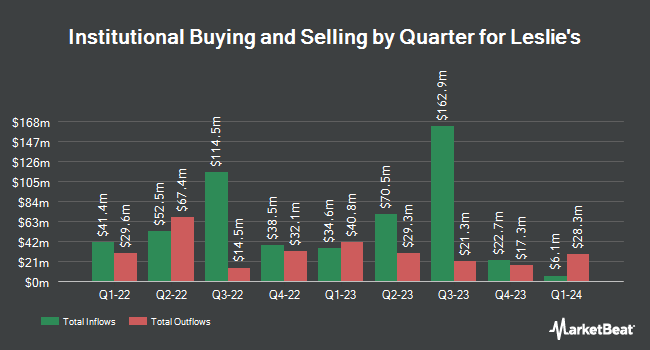

Point72 Asset Management L.P. purchased a new stake in Leslie's, Inc. (NASDAQ:LESL - Free Report) in the third quarter, according to its most recent filing with the SEC. The fund purchased 538,661 shares of the company's stock, valued at approximately $1,702,000. Point72 Asset Management L.P. owned about 0.29% of Leslie's at the end of the most recent quarter.

Several other institutional investors and hedge funds have also made changes to their positions in the company. IHT Wealth Management LLC grew its holdings in shares of Leslie's by 52.6% during the third quarter. IHT Wealth Management LLC now owns 16,760 shares of the company's stock valued at $51,000 after purchasing an additional 5,776 shares during the last quarter. Jacobs Levy Equity Management Inc. acquired a new position in Leslie's during the 3rd quarter valued at approximately $240,000. HighTower Advisors LLC grew its stake in Leslie's by 27.0% during the 3rd quarter. HighTower Advisors LLC now owns 173,599 shares of the company's stock worth $565,000 after buying an additional 36,953 shares during the last quarter. Centiva Capital LP grew its stake in Leslie's by 83.1% during the 3rd quarter. Centiva Capital LP now owns 353,807 shares of the company's stock worth $1,118,000 after buying an additional 160,583 shares during the last quarter. Finally, Paloma Partners Management Co acquired a new stake in Leslie's in the third quarter worth $569,000.

Wall Street Analyst Weigh In

Several equities analysts have recently issued reports on the stock. Telsey Advisory Group reduced their price target on shares of Leslie's from $4.00 to $3.75 and set a "market perform" rating for the company in a report on Tuesday, November 26th. Robert W. Baird reduced their target price on shares of Leslie's from $4.00 to $3.50 and set a "neutral" rating for the company in a research note on Tuesday, November 26th. Finally, William Blair restated a "market perform" rating on shares of Leslie's in a research report on Tuesday, November 26th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $3.61.

Read Our Latest Stock Report on LESL

Leslie's Stock Performance

Shares of NASDAQ:LESL traded down $0.14 during trading on Wednesday, reaching $2.46. The company had a trading volume of 4,815,413 shares, compared to its average volume of 4,519,887. Leslie's, Inc. has a twelve month low of $2.20 and a twelve month high of $8.21. The firm has a market capitalization of $455.02 million, a PE ratio of -20.50 and a beta of 1.12. The firm's fifty day moving average is $2.75 and its 200 day moving average is $3.28.

Leslie's (NASDAQ:LESL - Get Free Report) last released its earnings results on Monday, November 25th. The company reported $0.02 earnings per share for the quarter, missing analysts' consensus estimates of $0.11 by ($0.09). Leslie's had a negative return on equity of 6.11% and a negative net margin of 1.76%. The firm had revenue of $397.90 million during the quarter, compared to analyst estimates of $405.19 million. During the same quarter last year, the company earned $0.14 earnings per share. The business's revenue for the quarter was down 8.0% on a year-over-year basis. Equities analysts predict that Leslie's, Inc. will post 0.12 earnings per share for the current fiscal year.

Leslie's Profile

(

Free Report)

Leslie's, Inc operates as a direct-to-consumer pool and spa care brand in the United States. The company markets and sells pool and spa supplies and related products and services. It also offers various pool and spa maintenance items, such as chemicals, equipment and parts, cleaning and maintenance equipment, safety, recreational, and fitness related products.

See Also

Before you consider Leslie's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leslie's wasn't on the list.

While Leslie's currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.