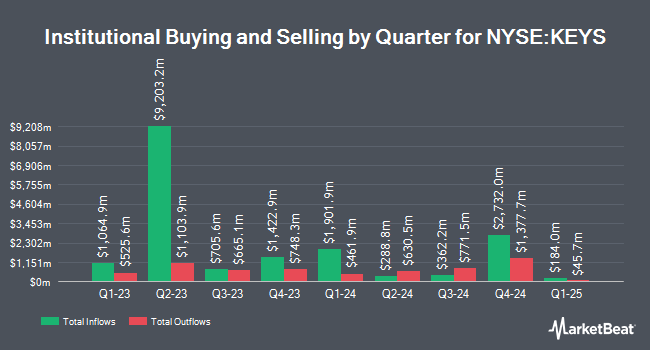

Resona Asset Management Co. Ltd. acquired a new position in shares of Keysight Technologies, Inc. (NYSE:KEYS - Free Report) in the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor acquired 52,383 shares of the scientific and technical instruments company's stock, valued at approximately $8,432,000.

Several other large investors have also made changes to their positions in KEYS. Goodman Advisory Group LLC acquired a new position in Keysight Technologies during the third quarter valued at approximately $35,000. Venturi Wealth Management LLC lifted its holdings in shares of Keysight Technologies by 100.8% during the 4th quarter. Venturi Wealth Management LLC now owns 265 shares of the scientific and technical instruments company's stock valued at $43,000 after acquiring an additional 133 shares in the last quarter. Versant Capital Management Inc boosted its position in Keysight Technologies by 79.4% during the 4th quarter. Versant Capital Management Inc now owns 357 shares of the scientific and technical instruments company's stock worth $57,000 after purchasing an additional 158 shares during the period. Wilmington Savings Fund Society FSB acquired a new stake in Keysight Technologies in the 3rd quarter valued at $120,000. Finally, Huntington National Bank raised its position in Keysight Technologies by 37.4% in the fourth quarter. Huntington National Bank now owns 793 shares of the scientific and technical instruments company's stock valued at $127,000 after purchasing an additional 216 shares during the period. 84.58% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Keysight Technologies

In other news, CFO Neil Dougherty sold 3,632 shares of Keysight Technologies stock in a transaction that occurred on Thursday, March 27th. The stock was sold at an average price of $155.00, for a total value of $562,960.00. Following the completion of the transaction, the chief financial officer now owns 115,063 shares in the company, valued at approximately $17,834,765. This trade represents a 3.06 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 0.61% of the company's stock.

Wall Street Analyst Weigh In

KEYS has been the subject of a number of recent research reports. Robert W. Baird increased their target price on Keysight Technologies from $180.00 to $190.00 and gave the company an "outperform" rating in a research note on Thursday, February 27th. Wells Fargo & Company increased their price objective on shares of Keysight Technologies from $180.00 to $190.00 and gave the company an "overweight" rating in a research report on Wednesday, February 26th. JPMorgan Chase & Co. raised shares of Keysight Technologies from a "neutral" rating to an "overweight" rating and boosted their target price for the stock from $170.00 to $200.00 in a research report on Monday, December 16th. Finally, StockNews.com downgraded shares of Keysight Technologies from a "strong-buy" rating to a "buy" rating in a research note on Saturday, March 22nd. One analyst has rated the stock with a sell rating and nine have assigned a buy rating to the company. Based on data from MarketBeat.com, Keysight Technologies presently has an average rating of "Moderate Buy" and an average target price of $184.44.

Read Our Latest Stock Report on Keysight Technologies

Keysight Technologies Stock Up 0.0 %

KEYS traded up $0.02 during trading on Friday, hitting $133.43. The company had a trading volume of 1,590,979 shares, compared to its average volume of 1,154,251. Keysight Technologies, Inc. has a 1-year low of $119.72 and a 1-year high of $186.20. The company has a debt-to-equity ratio of 0.35, a current ratio of 2.98 and a quick ratio of 2.27. The company has a market cap of $23.06 billion, a PE ratio of 38.12, a P/E/G ratio of 2.41 and a beta of 1.12. The business has a 50-day moving average of $157.85 and a 200-day moving average of $161.18.

Keysight Technologies Profile

(

Free Report)

Keysight Technologies, Inc provides electronic design and test solutions to commercial communications, networking, aerospace, defense and government, automotive, energy, semiconductor, electronic, and education industries in the Americas, Europe, and the Asia Pacific. The company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

Featured Articles

Before you consider Keysight Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keysight Technologies wasn't on the list.

While Keysight Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.