Glenmede Trust Co. NA acquired a new position in Urban Edge Properties (NYSE:UE - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 45,401 shares of the real estate investment trust's stock, valued at approximately $971,000.

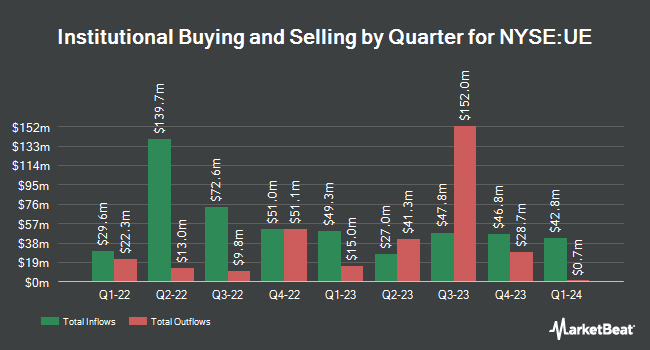

A number of other hedge funds and other institutional investors have also recently made changes to their positions in UE. Point72 Hong Kong Ltd bought a new stake in shares of Urban Edge Properties in the second quarter worth approximately $50,000. Signaturefd LLC raised its stake in shares of Urban Edge Properties by 91.6% during the second quarter. Signaturefd LLC now owns 2,755 shares of the real estate investment trust's stock valued at $51,000 after acquiring an additional 1,317 shares in the last quarter. GAMMA Investing LLC lifted its holdings in shares of Urban Edge Properties by 25.9% in the 3rd quarter. GAMMA Investing LLC now owns 2,740 shares of the real estate investment trust's stock worth $59,000 after buying an additional 563 shares during the period. Mirae Asset Global Investments Co. Ltd. lifted its position in shares of Urban Edge Properties by 36.0% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 4,612 shares of the real estate investment trust's stock worth $97,000 after purchasing an additional 1,221 shares during the period. Finally, Quest Partners LLC bought a new position in Urban Edge Properties in the third quarter worth approximately $101,000. Hedge funds and other institutional investors own 94.94% of the company's stock.

Insider Activity at Urban Edge Properties

In other news, CFO Mark Langer sold 93,962 shares of the firm's stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $23.57, for a total value of $2,214,684.34. Following the transaction, the chief financial officer now directly owns 35,816 shares of the company's stock, valued at approximately $844,183.12. This trade represents a 72.40 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. 4.30% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

Separately, Evercore ISI upped their price objective on Urban Edge Properties from $21.00 to $22.00 and gave the stock an "in-line" rating in a research note on Monday, September 16th.

View Our Latest Stock Analysis on Urban Edge Properties

Urban Edge Properties Stock Performance

Urban Edge Properties stock traded up $0.13 during mid-day trading on Tuesday, hitting $22.74. The company had a trading volume of 1,797,497 shares, compared to its average volume of 893,229. The company's fifty day moving average is $22.23 and its 200-day moving average is $20.28. Urban Edge Properties has a 12-month low of $15.81 and a 12-month high of $23.85. The company has a market capitalization of $2.84 billion, a price-to-earnings ratio of 10.19 and a beta of 1.53. The company has a current ratio of 1.30, a quick ratio of 1.30 and a debt-to-equity ratio of 1.13.

Urban Edge Properties (NYSE:UE - Get Free Report) last posted its earnings results on Wednesday, October 30th. The real estate investment trust reported $0.07 earnings per share (EPS) for the quarter. Urban Edge Properties had a net margin of 59.23% and a return on equity of 20.89%. The business had revenue of $112.26 million for the quarter. Equities research analysts predict that Urban Edge Properties will post 1.32 EPS for the current year.

Urban Edge Properties Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be given a dividend of $0.17 per share. The ex-dividend date is Friday, December 13th. This represents a $0.68 dividend on an annualized basis and a dividend yield of 2.99%. Urban Edge Properties's dividend payout ratio (DPR) is 30.49%.

Urban Edge Properties Profile

(

Free Report)

Urban Edge Properties is a NYSE listed real estate investment trust focused on owning, managing, acquiring, developing, and redeveloping retail real estate in urban communities, primarily in the Washington, DC to Boston corridor. Urban Edge owns 76 properties totaling 17.1 million square feet of gross leasable area.

Featured Articles

Before you consider Urban Edge Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Urban Edge Properties wasn't on the list.

While Urban Edge Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.