UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC bought a new position in shares of Rush Street Interactive, Inc. (NYSE:RSI - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor bought 60,420 shares of the company's stock, valued at approximately $656,000.

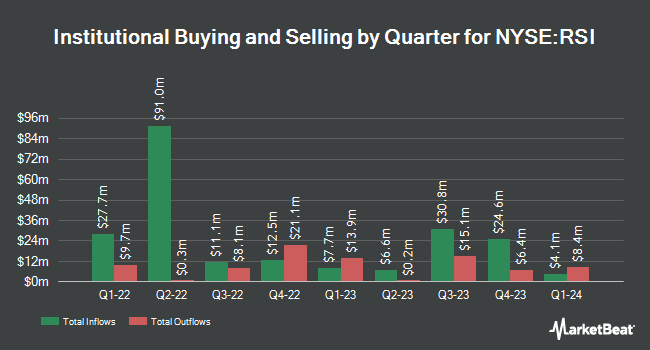

A number of other institutional investors and hedge funds also recently made changes to their positions in the stock. Zurcher Kantonalbank Zurich Cantonalbank purchased a new stake in shares of Rush Street Interactive during the third quarter valued at approximately $44,000. New York State Teachers Retirement System lifted its stake in Rush Street Interactive by 17.2% in the third quarter. New York State Teachers Retirement System now owns 6,938 shares of the company's stock valued at $75,000 after purchasing an additional 1,020 shares during the last quarter. Quarry LP grew its holdings in Rush Street Interactive by 15.9% during the second quarter. Quarry LP now owns 8,762 shares of the company's stock valued at $84,000 after purchasing an additional 1,200 shares during the period. CWM LLC increased its position in Rush Street Interactive by 425.6% in the third quarter. CWM LLC now owns 9,209 shares of the company's stock worth $100,000 after buying an additional 7,457 shares during the last quarter. Finally, Principal Financial Group Inc. bought a new stake in shares of Rush Street Interactive in the second quarter valued at $98,000. Institutional investors own 24.78% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on the stock. Craig Hallum raised their price objective on shares of Rush Street Interactive from $14.00 to $17.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. Jefferies Financial Group increased their price target on shares of Rush Street Interactive from $15.00 to $16.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. Finally, Needham & Company LLC boosted their target price on Rush Street Interactive from $14.00 to $15.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Two investment analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $12.43.

Read Our Latest Stock Analysis on RSI

Rush Street Interactive Stock Up 4.0 %

Shares of NYSE:RSI traded up $0.53 during midday trading on Friday, reaching $13.67. The company's stock had a trading volume of 3,054,905 shares, compared to its average volume of 1,685,743. The firm has a 50 day moving average of $12.27 and a 200-day moving average of $10.57. The firm has a market capitalization of $3.09 billion, a P/E ratio of -683.50 and a beta of 1.88. Rush Street Interactive, Inc. has a 12-month low of $3.56 and a 12-month high of $14.92.

Insider Buying and Selling

In other news, COO Mattias Stetz sold 20,000 shares of Rush Street Interactive stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $11.02, for a total value of $220,400.00. Following the completion of the sale, the chief operating officer now directly owns 580,484 shares in the company, valued at $6,396,933.68. The trade was a 3.33 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, CEO Richard Todd Schwartz sold 103,905 shares of the stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $11.02, for a total transaction of $1,145,033.10. Following the transaction, the chief executive officer now owns 1,703,578 shares in the company, valued at approximately $18,773,429.56. This trade represents a 5.75 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 357,595 shares of company stock valued at $4,224,380 over the last quarter. Corporate insiders own 56.89% of the company's stock.

Rush Street Interactive Profile

(

Free Report)

Rush Street Interactive, Inc operates as an online casino and sports betting company in the United States, Canada, Mexico, and rest of Latin America. It provides real-money online casino, online and retail sports betting, and social gaming services. In addition, the company offers full suite of games comprising of bricks-and-mortar casinos, table games, and slot machines.

See Also

Before you consider Rush Street Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rush Street Interactive wasn't on the list.

While Rush Street Interactive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.