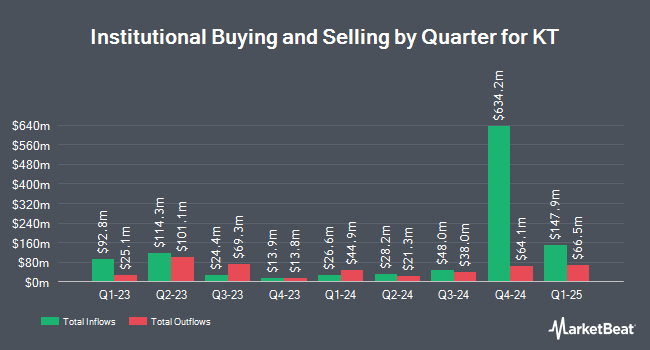

Dynamic Technology Lab Private Ltd acquired a new stake in KT Co. (NYSE:KT - Free Report) during the third quarter, according to its most recent disclosure with the SEC. The institutional investor acquired 50,693 shares of the technology company's stock, valued at approximately $779,000.

Several other large investors also recently modified their holdings of the company. EverSource Wealth Advisors LLC grew its position in shares of KT by 41.9% during the 1st quarter. EverSource Wealth Advisors LLC now owns 4,278 shares of the technology company's stock worth $60,000 after buying an additional 1,264 shares during the period. Venturi Wealth Management LLC increased its stake in KT by 3,915.8% in the third quarter. Venturi Wealth Management LLC now owns 4,578 shares of the technology company's stock valued at $70,000 after purchasing an additional 4,464 shares in the last quarter. Envestnet Portfolio Solutions Inc. acquired a new position in shares of KT during the second quarter valued at about $140,000. Aprio Wealth Management LLC bought a new position in shares of KT during the 2nd quarter worth about $151,000. Finally, Private Advisor Group LLC bought a new position in shares of KT during the 3rd quarter worth about $164,000. 18.86% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of research analysts recently weighed in on the company. New Street Research raised KT to a "strong-buy" rating in a research note on Monday, September 9th. StockNews.com upgraded KT from a "buy" rating to a "strong-buy" rating in a report on Saturday, November 16th.

View Our Latest Analysis on KT

KT Stock Performance

Shares of KT stock traded up $0.88 during trading hours on Thursday, hitting $18.29. 2,961,815 shares of the company were exchanged, compared to its average volume of 834,355. KT Co. has a 52-week low of $12.10 and a 52-week high of $18.34. The company has a current ratio of 1.04, a quick ratio of 0.98 and a debt-to-equity ratio of 0.28. The firm has a fifty day simple moving average of $15.62 and a 200 day simple moving average of $14.54. The stock has a market capitalization of $9.43 billion, a price-to-earnings ratio of 11.16, a P/E/G ratio of 1.24 and a beta of 0.90.

KT (NYSE:KT - Get Free Report) last issued its earnings results on Monday, August 26th. The technology company reported $0.58 earnings per share (EPS) for the quarter. KT had a return on equity of 6.23% and a net margin of 4.50%. The firm had revenue of $4.77 billion for the quarter. Research analysts predict that KT Co. will post 0.85 earnings per share for the current fiscal year.

About KT

(

Free Report)

KT Corporation provides integrated telecommunications and platform services in Korea and internationally. The company offers mobile voice and data telecommunications services based on 5G, 4G LTE and 3G W-CDMA technology; fixed-line telephone services, including local, domestic long-distance, international long-distance, and voice over Internet protocol telephone services, as well as interconnection services; broadband Internet access service and other Internet-related services; and data communication services, such as fixed-line and leased line services, as well as broadband Internet connection services.

See Also

Before you consider KT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KT wasn't on the list.

While KT currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.