Point72 Asset Management L.P. purchased a new position in shares of Adaptive Biotechnologies Co. (NASDAQ:ADPT - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm purchased 495,492 shares of the company's stock, valued at approximately $2,537,000. Point72 Asset Management L.P. owned approximately 0.34% of Adaptive Biotechnologies at the end of the most recent reporting period.

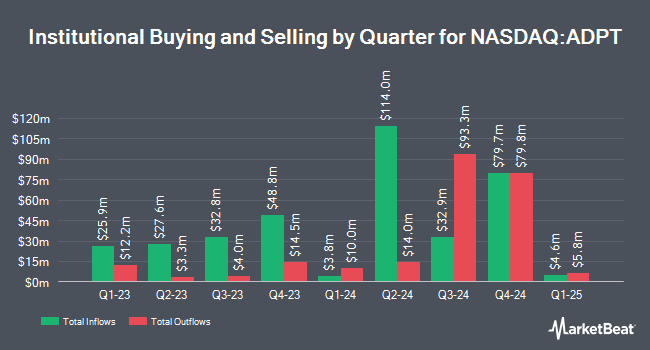

Several other institutional investors have also made changes to their positions in ADPT. The Manufacturers Life Insurance Company raised its holdings in shares of Adaptive Biotechnologies by 5.9% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 48,834 shares of the company's stock valued at $177,000 after purchasing an additional 2,710 shares in the last quarter. Vontobel Holding Ltd. lifted its position in shares of Adaptive Biotechnologies by 30.8% in the third quarter. Vontobel Holding Ltd. now owns 17,000 shares of the company's stock worth $87,000 after buying an additional 4,000 shares during the last quarter. JTC Employer Solutions Trustee Ltd bought a new stake in shares of Adaptive Biotechnologies during the 3rd quarter worth about $26,000. IQ EQ FUND MANAGEMENT IRELAND Ltd increased its holdings in shares of Adaptive Biotechnologies by 29.5% during the 3rd quarter. IQ EQ FUND MANAGEMENT IRELAND Ltd now owns 25,576 shares of the company's stock valued at $131,000 after acquiring an additional 5,826 shares during the last quarter. Finally, Ashton Thomas Securities LLC acquired a new stake in Adaptive Biotechnologies in the 3rd quarter worth approximately $34,000. 99.17% of the stock is currently owned by institutional investors and hedge funds.

Adaptive Biotechnologies Stock Performance

Shares of NASDAQ:ADPT traded up $0.46 on Tuesday, hitting $6.90. 792,031 shares of the company were exchanged, compared to its average volume of 1,411,983. The company's 50 day moving average price is $5.28 and its two-hundred day moving average price is $4.51. The firm has a market capitalization of $1.02 billion, a price-to-earnings ratio of -5.25 and a beta of 1.49. Adaptive Biotechnologies Co. has a one year low of $2.28 and a one year high of $7.07.

Analyst Upgrades and Downgrades

A number of analysts have recently weighed in on the stock. BTIG Research boosted their price objective on shares of Adaptive Biotechnologies from $7.00 to $8.00 and gave the stock a "buy" rating in a research note on Wednesday, October 2nd. Piper Sandler raised their price target on Adaptive Biotechnologies from $6.00 to $7.00 and gave the company an "overweight" rating in a research report on Monday, November 11th.

Get Our Latest Report on ADPT

Adaptive Biotechnologies Company Profile

(

Free Report)

Adaptive Biotechnologies Corporation, a commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases. The company offers immunosequencing platform which combines a suite of proprietary chemistry, computational biology, and machine learning to generate clinical immunomics data to decode the adaptive immune system.

Featured Stories

Before you consider Adaptive Biotechnologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adaptive Biotechnologies wasn't on the list.

While Adaptive Biotechnologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.