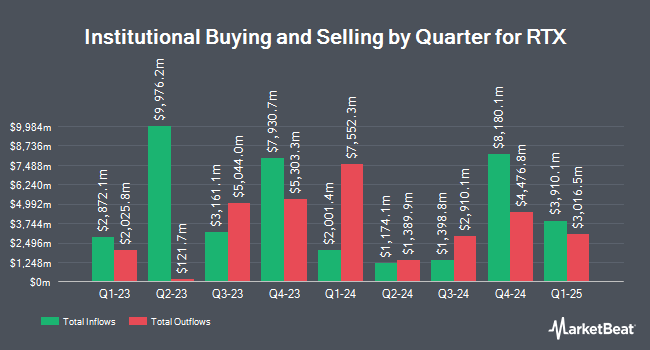

Allianz SE purchased a new stake in shares of RTX Co. (NYSE:RTX - Free Report) during the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 50,712 shares of the company's stock, valued at approximately $5,844,000.

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in RTX. Fairway Wealth LLC bought a new stake in shares of RTX in the 4th quarter worth approximately $31,000. Picton Mahoney Asset Management boosted its holdings in RTX by 2,944.4% in the fourth quarter. Picton Mahoney Asset Management now owns 274 shares of the company's stock worth $31,000 after acquiring an additional 265 shares in the last quarter. Modus Advisors LLC purchased a new stake in shares of RTX in the fourth quarter worth $39,000. Millstone Evans Group LLC bought a new position in shares of RTX during the fourth quarter valued at $39,000. Finally, Comprehensive Financial Planning Inc. PA bought a new position in RTX in the 4th quarter worth about $40,000. 86.50% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several brokerages have issued reports on RTX. StockNews.com cut shares of RTX from a "buy" rating to a "hold" rating in a report on Friday, February 14th. JPMorgan Chase & Co. upped their price objective on RTX from $140.00 to $150.00 and gave the company an "overweight" rating in a research report on Wednesday, January 29th. Bank of America lifted their target price on RTX from $145.00 to $155.00 and gave the stock a "buy" rating in a report on Thursday, January 30th. Argus raised RTX from a "hold" rating to a "buy" rating in a report on Tuesday, February 11th. Finally, Deutsche Bank Aktiengesellschaft raised shares of RTX from a "hold" rating to a "buy" rating and raised their price target for the company from $131.00 to $140.00 in a report on Thursday, January 2nd. Four equities research analysts have rated the stock with a hold rating, eleven have given a buy rating and three have assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, RTX presently has a consensus rating of "Moderate Buy" and an average target price of $166.40.

Check Out Our Latest Report on RTX

Insiders Place Their Bets

In related news, CFO Neil G. Mitchill, Jr. sold 16,118 shares of the firm's stock in a transaction on Thursday, February 27th. The stock was sold at an average price of $130.35, for a total value of $2,100,981.30. Following the completion of the sale, the chief financial officer now directly owns 59,556 shares in the company, valued at $7,763,124.60. This trade represents a 21.30 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Christopher T. Calio sold 27,379 shares of the business's stock in a transaction on Thursday, February 27th. The shares were sold at an average price of $130.36, for a total transaction of $3,569,126.44. Following the transaction, the chief executive officer now owns 81,508 shares in the company, valued at $10,625,382.88. This trade represents a 25.14 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 79,831 shares of company stock valued at $10,309,302 in the last three months. Corporate insiders own 0.15% of the company's stock.

RTX Stock Performance

NYSE RTX traded up $0.84 on Monday, hitting $132.56. 5,519,690 shares of the company traded hands, compared to its average volume of 5,647,829. The business's 50 day moving average price is $128.59 and its 200-day moving average price is $123.06. RTX Co. has a 52-week low of $97.03 and a 52-week high of $136.17. The company has a current ratio of 0.99, a quick ratio of 0.74 and a debt-to-equity ratio of 0.63. The company has a market capitalization of $176.97 billion, a price-to-earnings ratio of 37.34, a P/E/G ratio of 2.11 and a beta of 0.78.

RTX (NYSE:RTX - Get Free Report) last posted its quarterly earnings data on Tuesday, January 28th. The company reported $1.54 earnings per share for the quarter, beating analysts' consensus estimates of $1.35 by $0.19. RTX had a return on equity of 12.45% and a net margin of 5.91%. Equities analysts expect that RTX Co. will post 6.11 earnings per share for the current year.

RTX Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, March 20th. Shareholders of record on Friday, February 21st were given a dividend of $0.63 per share. The ex-dividend date was Friday, February 21st. This represents a $2.52 annualized dividend and a yield of 1.90%. RTX's dividend payout ratio (DPR) is currently 70.99%.

RTX Company Profile

(

Free Report)

RTX Corporation, an aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally. It operates through three segments: Collins Aerospace, Pratt & Whitney, and Raytheon. The Collins Aerospace Systems segment offers aerospace and defense products, and aftermarket service solutions for civil and military aircraft manufacturers and commercial airlines, as well as regional, business, and general aviation, defense, and commercial space operations.

See Also

Before you consider RTX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RTX wasn't on the list.

While RTX currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.