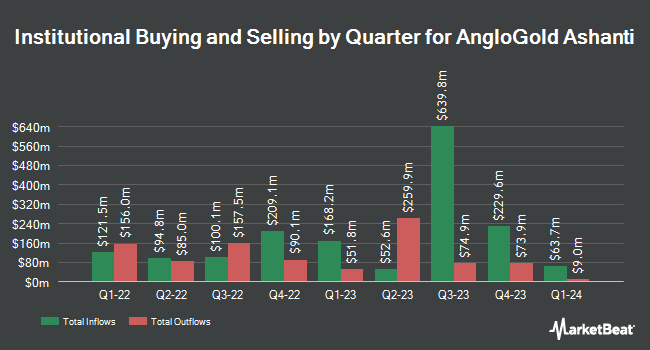

Public Employees Retirement System of Ohio purchased a new position in AngloGold Ashanti plc (NYSE:AU - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 60,298 shares of the mining company's stock, valued at approximately $1,606,000.

Several other hedge funds and other institutional investors have also bought and sold shares of the stock. FMR LLC lifted its stake in shares of AngloGold Ashanti by 39.5% in the 3rd quarter. FMR LLC now owns 10,448,445 shares of the mining company's stock worth $277,968,000 after purchasing an additional 2,957,304 shares during the period. Barings LLC increased its position in AngloGold Ashanti by 395.0% in the second quarter. Barings LLC now owns 1,101,183 shares of the mining company's stock worth $27,818,000 after buying an additional 878,717 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of AngloGold Ashanti by 159.0% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,251,492 shares of the mining company's stock worth $33,327,000 after buying an additional 768,363 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp lifted its position in shares of AngloGold Ashanti by 1,504.8% during the 3rd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 391,715 shares of the mining company's stock valued at $10,419,000 after buying an additional 367,306 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. grew its stake in shares of AngloGold Ashanti by 297.9% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 259,120 shares of the mining company's stock valued at $6,900,000 after acquiring an additional 193,992 shares during the period. Institutional investors own 36.09% of the company's stock.

Wall Street Analysts Forecast Growth

A number of analysts have recently issued reports on AU shares. Royal Bank of Canada raised shares of AngloGold Ashanti from a "sector perform" rating to an "outperform" rating and set a $31.00 price objective for the company in a research note on Tuesday, December 3rd. StockNews.com cut AngloGold Ashanti from a "buy" rating to a "hold" rating in a report on Tuesday, November 12th. JPMorgan Chase & Co. dropped their price objective on AngloGold Ashanti from $37.00 to $32.00 and set an "overweight" rating for the company in a research note on Friday, December 6th. Investec raised AngloGold Ashanti from a "hold" rating to a "buy" rating in a research note on Friday, October 18th. Finally, Scotiabank upgraded AngloGold Ashanti from a "sector underperform" rating to a "sector perform" rating and set a $30.00 price target for the company in a research note on Thursday, November 21st. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $31.75.

Get Our Latest Stock Report on AU

AngloGold Ashanti Price Performance

Shares of AngloGold Ashanti stock traded up $0.11 during trading on Thursday, reaching $23.26. 2,274,611 shares of the stock traded hands, compared to its average volume of 2,262,134. AngloGold Ashanti plc has a 52-week low of $15.80 and a 52-week high of $32.57. The company has a debt-to-equity ratio of 0.46, a current ratio of 1.73 and a quick ratio of 1.14. The business has a fifty day simple moving average of $26.45 and a two-hundred day simple moving average of $27.07. The company has a market capitalization of $9.76 billion, a price-to-earnings ratio of 7.27 and a beta of 0.94.

AngloGold Ashanti Company Profile

(

Free Report)

AngloGold Ashanti plc operates as a gold mining company in Africa, Australia, and the Americas. The company primarily explores for gold, as well as produces silver and sulphuric acid as by-products. Its flagship property is a 100% owned Geita mine located in the Lake Victoria goldfields of the Mwanza region in north-western Tanzania.

See Also

Before you consider AngloGold Ashanti, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AngloGold Ashanti wasn't on the list.

While AngloGold Ashanti currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.