Russell Investments Group Ltd. acquired a new position in shares of Inhibrx, Inc. (NASDAQ:INBX - Free Report) during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 54,345 shares of the company's stock, valued at approximately $837,000. Russell Investments Group Ltd. owned approximately 0.38% of Inhibrx at the end of the most recent quarter.

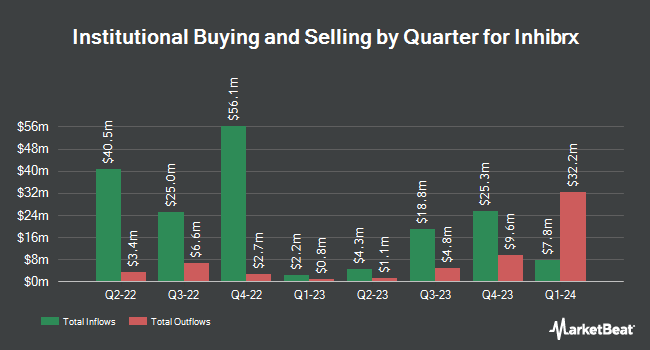

A number of other institutional investors and hedge funds have also modified their holdings of INBX. Empirical Financial Services LLC d.b.a. Empirical Wealth Management acquired a new stake in Inhibrx during the fourth quarter worth $348,000. Exchange Traded Concepts LLC bought a new position in shares of Inhibrx during the 4th quarter worth about $148,000. Bank of New York Mellon Corp acquired a new stake in shares of Inhibrx during the 4th quarter valued at about $792,000. Meridian Wealth Advisors LLC bought a new stake in Inhibrx in the fourth quarter valued at about $385,000. Finally, Rangeley Capital LLC acquired a new position in Inhibrx in the fourth quarter worth about $761,000. 82.46% of the stock is currently owned by institutional investors.

Inhibrx Price Performance

INBX stock traded up $0.27 during trading on Friday, hitting $12.25. The company had a trading volume of 21,871 shares, compared to its average volume of 197,793. The company has a fifty day moving average price of $13.03 and a two-hundred day moving average price of $14.10. Inhibrx, Inc. has a fifty-two week low of $10.80 and a fifty-two week high of $34.75.

Inhibrx (NASDAQ:INBX - Get Free Report) last issued its earnings results on Monday, March 17th. The company reported ($3.09) EPS for the quarter, missing the consensus estimate of ($2.88) by ($0.21). The firm had revenue of $0.10 million for the quarter. On average, analysts expect that Inhibrx, Inc. will post 104.88 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Separately, JMP Securities reaffirmed a "market perform" rating on shares of Inhibrx in a report on Wednesday, January 22nd.

Read Our Latest Stock Report on Inhibrx

Inhibrx Profile

(

Free Report)

Inhibrx, Inc, a clinical-stage biopharmaceutical company, develops a pipeline of novel biologic therapeutic candidates. The company's therapeutic candidate includes INBRX-101, an alpha-1 antitrypsin (AAT)-Fc fusion protein therapeutic candidate, which is in Phase 1 clinical trials for use in the treatment of patients with AAT deficiency.

Read More

Before you consider Inhibrx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inhibrx wasn't on the list.

While Inhibrx currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.