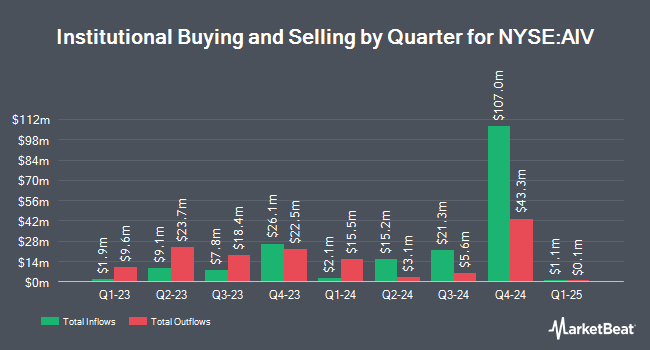

Resona Asset Management Co. Ltd. acquired a new stake in Apartment Investment and Management (NYSE:AIV - Free Report) in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor acquired 51,449 shares of the real estate investment trust's stock, valued at approximately $432,000.

Several other institutional investors and hedge funds have also made changes to their positions in the stock. Charles Schwab Investment Management Inc. grew its position in Apartment Investment and Management by 0.5% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,851,566 shares of the real estate investment trust's stock worth $16,831,000 after acquiring an additional 8,713 shares during the period. JPMorgan Chase & Co. raised its holdings in Apartment Investment and Management by 34.5% in the 4th quarter. JPMorgan Chase & Co. now owns 967,860 shares of the real estate investment trust's stock valued at $8,798,000 after buying an additional 248,329 shares during the period. Thompson Siegel & Walmsley LLC acquired a new position in Apartment Investment and Management in the fourth quarter valued at about $8,155,000. Barclays PLC boosted its stake in Apartment Investment and Management by 40.7% during the third quarter. Barclays PLC now owns 658,083 shares of the real estate investment trust's stock worth $5,948,000 after buying an additional 190,440 shares during the period. Finally, Norges Bank acquired a new position in shares of Apartment Investment and Management in the 4th quarter worth approximately $5,691,000. 83.26% of the stock is currently owned by institutional investors and hedge funds.

Apartment Investment and Management Trading Up 0.3 %

NYSE AIV traded up $0.03 during trading on Tuesday, hitting $7.73. The stock had a trading volume of 749,900 shares, compared to its average volume of 976,625. The firm has a 50 day moving average price of $8.57 and a 200 day moving average price of $8.68. The company has a quick ratio of 1.35, a current ratio of 1.35 and a debt-to-equity ratio of 4.28. Apartment Investment and Management has a twelve month low of $6.89 and a twelve month high of $9.49. The company has a market capitalization of $1.10 billion, a PE ratio of -4.47 and a beta of 1.29.

Apartment Investment and Management (NYSE:AIV - Get Free Report) last posted its quarterly earnings results on Monday, February 24th. The real estate investment trust reported ($0.08) EPS for the quarter, topping the consensus estimate of ($0.12) by $0.04. Apartment Investment and Management had a negative net margin of 119.76% and a negative return on equity of 68.04%. The business had revenue of $54.17 million during the quarter, compared to the consensus estimate of $53.11 million. As a group, equities research analysts forecast that Apartment Investment and Management will post -0.8 earnings per share for the current year.

Analysts Set New Price Targets

Separately, StockNews.com raised Apartment Investment and Management from a "sell" rating to a "hold" rating in a research report on Wednesday, February 26th.

Check Out Our Latest Stock Report on Apartment Investment and Management

Apartment Investment and Management Profile

(

Free Report)

Apartment Investment & Management Co operates as a real estate investment trust that engages in the acquisition, ownership, management and redevelopment of apartment properties. The company was founded in 1975 and is headquartered in Denver, CO.

Read More

Before you consider Apartment Investment and Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apartment Investment and Management wasn't on the list.

While Apartment Investment and Management currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.