Vestcor Inc acquired a new stake in shares of Braze, Inc. (NASDAQ:BRZE - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 50,000 shares of the company's stock, valued at approximately $1,617,000.

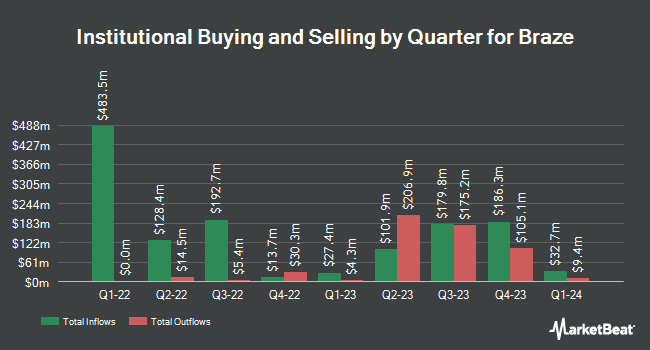

Other institutional investors and hedge funds have also modified their holdings of the company. Quarry LP acquired a new stake in Braze during the second quarter valued at approximately $50,000. Comerica Bank boosted its holdings in Braze by 29.4% during the first quarter. Comerica Bank now owns 1,216 shares of the company's stock worth $54,000 after buying an additional 276 shares during the last quarter. KBC Group NV boosted its stake in Braze by 41.5% during the 3rd quarter. KBC Group NV now owns 2,097 shares of the company's stock worth $68,000 after acquiring an additional 615 shares during the last quarter. Amalgamated Bank grew its holdings in shares of Braze by 18.9% in the 3rd quarter. Amalgamated Bank now owns 2,253 shares of the company's stock valued at $73,000 after buying an additional 358 shares during the period. Finally, Canton Hathaway LLC increased its holdings in shares of Braze by 149.9% in the second quarter. Canton Hathaway LLC now owns 1,979 shares of the company's stock worth $77,000 after acquiring an additional 1,187 shares in the last quarter. Institutional investors and hedge funds own 90.47% of the company's stock.

Braze Price Performance

NASDAQ BRZE traded down $0.37 on Thursday, hitting $42.01. 1,278,058 shares of the company's stock were exchanged, compared to its average volume of 1,081,142. The firm's 50-day moving average price is $34.90 and its two-hundred day moving average price is $37.32. The firm has a market cap of $4.32 billion, a price-to-earnings ratio of -36.85 and a beta of 1.15. Braze, Inc. has a fifty-two week low of $29.18 and a fifty-two week high of $61.53.

Insider Transactions at Braze

In other Braze news, major shareholder Roger H. Lee sold 56,830 shares of Braze stock in a transaction dated Friday, October 11th. The stock was sold at an average price of $30.27, for a total value of $1,720,244.10. Following the completion of the sale, the insider now owns 56,830 shares in the company, valued at $1,720,244.10. The trade was a 50.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CAO Pankaj Malik sold 3,432 shares of the stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $34.45, for a total transaction of $118,232.40. Following the transaction, the chief accounting officer now owns 67,095 shares in the company, valued at approximately $2,311,422.75. The trade was a 4.87 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 113,979 shares of company stock valued at $3,688,914 in the last ninety days. Corporate insiders own 24.03% of the company's stock.

Wall Street Analyst Weigh In

BRZE has been the topic of a number of recent analyst reports. TD Cowen cut their price objective on Braze from $52.00 to $45.00 and set a "buy" rating on the stock in a research note on Tuesday, September 24th. Stifel Nicolaus boosted their target price on shares of Braze from $37.00 to $48.00 and gave the company a "buy" rating in a report on Tuesday. Piper Sandler boosted their target price on Braze from $40.00 to $48.00 and gave the company an "overweight" rating in a research note on Tuesday. Macquarie upped their target price on Braze from $30.00 to $39.00 and gave the company a "neutral" rating in a report on Wednesday. Finally, Oppenheimer reiterated an "outperform" rating and set a $51.00 target price on shares of Braze in a report on Tuesday. One analyst has rated the stock with a hold rating and nineteen have given a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $53.74.

Check Out Our Latest Report on Braze

Braze Profile

(

Free Report)

Braze, Inc operates a customer engagement platform that provides interactions between consumers and brands worldwide. The company offers Braze software development kits that automatically manage data ingestion and deliver mobile and web notifications, in-application/in-browser interstitial messages, and content cards; REST API that can be used to import or export data or to trigger workflows between Braze and brands' existing technology stacks; Partner Data Integrations, which allow brands to sync user cohorts from partners; Data Transformation, in which brands can programmatically sync and transform user data; and Braze Cloud Data Ingestion that enables brands to harness their customer data.

See Also

Before you consider Braze, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Braze wasn't on the list.

While Braze currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.