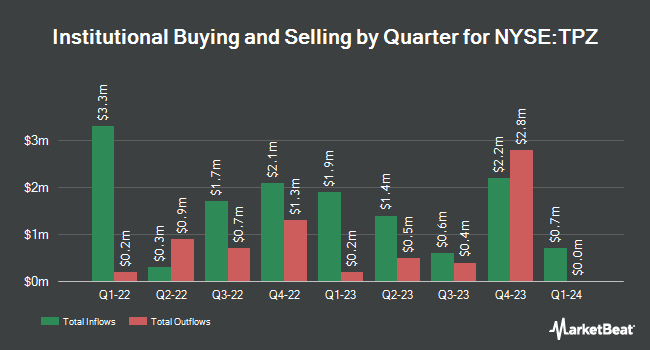

Bank of Montreal Can bought a new position in Tortoise Power and Energy Infrastructure Fund, Inc. (NYSE:TPZ - Free Report) during the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 58,958 shares of the investment management company's stock, valued at approximately $1,183,000.

Other institutional investors also recently bought and sold shares of the company. Harbor Investment Advisory LLC acquired a new stake in shares of Tortoise Power and Energy Infrastructure Fund in the 4th quarter valued at $27,000. JPMorgan Chase & Co. acquired a new stake in Tortoise Power and Energy Infrastructure Fund during the 4th quarter worth approximately $47,000. Blue Bell Private Wealth Management LLC grew its holdings in shares of Tortoise Power and Energy Infrastructure Fund by 2,266.8% during the fourth quarter. Blue Bell Private Wealth Management LLC now owns 6,414 shares of the investment management company's stock worth $129,000 after buying an additional 6,143 shares in the last quarter. Cerity Partners LLC bought a new position in shares of Tortoise Power and Energy Infrastructure Fund in the 4th quarter valued at about $205,000. Finally, Atomi Financial Group Inc. bought a new stake in Tortoise Power and Energy Infrastructure Fund during the fourth quarter worth $316,000.

Tortoise Power and Energy Infrastructure Fund Stock Up 1.7 %

Tortoise Power and Energy Infrastructure Fund stock traded up $0.33 during trading hours on Thursday, hitting $19.54. The company had a trading volume of 3,778 shares, compared to its average volume of 44,630. The firm has a 50-day moving average of $20.03 and a 200 day moving average of $20.12. Tortoise Power and Energy Infrastructure Fund, Inc. has a one year low of $14.93 and a one year high of $22.30.

Tortoise Power and Energy Infrastructure Fund Cuts Dividend

The company also recently declared a monthly dividend, which was paid on Friday, February 28th. Investors of record on Thursday, February 27th were given a dividend of $0.0679 per share. The ex-dividend date was Thursday, February 27th. This represents a $0.81 annualized dividend and a dividend yield of 4.17%.

Tortoise Power and Energy Infrastructure Fund Company Profile

(

Free Report)

Tortoise Power and Energy Infrastructure Fund, Inc is a closed-ended balanced mutual fund launched and managed by Tortoise Capital Advisors, LLC. The fund invests in the fixed income and public equity markets of the United States. It invests in securities of companies operating in the power and energy infrastructure sectors.

Recommended Stories

Before you consider Tortoise Power and Energy Infrastructure Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tortoise Power and Energy Infrastructure Fund wasn't on the list.

While Tortoise Power and Energy Infrastructure Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.