its position in JPMorgan Chase & Co. by 0.3% in the third quarter. Delta Financial Advisors LLC now owns 15,519 shares of the financial services provider's stock valued at $3,272,000 after acquiring an additional 46 shares during the last quarter. Finally, Instrumental Wealth LLC grew its position in JPMorgan Chase & Co. by 4.5% in the second quarter. Instrumental Wealth LLC now owns 1,101 shares of the financial services provider's stock valued at $230,000 after acquiring an additional 47 shares during the last quarter. Institutional investors own 71.55% of the company's stock.

Wall Street Analysts Forecast Growth

JPM has been the topic of several research reports. Oppenheimer cut JPMorgan Chase & Co. from an "outperform" rating to a "market perform" rating in a report on Wednesday. Robert W. Baird cut JPMorgan Chase & Co. from a "neutral" rating to an "underperform" rating and set a $200.00 target price on the stock. in a report on Thursday, November 7th. Barclays upped their target price on JPMorgan Chase & Co. from $217.00 to $257.00 and gave the company an "overweight" rating in a report on Monday, October 14th. Citigroup upped their target price on JPMorgan Chase & Co. from $215.00 to $250.00 and gave the company a "neutral" rating in a report on Tuesday. Finally, Wells Fargo & Company upped their target price on JPMorgan Chase & Co. from $240.00 to $270.00 and gave the company an "overweight" rating in a report on Friday, November 15th. Two investment analysts have rated the stock with a sell rating, eight have given a hold rating and ten have given a buy rating to the stock. Based on data from MarketBeat.com, JPMorgan Chase & Co. has an average rating of "Hold" and an average price target of $229.31.

Check Out Our Latest Stock Report on JPM

JPMorgan Chase & Co. Stock Up 1.6 %

Shares of NYSE:JPM traded up $3.80 during trading on Friday, reaching $248.56. 7,994,315 shares of the stock were exchanged, compared to its average volume of 9,093,902. The company has a debt-to-equity ratio of 1.27, a current ratio of 0.89 and a quick ratio of 0.89. JPMorgan Chase & Co. has a 1-year low of $152.71 and a 1-year high of $249.15. The stock has a fifty day moving average of $222.25 and a two-hundred day moving average of $211.36. The firm has a market cap of $699.78 billion, a price-to-earnings ratio of 13.82, a price-to-earnings-growth ratio of 3.53 and a beta of 1.10.

JPMorgan Chase & Co. (NYSE:JPM - Get Free Report) last released its quarterly earnings results on Friday, October 11th. The financial services provider reported $4.37 EPS for the quarter, beating analysts' consensus estimates of $4.02 by $0.35. The business had revenue of $43.32 billion during the quarter, compared to analyst estimates of $41.43 billion. JPMorgan Chase & Co. had a return on equity of 16.71% and a net margin of 19.64%. JPMorgan Chase & Co.'s quarterly revenue was up 6.5% compared to the same quarter last year. During the same period in the prior year, the firm posted $4.33 EPS. Research analysts anticipate that JPMorgan Chase & Co. will post 17.62 earnings per share for the current fiscal year.

JPMorgan Chase & Co. Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Investors of record on Friday, October 4th were given a $1.25 dividend. This is a positive change from JPMorgan Chase & Co.'s previous quarterly dividend of $1.15. This represents a $5.00 dividend on an annualized basis and a yield of 2.01%. The ex-dividend date of this dividend was Friday, October 4th. JPMorgan Chase & Co.'s dividend payout ratio is presently 27.82%.

JPMorgan Chase & Co. Profile

(

Free Report)

JPMorgan Chase & Co operates as a financial services company worldwide. It operates through four segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The CCB segment offers deposit, investment and lending products, cash management, and payments and services; mortgage origination and servicing activities; residential mortgages and home equity loans; and credit cards, auto loans, leases, and travel services to consumers and small businesses through bank branches, ATMs, and digital and telephone banking.

Recommended Stories

Before you consider JPMorgan Chase & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JPMorgan Chase & Co. wasn't on the list.

While JPMorgan Chase & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.