Healthcare of Ontario Pension Plan Trust Fund purchased a new position in shares of Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund purchased 5,283 shares of the company's stock, valued at approximately $1,763,000.

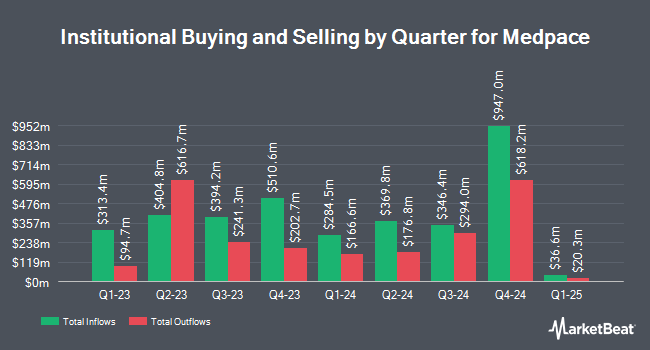

Other institutional investors and hedge funds have also recently modified their holdings of the company. Ashton Thomas Securities LLC purchased a new position in Medpace during the third quarter worth about $37,000. DT Investment Partners LLC acquired a new position in Medpace in the second quarter valued at approximately $41,000. Capital Performance Advisors LLP purchased a new position in Medpace in the third quarter worth approximately $46,000. Ashton Thomas Private Wealth LLC acquired a new stake in Medpace during the second quarter worth $52,000. Finally, International Assets Investment Management LLC acquired a new position in shares of Medpace in the 2nd quarter valued at $61,000. Institutional investors and hedge funds own 77.98% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on MEDP. TD Cowen dropped their target price on shares of Medpace from $413.00 to $372.00 and set a "buy" rating for the company in a report on Wednesday, October 23rd. William Blair reiterated an "outperform" rating on shares of Medpace in a research note on Tuesday, October 22nd. Robert W. Baird lifted their price objective on shares of Medpace from $349.00 to $354.00 and gave the company a "neutral" rating in a report on Monday, November 25th. Baird R W lowered shares of Medpace from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 23rd. Finally, StockNews.com lowered Medpace from a "buy" rating to a "hold" rating in a research report on Friday, September 27th. Seven analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $380.56.

View Our Latest Stock Report on Medpace

Medpace Trading Up 0.5 %

MEDP stock traded up $1.73 during trading on Monday, hitting $342.36. 193,034 shares of the company's stock were exchanged, compared to its average volume of 284,021. The business has a 50-day moving average price of $337.82 and a two-hundred day moving average price of $370.98. The stock has a market capitalization of $10.64 billion, a price-to-earnings ratio of 29.83, a PEG ratio of 1.88 and a beta of 1.37. Medpace Holdings, Inc. has a 52-week low of $273.14 and a 52-week high of $459.77.

Medpace (NASDAQ:MEDP - Get Free Report) last issued its quarterly earnings data on Monday, October 21st. The company reported $3.01 earnings per share for the quarter, topping the consensus estimate of $2.77 by $0.24. The business had revenue of $533.32 million during the quarter, compared to the consensus estimate of $540.99 million. Medpace had a net margin of 17.66% and a return on equity of 50.87%. The company's revenue was up 8.3% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $2.22 EPS. On average, equities research analysts anticipate that Medpace Holdings, Inc. will post 11.93 earnings per share for the current fiscal year.

About Medpace

(

Free Report)

Medpace Holdings, Inc provides clinical research-based drug and medical device development services in North America, Europe, and Asia. The company offers a suite of services supporting the clinical development process from Phase I to Phase IV in various therapeutic areas. It provides clinical development services to the pharmaceutical, biotechnology, and medical device industries; and development plan design, coordinated central laboratory, project management, regulatory affairs, clinical monitoring, data management and analysis, pharmacovigilance new drug application submissions, and post-marketing clinical support services.

See Also

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.