Altman Advisors Inc. acquired a new stake in shares of McDonald's Co. (NYSE:MCD - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 5,656 shares of the fast-food giant's stock, valued at approximately $1,722,000.

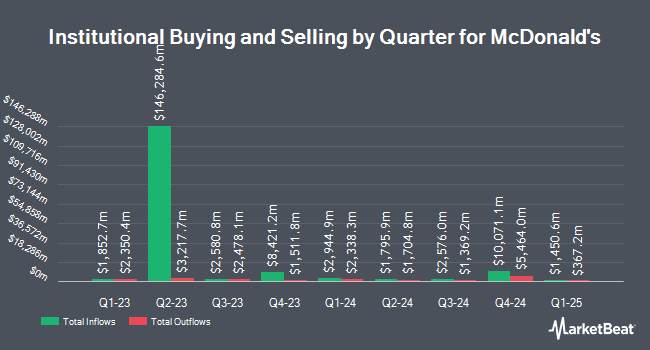

Several other institutional investors and hedge funds have also bought and sold shares of the company. Kings Path Partners LLC bought a new stake in shares of McDonald's in the 2nd quarter valued at about $38,000. Hara Capital LLC bought a new position in McDonald's during the 3rd quarter valued at approximately $44,000. Peterson Financial Group Inc. bought a new position in McDonald's during the 3rd quarter valued at approximately $58,000. Opal Wealth Advisors LLC bought a new position in McDonald's during the 2nd quarter valued at approximately $59,000. Finally, Bbjs Financial Advisors LLC bought a new position in McDonald's during the 2nd quarter valued at approximately $65,000. 70.29% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

A number of research firms have weighed in on MCD. Baird R W downgraded McDonald's from a "strong-buy" rating to a "hold" rating in a report on Wednesday, October 23rd. Deutsche Bank Aktiengesellschaft reduced their target price on McDonald's from $295.00 to $290.00 and set a "buy" rating on the stock in a report on Tuesday, July 30th. Guggenheim downgraded McDonald's from a "buy" rating to a "neutral" rating and cut their price target for the stock from $290.00 to $285.00 in a research note on Wednesday, October 23rd. Loop Capital restated a "buy" rating on shares of McDonald's in a research note on Friday, October 18th. Finally, Jefferies Financial Group upped their price target on McDonald's from $310.00 to $330.00 and gave the stock a "buy" rating in a research note on Monday, September 9th. Thirteen research analysts have rated the stock with a hold rating and eighteen have given a buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $319.46.

Check Out Our Latest Stock Report on McDonald's

McDonald's Trading Up 0.1 %

McDonald's stock traded up $0.16 during trading on Wednesday, reaching $290.89. The company had a trading volume of 2,524,679 shares, compared to its average volume of 3,497,092. McDonald's Co. has a 52 week low of $243.53 and a 52 week high of $317.90. The firm's 50-day simple moving average is $300.04 and its 200 day simple moving average is $277.75. The firm has a market capitalization of $208.46 billion, a price-to-earnings ratio of 25.55, a price-to-earnings-growth ratio of 3.89 and a beta of 0.74.

McDonald's (NYSE:MCD - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The fast-food giant reported $3.23 earnings per share (EPS) for the quarter, topping the consensus estimate of $3.18 by $0.05. The business had revenue of $6.87 billion during the quarter, compared to the consensus estimate of $6.82 billion. McDonald's had a net margin of 31.79% and a negative return on equity of 175.42%. The firm's quarterly revenue was up 2.7% compared to the same quarter last year. During the same quarter last year, the firm earned $3.19 earnings per share. On average, analysts predict that McDonald's Co. will post 11.77 earnings per share for the current year.

McDonald's Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be issued a dividend of $1.77 per share. The ex-dividend date of this dividend is Monday, December 2nd. This is a positive change from McDonald's's previous quarterly dividend of $1.67. This represents a $7.08 dividend on an annualized basis and a dividend yield of 2.43%. McDonald's's payout ratio is 62.16%.

Insider Activity

In related news, CEO Christopher J. Kempczinski sold 11,727 shares of the stock in a transaction that occurred on Monday, September 23rd. The stock was sold at an average price of $300.03, for a total value of $3,518,451.81. Following the completion of the transaction, the chief executive officer now directly owns 49,885 shares in the company, valued at approximately $14,966,996.55. This represents a 19.03 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider Joseph M. Erlinger sold 1,098 shares of the company's stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $288.70, for a total value of $316,992.60. Following the transaction, the insider now owns 12,583 shares in the company, valued at $3,632,712.10. This trade represents a 8.03 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 35,596 shares of company stock valued at $10,698,289 over the last ninety days. 0.23% of the stock is currently owned by insiders.

About McDonald's

(

Free Report)

McDonald's Corporation operates and franchises restaurants under the McDonald's brand in the United States and internationally. It offers food and beverages, including hamburgers and cheeseburgers, various chicken sandwiches, fries, shakes, desserts, sundaes, cookies, pies, soft drinks, coffee, and other beverages; and full or limited breakfast, as well as sells various other products during limited-time promotions.

See Also

Before you consider McDonald's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McDonald's wasn't on the list.

While McDonald's currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.