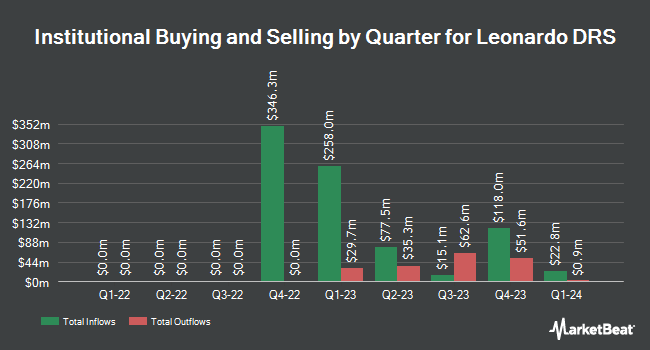

Point72 Asset Management L.P. acquired a new stake in shares of Leonardo DRS, Inc. (NASDAQ:DRS - Free Report) during the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund acquired 58,500 shares of the company's stock, valued at approximately $1,651,000.

Other large investors have also modified their holdings of the company. Jacobs Levy Equity Management Inc. increased its stake in Leonardo DRS by 71.7% in the third quarter. Jacobs Levy Equity Management Inc. now owns 921,156 shares of the company's stock valued at $25,995,000 after acquiring an additional 384,522 shares during the period. Janus Henderson Group PLC boosted its holdings in Leonardo DRS by 4.9% during the third quarter. Janus Henderson Group PLC now owns 291,871 shares of the company's stock valued at $8,236,000 after purchasing an additional 13,613 shares in the last quarter. ClearAlpha Technologies LP bought a new stake in shares of Leonardo DRS in the 3rd quarter valued at approximately $308,000. Point72 Asia Singapore Pte. Ltd. acquired a new position in shares of Leonardo DRS in the 3rd quarter worth approximately $113,000. Finally, Point72 Hong Kong Ltd bought a new position in shares of Leonardo DRS during the 3rd quarter worth approximately $109,000. 18.76% of the stock is currently owned by institutional investors and hedge funds.

Leonardo DRS Price Performance

Shares of DRS stock traded up $0.83 during trading hours on Wednesday, hitting $35.09. 455,993 shares of the company's stock were exchanged, compared to its average volume of 622,425. Leonardo DRS, Inc. has a 52 week low of $18.60 and a 52 week high of $37.99. The stock has a market cap of $9.28 billion, a price-to-earnings ratio of 47.42, a price-to-earnings-growth ratio of 1.91 and a beta of 0.97. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.11 and a quick ratio of 1.70. The stock's 50-day moving average is $32.37 and its 200-day moving average is $28.72.

Leonardo DRS (NASDAQ:DRS - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $0.24 EPS for the quarter, topping analysts' consensus estimates of $0.20 by $0.04. Leonardo DRS had a net margin of 6.23% and a return on equity of 9.71%. The firm had revenue of $812.00 million for the quarter, compared to analyst estimates of $775.44 million. During the same quarter in the prior year, the firm earned $0.20 EPS. The company's revenue was up 15.5% on a year-over-year basis. As a group, research analysts forecast that Leonardo DRS, Inc. will post 0.92 EPS for the current year.

Insider Activity at Leonardo DRS

In other Leonardo DRS news, CFO Michael Dippold sold 25,880 shares of the business's stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $34.08, for a total transaction of $881,990.40. Following the completion of the sale, the chief financial officer now directly owns 47,028 shares of the company's stock, valued at approximately $1,602,714.24. The trade was a 35.50 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO William Lynn III sold 45,000 shares of the firm's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $34.07, for a total transaction of $1,533,150.00. Following the completion of the transaction, the chief executive officer now directly owns 234,937 shares in the company, valued at $8,004,303.59. This trade represents a 16.08 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 86,319 shares of company stock valued at $2,952,572 over the last quarter. Corporate insiders own 0.12% of the company's stock.

Analysts Set New Price Targets

DRS has been the topic of a number of analyst reports. JPMorgan Chase & Co. upped their price target on Leonardo DRS from $29.00 to $32.00 and gave the company a "neutral" rating in a research report on Monday, November 4th. Robert W. Baird boosted their target price on shares of Leonardo DRS from $30.00 to $40.00 and gave the company an "outperform" rating in a research note on Thursday, October 31st. Finally, Bank of America cut shares of Leonardo DRS from a "buy" rating to a "neutral" rating and increased their target price for the stock from $26.00 to $30.00 in a research report on Tuesday, September 24th. Three research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $32.17.

Read Our Latest Analysis on DRS

Leonardo DRS Profile

(

Free Report)

Leonardo DRS, Inc, together with its subsidiaries, provides defense electronic products and systems, and military support services. It operates through Advanced Sensing and Computing (ASC) segment, and Integrated Mission Systems (IMS) segments. The ASC segment designs, develops, and manufacture sensing and network computing technology that enables real-time situational awareness required for enhanced operational decision making and execution; and offers sensing capabilities span applications, such as missions requiring advanced detection, precision targeting and surveillance sensing, long range electro-optic/infrared, signals intelligence, and other intelligence systems including electronic warfare, ground vehicle sensing, active electronically scanned array tactical radars, dismounted soldier, and space sensing.

Further Reading

Before you consider Leonardo DRS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leonardo DRS wasn't on the list.

While Leonardo DRS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.