Connor Clark & Lunn Investment Management Ltd. bought a new stake in shares of Royal Gold, Inc. (NASDAQ:RGLD - Free Report) TSE: RGL in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm bought 5,622 shares of the basic materials company's stock, valued at approximately $741,000.

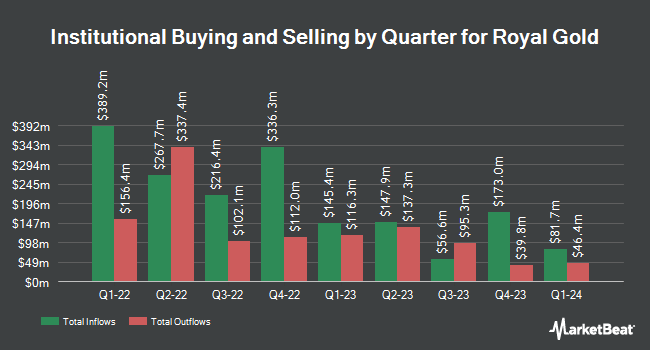

A number of other institutional investors and hedge funds also recently bought and sold shares of RGLD. Geode Capital Management LLC grew its position in shares of Royal Gold by 2.6% during the third quarter. Geode Capital Management LLC now owns 1,321,555 shares of the basic materials company's stock valued at $185,454,000 after purchasing an additional 33,151 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its stake in Royal Gold by 1.1% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 484,207 shares of the basic materials company's stock valued at $63,843,000 after buying an additional 5,067 shares during the last quarter. Rhumbline Advisers grew its holdings in Royal Gold by 1.9% during the 4th quarter. Rhumbline Advisers now owns 179,029 shares of the basic materials company's stock valued at $23,605,000 after buying an additional 3,286 shares in the last quarter. FMR LLC increased its stake in Royal Gold by 35.3% in the 3rd quarter. FMR LLC now owns 178,719 shares of the basic materials company's stock worth $25,074,000 after acquiring an additional 46,615 shares during the last quarter. Finally, Proficio Capital Partners LLC purchased a new stake in shares of Royal Gold during the 4th quarter worth approximately $18,427,000. 83.65% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Jefferies Financial Group raised shares of Royal Gold from a "hold" rating to a "buy" rating and raised their target price for the company from $154.00 to $178.00 in a report on Tuesday, January 7th. One analyst has rated the stock with a sell rating, three have given a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $168.86.

Check Out Our Latest Report on RGLD

Royal Gold Price Performance

Shares of Royal Gold stock traded up $3.06 on Tuesday, reaching $160.23. The company had a trading volume of 435,099 shares, compared to its average volume of 371,153. The firm has a market cap of $10.54 billion, a price-to-earnings ratio of 31.79, a P/E/G ratio of 3.42 and a beta of 0.84. The firm's 50-day moving average price is $146.79 and its two-hundred day moving average price is $144.08. Royal Gold, Inc. has a 1 year low of $110.01 and a 1 year high of $159.23.

Royal Gold (NASDAQ:RGLD - Get Free Report) TSE: RGL last posted its quarterly earnings data on Wednesday, February 12th. The basic materials company reported $1.63 EPS for the quarter, topping the consensus estimate of $1.46 by $0.17. Royal Gold had a net margin of 46.15% and a return on equity of 11.46%. As a group, analysts anticipate that Royal Gold, Inc. will post 6.2 EPS for the current year.

Royal Gold Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, April 17th. Investors of record on Friday, April 4th will be given a $0.45 dividend. This represents a $1.80 dividend on an annualized basis and a yield of 1.12%. The ex-dividend date of this dividend is Friday, April 4th. Royal Gold's dividend payout ratio (DPR) is currently 35.71%.

Insiders Place Their Bets

In other news, SVP Randy Shefman sold 1,300 shares of the company's stock in a transaction that occurred on Monday, March 17th. The stock was sold at an average price of $154.98, for a total transaction of $201,474.00. Following the transaction, the senior vice president now owns 9,360 shares of the company's stock, valued at approximately $1,450,612.80. This represents a 12.20 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. 0.52% of the stock is owned by insiders.

About Royal Gold

(

Free Report)

Royal Gold, Inc, together with its subsidiaries, acquires and manages precious metal streams, royalties, and related interests. The company engages in acquiring stream and royalty interests or to finance projects that are in production, development, or in the exploration stage in exchange for stream or royalty interests, which primarily consists of gold, silver, copper, nickel, zinc, lead, and other metals.

Featured Stories

Before you consider Royal Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Gold wasn't on the list.

While Royal Gold currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.