Intech Investment Management LLC acquired a new position in Bloom Energy Co. (NYSE:BE - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The fund acquired 56,834 shares of the company's stock, valued at approximately $600,000.

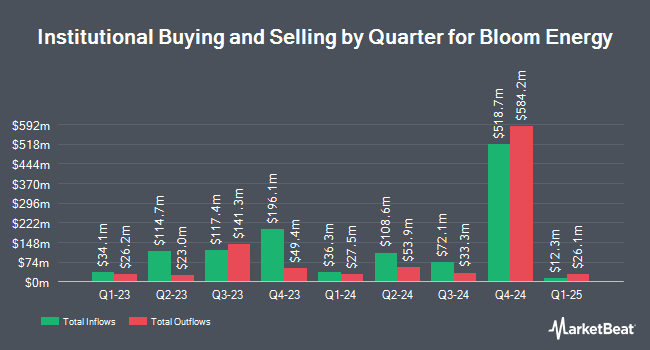

Several other institutional investors have also modified their holdings of BE. ORG Partners LLC bought a new stake in Bloom Energy in the second quarter worth about $40,000. Quest Partners LLC grew its position in Bloom Energy by 2,780.0% in the second quarter. Quest Partners LLC now owns 3,600 shares of the company's stock worth $44,000 after buying an additional 3,475 shares during the last quarter. Gilliland Jeter Wealth Management LLC bought a new position in shares of Bloom Energy in the second quarter valued at $53,000. Mather Group LLC. bought a new position in shares of Bloom Energy in the second quarter valued at $66,000. Finally, Emerald Mutual Fund Advisers Trust bought a new stake in shares of Bloom Energy during the 3rd quarter worth $74,000. Institutional investors and hedge funds own 77.04% of the company's stock.

Wall Street Analyst Weigh In

BE has been the topic of a number of recent analyst reports. Morgan Stanley boosted their target price on Bloom Energy from $20.00 to $28.00 and gave the stock an "overweight" rating in a research report on Monday, November 18th. Hsbc Global Res upgraded Bloom Energy to a "hold" rating in a report on Wednesday, November 20th. Robert W. Baird dropped their target price on shares of Bloom Energy from $18.00 to $15.00 and set an "outperform" rating on the stock in a research report on Friday, November 8th. HSBC downgraded shares of Bloom Energy from a "buy" rating to a "hold" rating and set a $24.50 price target for the company. in a research report on Wednesday, November 20th. Finally, Royal Bank of Canada lifted their price objective on shares of Bloom Energy from $15.00 to $28.00 and gave the stock an "outperform" rating in a research report on Monday, November 18th. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating, nine have given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, Bloom Energy has an average rating of "Hold" and an average target price of $19.14.

View Our Latest Analysis on Bloom Energy

Bloom Energy Price Performance

NYSE:BE traded up $0.24 during trading hours on Friday, reaching $27.45. The company's stock had a trading volume of 3,830,521 shares, compared to its average volume of 14,135,264. The company has a current ratio of 3.36, a quick ratio of 2.33 and a debt-to-equity ratio of 3.09. Bloom Energy Co. has a one year low of $8.41 and a one year high of $28.70. The business's 50-day moving average is $13.88 and its 200-day moving average is $13.24.

Insider Activity at Bloom Energy

In other news, CEO Kr Sridhar sold 72,903 shares of the firm's stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $25.02, for a total value of $1,824,033.06. Following the sale, the chief executive officer now directly owns 1,869,593 shares of the company's stock, valued at approximately $46,777,216.86. This trade represents a 3.75 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Shawn Marie Soderberg sold 1,289 shares of Bloom Energy stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $24.56, for a total value of $31,657.84. Following the completion of the transaction, the insider now owns 168,561 shares in the company, valued at $4,139,858.16. The trade was a 0.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 122,975 shares of company stock valued at $3,045,019. Corporate insiders own 8.81% of the company's stock.

About Bloom Energy

(

Free Report)

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels into electricity through an electrochemical process without combustion.

Featured Stories

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.