Main Management ETF Advisors LLC purchased a new position in shares of Airbnb, Inc. (NASDAQ:ABNB - Free Report) in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 6,208 shares of the company's stock, valued at approximately $787,000.

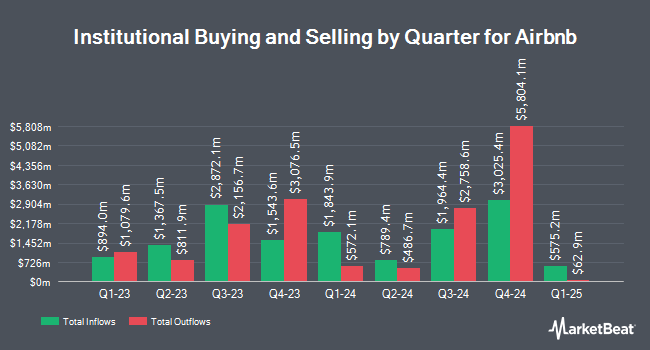

Other institutional investors have also recently bought and sold shares of the company. Pacer Advisors Inc. lifted its position in shares of Airbnb by 6,085.6% during the 3rd quarter. Pacer Advisors Inc. now owns 4,241,557 shares of the company's stock valued at $537,872,000 after buying an additional 4,172,985 shares during the last quarter. Assenagon Asset Management S.A. grew its position in Airbnb by 19,052.8% during the 2nd quarter. Assenagon Asset Management S.A. now owns 1,693,488 shares of the company's stock worth $256,784,000 after acquiring an additional 1,684,646 shares during the last quarter. Edgewood Management LLC lifted its holdings in Airbnb by 9.2% in the 3rd quarter. Edgewood Management LLC now owns 13,582,433 shares of the company's stock worth $1,722,388,000 after buying an additional 1,143,464 shares during the period. International Assets Investment Management LLC lifted its holdings in Airbnb by 19,430.3% in the 3rd quarter. International Assets Investment Management LLC now owns 1,119,479 shares of the company's stock worth $1,419,610,000 after buying an additional 1,113,747 shares during the period. Finally, Temasek Holdings Private Ltd lifted its stake in shares of Airbnb by 91.3% in the 3rd quarter. Temasek Holdings Private Ltd now owns 2,324,151 shares of the company's stock valued at $294,726,000 after purchasing an additional 1,109,076 shares during the period. Institutional investors own 80.76% of the company's stock.

Airbnb Stock Performance

ABNB traded up $0.60 on Friday, hitting $136.92. 4,294,949 shares of the company's stock were exchanged, compared to its average volume of 5,668,135. The stock has a fifty day moving average of $134.92 and a two-hundred day moving average of $135.03. Airbnb, Inc. has a twelve month low of $110.38 and a twelve month high of $170.10. The firm has a market cap of $86.80 billion, a PE ratio of 48.04, a P/E/G ratio of 1.94 and a beta of 1.13. The company has a current ratio of 1.62, a quick ratio of 1.62 and a debt-to-equity ratio of 0.23.

Airbnb (NASDAQ:ABNB - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The company reported $2.13 EPS for the quarter, missing analysts' consensus estimates of $2.17 by ($0.04). Airbnb had a net margin of 16.96% and a return on equity of 32.88%. The company had revenue of $3.73 billion for the quarter, compared to analyst estimates of $3.72 billion. During the same quarter in the prior year, the business earned $2.39 EPS. On average, research analysts anticipate that Airbnb, Inc. will post 3.99 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of analysts have commented on the company. Barclays lifted their target price on Airbnb from $100.00 to $110.00 and gave the stock an "underweight" rating in a report on Friday, November 8th. Bank of America reissued a "hold" rating and set a $142.00 price target (up previously from $132.00) on shares of Airbnb in a report on Friday, October 11th. Citigroup boosted their price objective on Airbnb from $135.00 to $158.00 and gave the company a "buy" rating in a research report on Monday, November 11th. DA Davidson boosted their price objective on Airbnb from $125.00 to $131.00 and gave the company a "neutral" rating in a research report on Monday, November 18th. Finally, Raymond James assumed coverage on Airbnb in a research report on Friday, September 27th. They issued a "market perform" rating and a $134.00 target price on the stock. Six investment analysts have rated the stock with a sell rating, eighteen have issued a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Hold" and a consensus target price of $138.94.

View Our Latest Report on Airbnb

Insider Buying and Selling

In related news, CEO Brian Chesky sold 230,769 shares of the firm's stock in a transaction that occurred on Tuesday, September 17th. The shares were sold at an average price of $120.00, for a total value of $27,692,280.00. Following the completion of the transaction, the chief executive officer now owns 13,315,912 shares of the company's stock, valued at approximately $1,597,909,440. This trade represents a 1.70 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Nathan Blecharczyk sold 9,603 shares of the firm's stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $130.22, for a total transaction of $1,250,502.66. Following the completion of the transaction, the insider now directly owns 164,850 shares of the company's stock, valued at $21,466,767. This represents a 5.50 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 748,465 shares of company stock worth $96,015,340. Corporate insiders own 27.83% of the company's stock.

About Airbnb

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

Featured Articles

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report